Japanese Candlesticks Analysis 26.10.2021 (EURUSD, USDJPY, EURGBP)

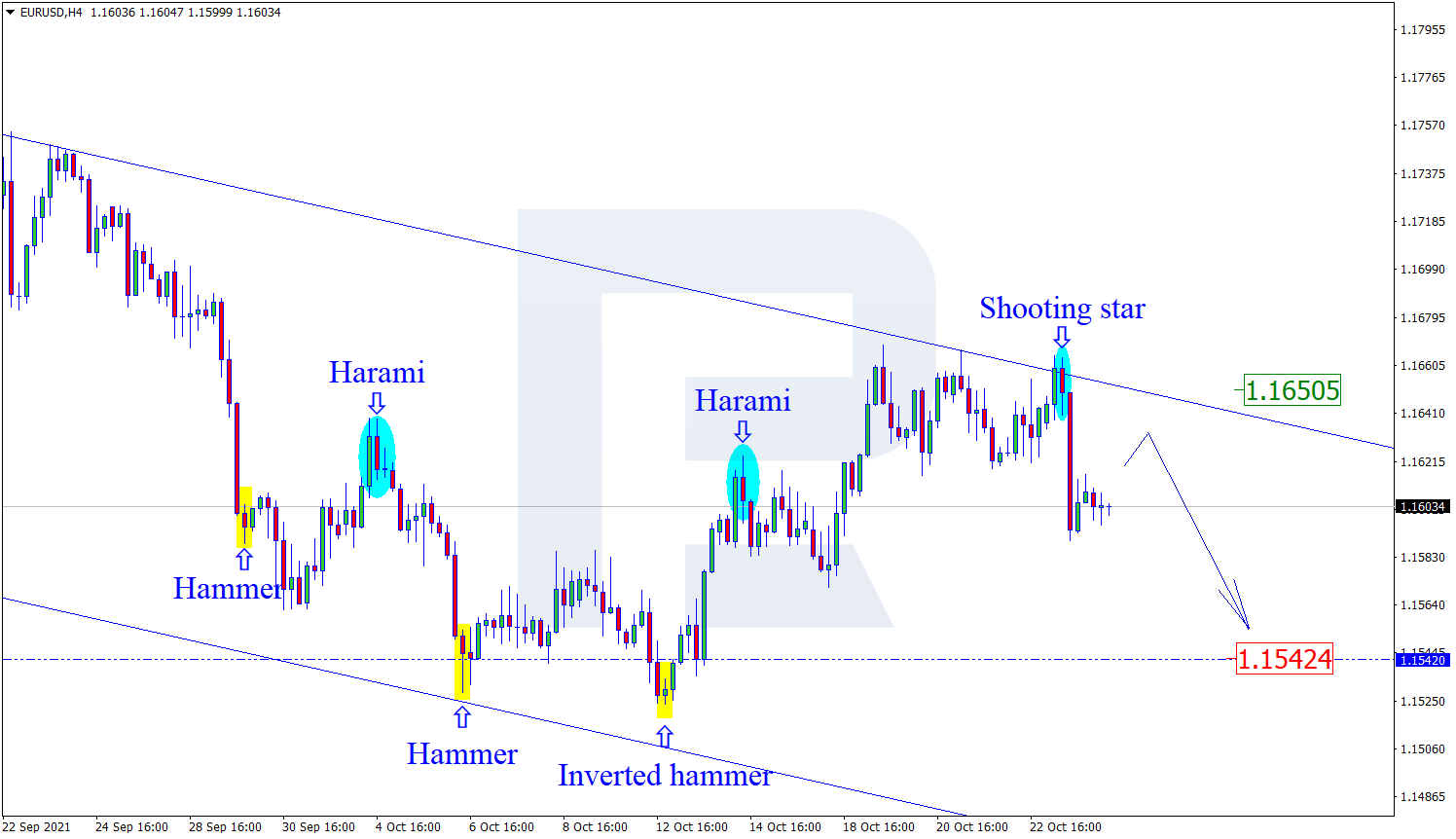

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the asset has completed the correction by forming several reversal patterns, including Shooting Star, close to the resistance level. At the moment, EURUSD may reverse and start a new decline. In this case, the downside target may be at 1.1542. Later, the market may break the support area and continue the descending tendency. However, an alternative scenario implies that the price may correct to reach 1.1650 first and then resume trading downwards.

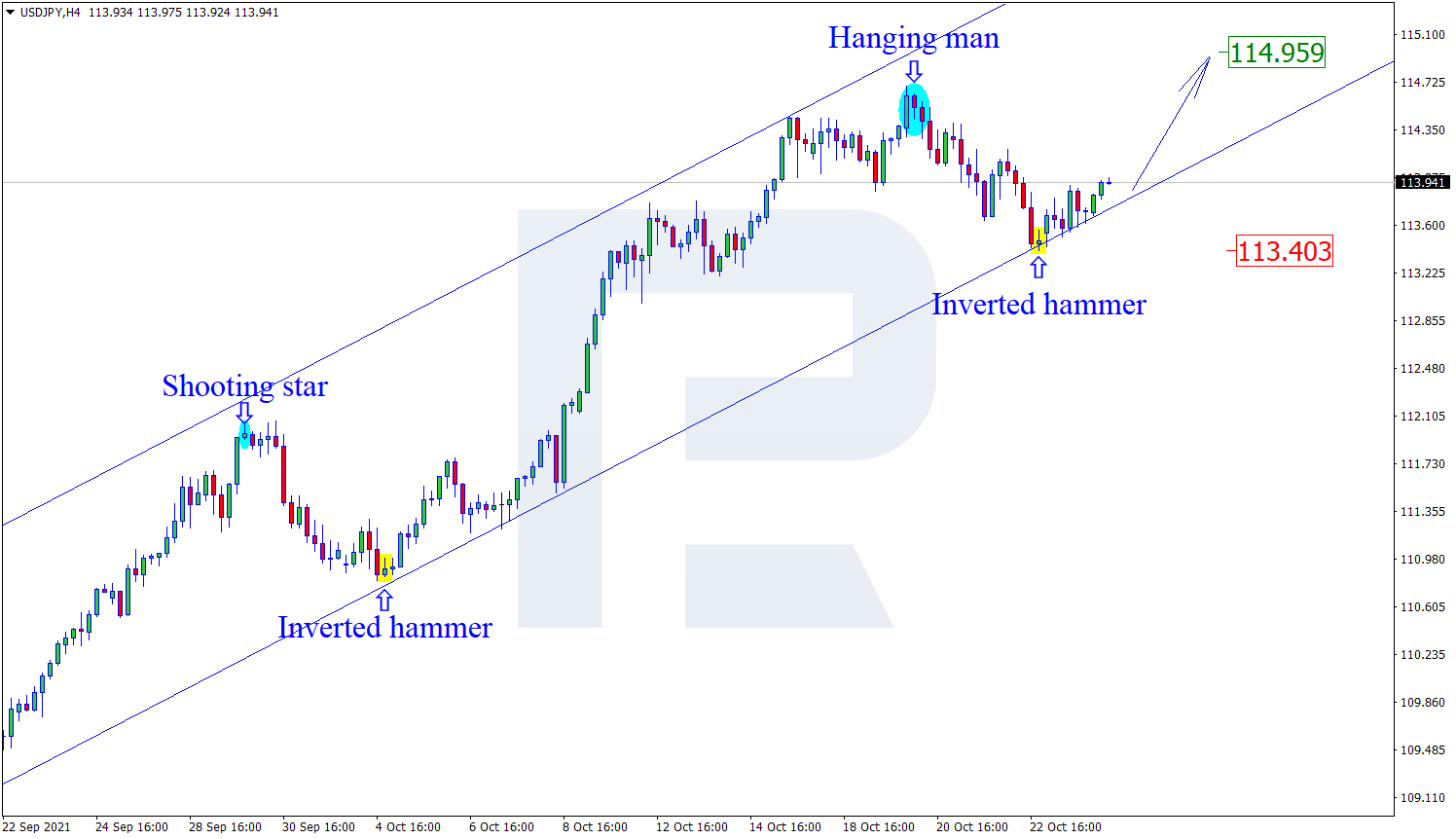

USDJPY, “US Dollar vs Japanese Yen”

As we can see in the H4 chart, USDJPY has formed several reversal patterns, for example, Inverted Hammer, while testing the support area. At the moment, USDJPY is reversing and may start a new growth. In this case, the upside target may be at 114.95. At the same time, an opposite scenario implies that the price may correct to reach 113.40 before resuming the ascending tendency.

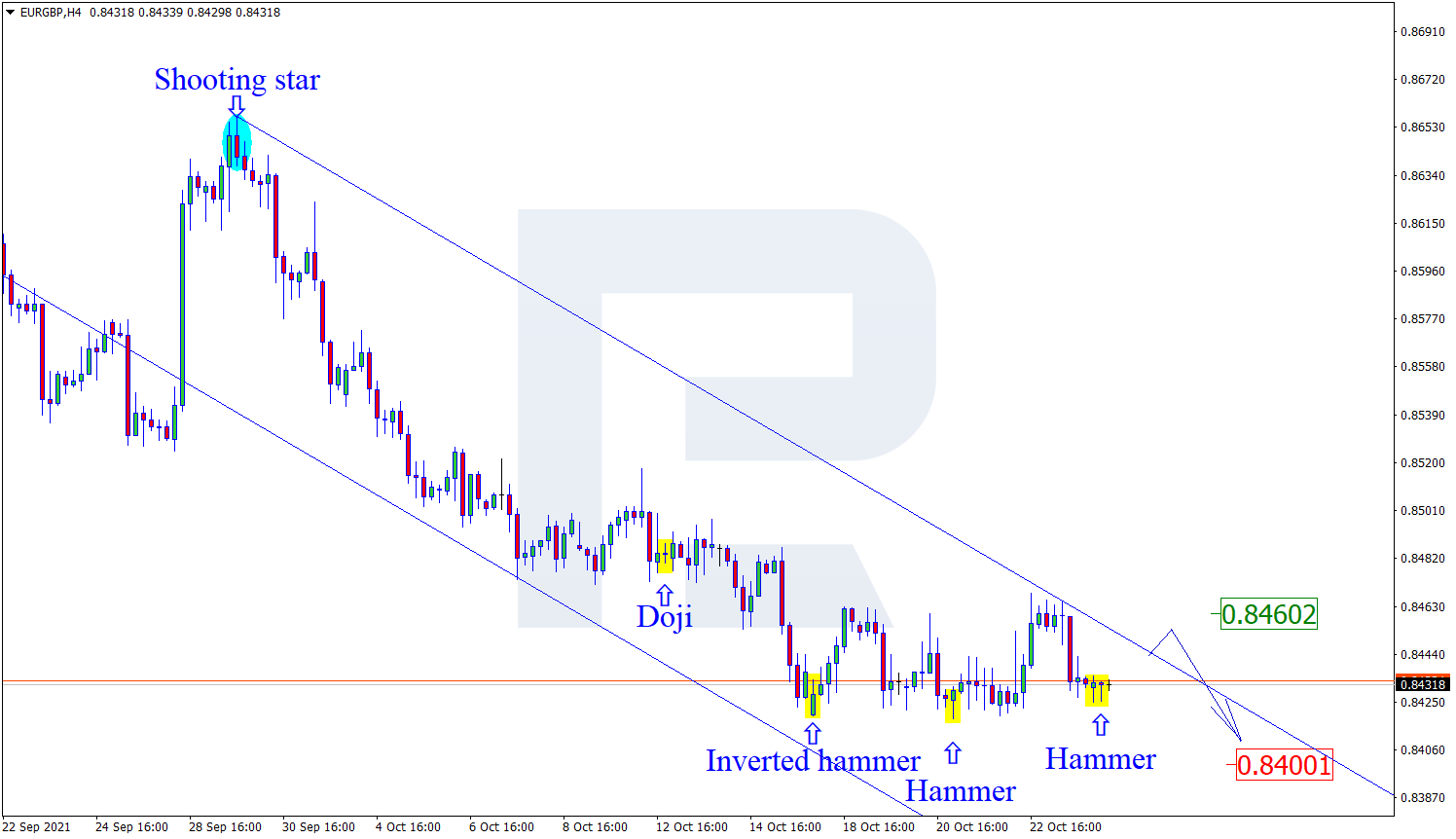

EURGBP, “Euro vs Great Britain Pound”

As we can see in the H4 chart, after forming several reversal patterns, such as Hammer, near the support level, EURGBP may reverse and start a new pullback. In this case, the correctional target may be at 0.8460. Later, the market may test the resistance area, rebound from it, and resume the descending tendency. Still, there might be an alternative scenario, according to which the asset may continue falling to reach 0.8400 without testing the resistance area.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.