Fibonacci Retracements Analysis 09.04.2020 (AUDUSD, USDCAD)

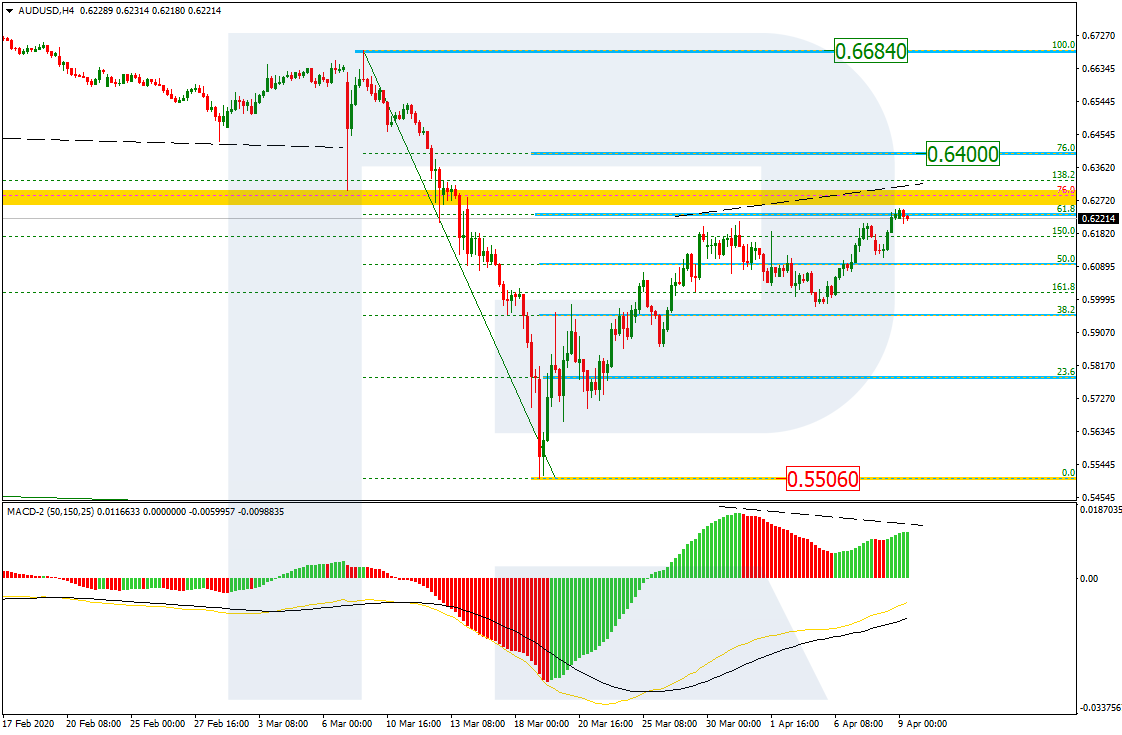

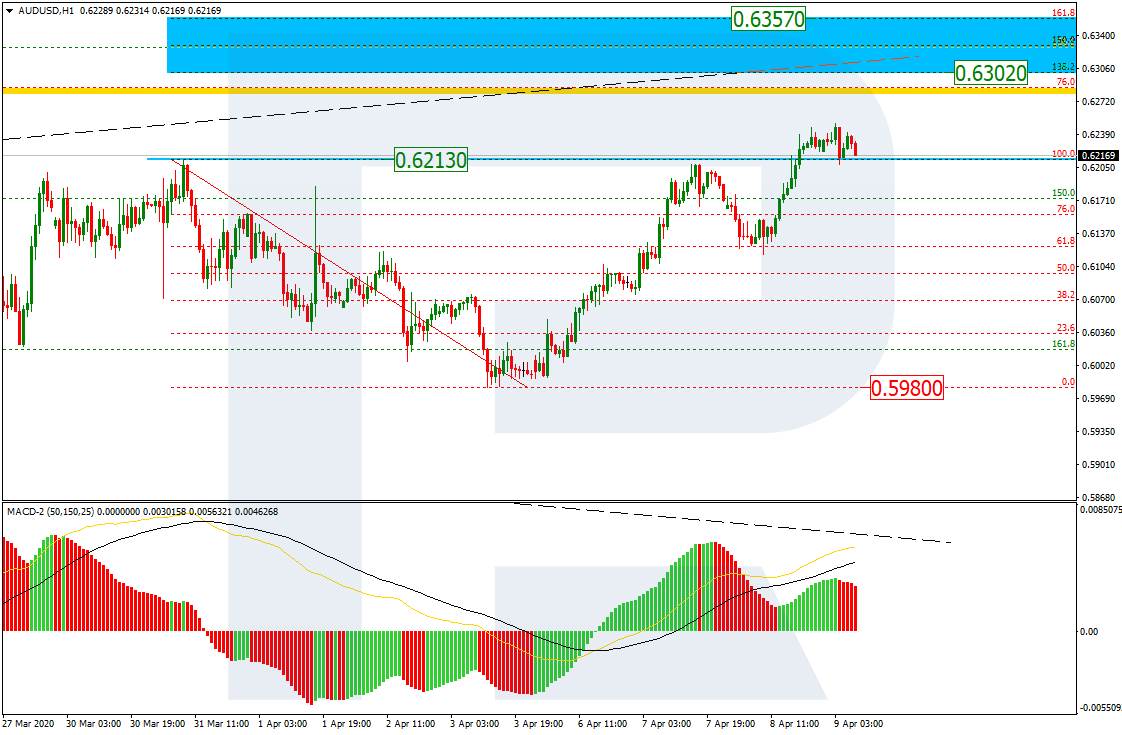

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the correctional uptrend has reached 61.8% fibo. At the same time, we there is a divergence on MACD, which indicates a possible reversal. Of course, the pair may yet grow and reach 76.0% fibo at 0.6400 but it might be its last upside target. The key support is the low at 0.5506.

In the H1 chart, after breaking the previous high, the pair is testing it from above. The next upside targets may be inside the post-correctional extension area between 138.2% and 161.8% fibo between 0.6302 and 0.6357 respectively. The local support is at 0.5980.

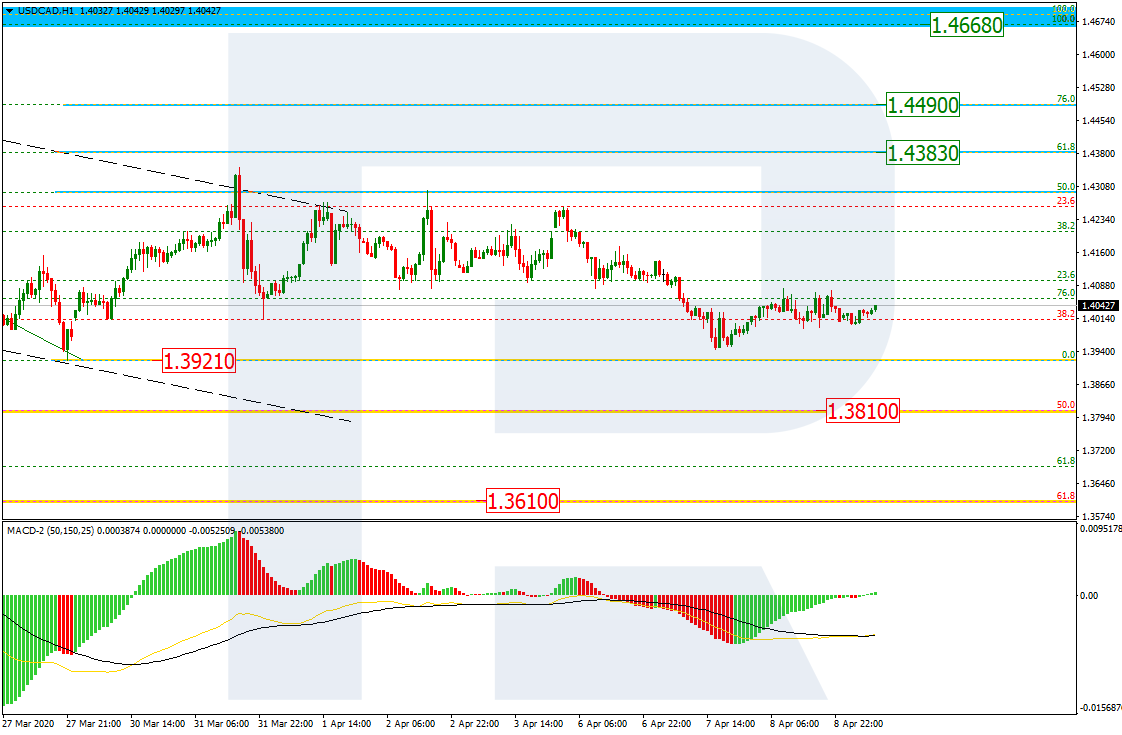

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, the descending correction has stopped at 38.2% fibo. Under such circumstances, the pair is expected to grow to break 23.6% fibo at 1.4262 and then reach the high at 1.4668. However, if the price rebounds from 23.6% fibo at 1.4262, the instrument may start a new decline towards 50.0% and 61.8% fibo at 1.3811 and 1.3610 respectively.

As we can see in the H1 chart, after rebounding from the low at 1.3921, USDCAD is trying to start a new rising wave. The possible upside targets may be 61.8% and 76.0% fibo at 1.4383 and 1.4490 respectively.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.