Fibonacci Retracements Analysis 15.07.2020 (GBPUSD, EURJPY)

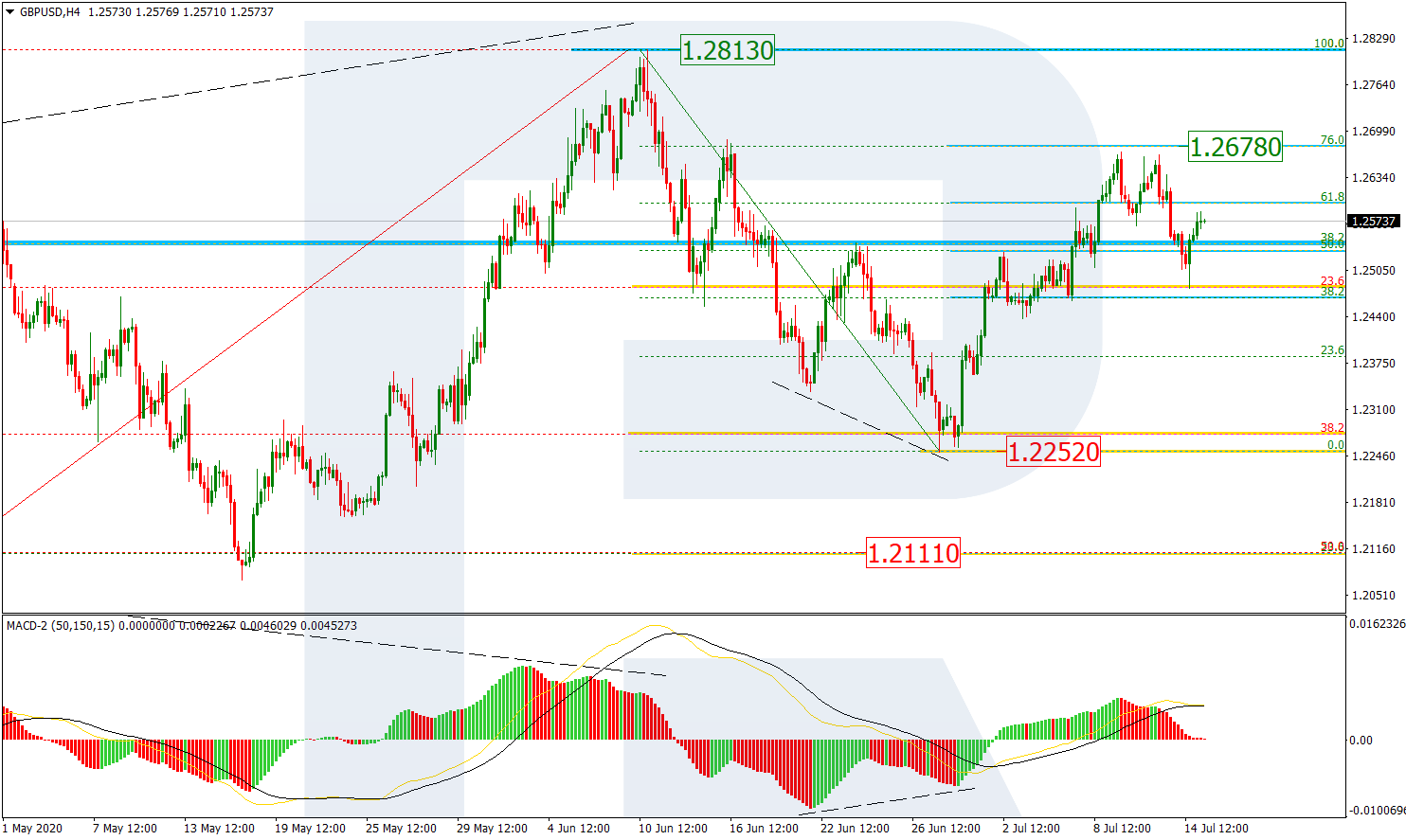

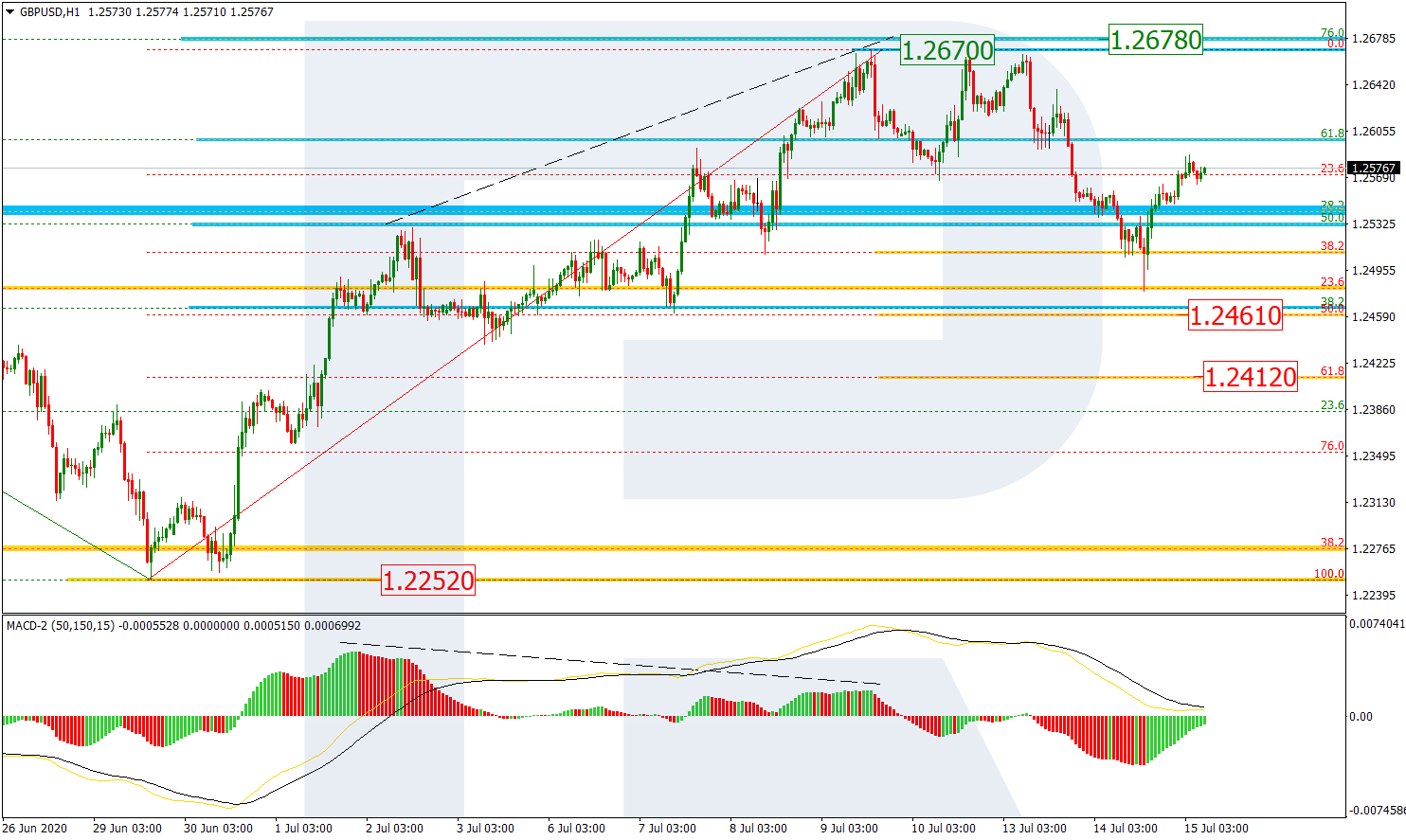

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after finishing the ascending wave very close to 76.0% fibo at 1.2678, GBPUSD has started a new pullback. If the pair is able to resume growing and break the high at 1.2813 in the nearest future, the price may continue growing towards 50.0% and 61.8% fibo at 1.2895 and 1.3242 respectively. However, one shouldn’t exclude that the instrument may fall with the targets at the low and 50.0% fibo at 1.2252 and 1.2111 respectively.

The H1 chart shows a more detailed structure of the correction after the divergence. By now, the pair has already broken 38.2% fibo but failed to reach 50.0% fibo at 1.2461. Later, it may continue falling towards the latter level, as well as 61.8% fibo at 1.2412. After completing the correction, the instrument may resume trading upwards to reach the high at 1.2670.

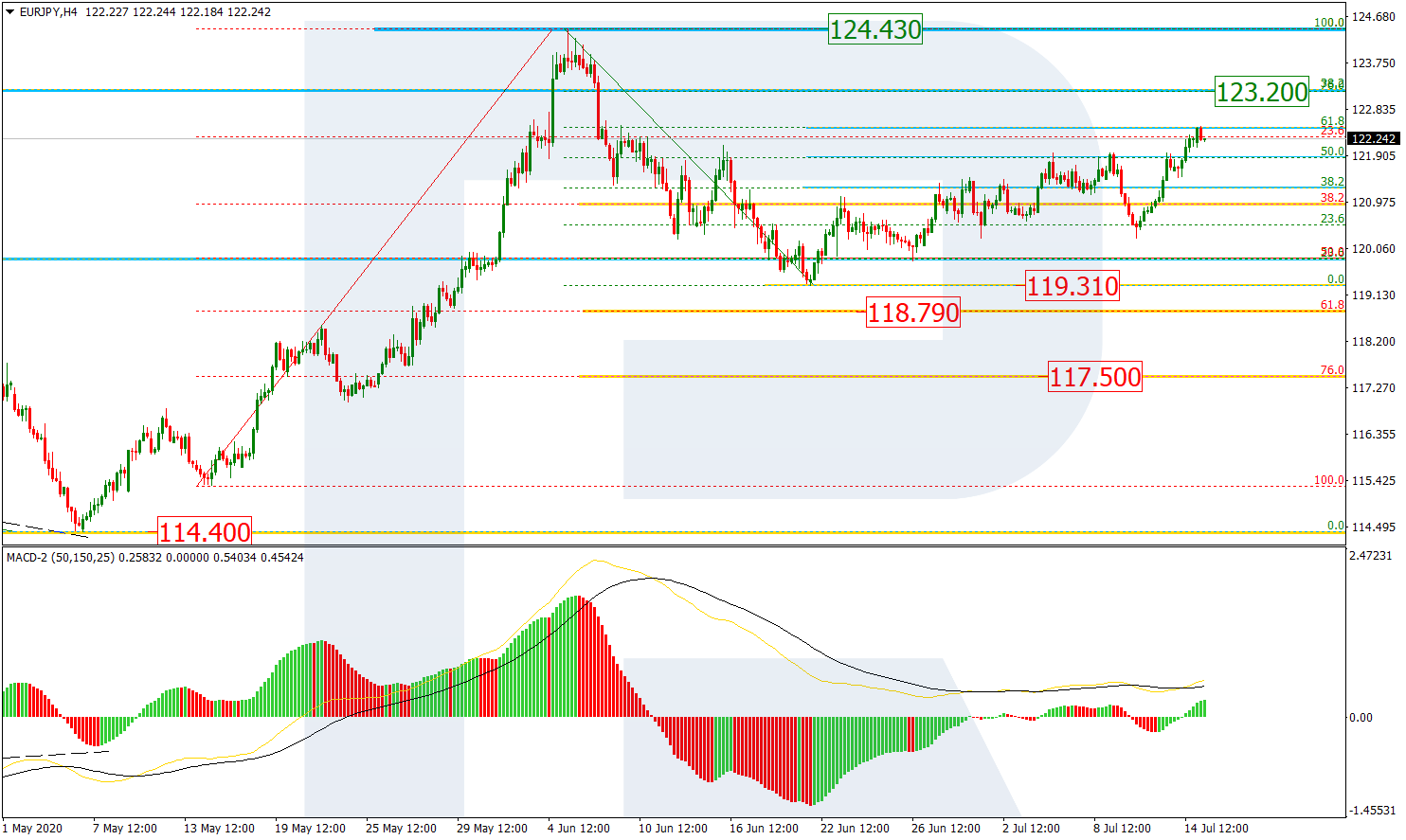

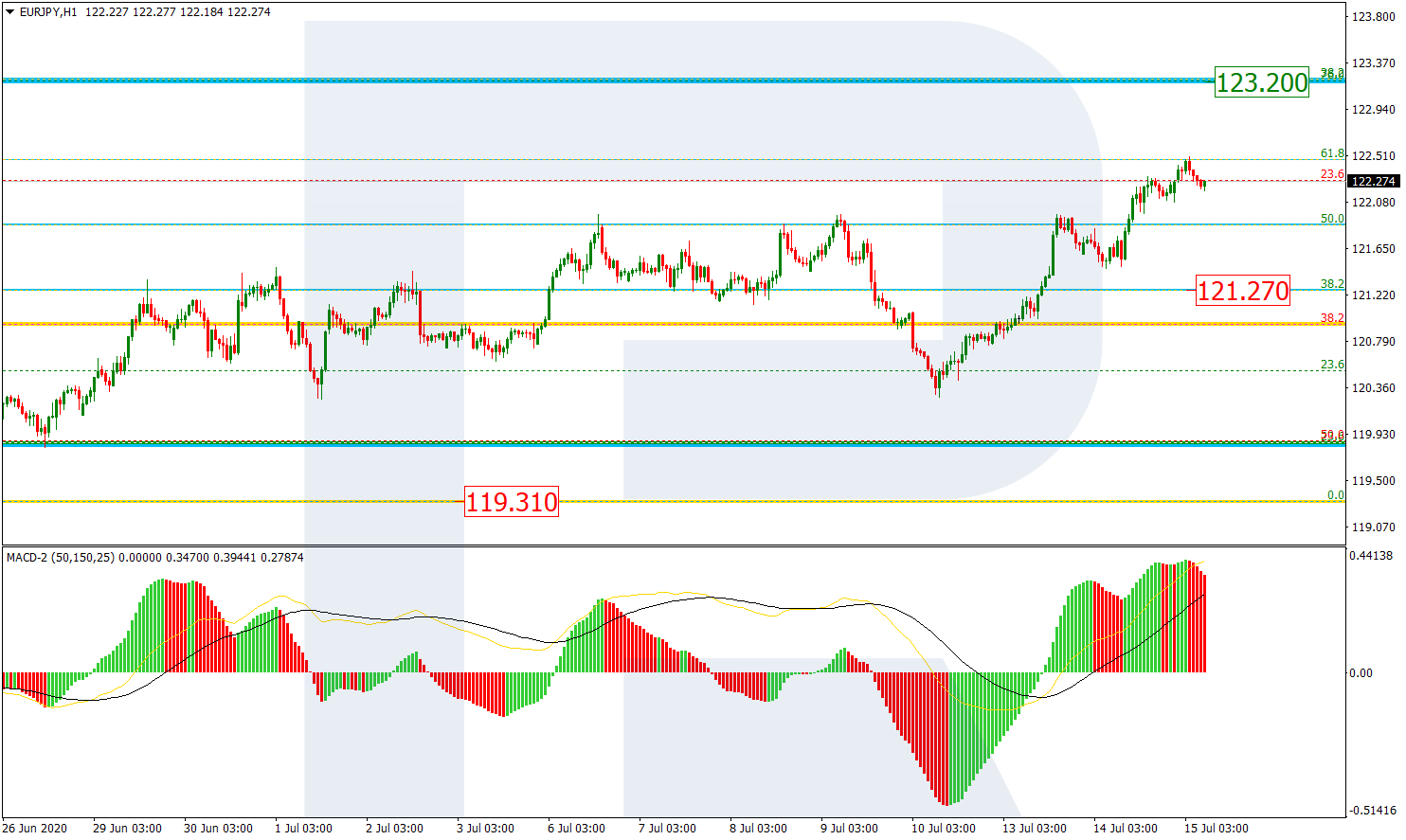

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, after reaching 50.0% fibo, EURJPY decided not to fall towards the low at 119.31 but chose to continue growing and reach 61.8% instead, thus transforming the current correctional structure into a proper ascending wave. The next upside target is 76.0% fibo at 123.20, while the key target is the high at 124.43.

In the H1 chart, the instrument is trading upwards and has already reached 61.8% fibo. The uptrend is looking quite stable but there is a possibility of a pullback towards the support at 121.27.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.