Fibonacci Retracements Analysis 16.07.2020 (AUDUSD, USDCAD)

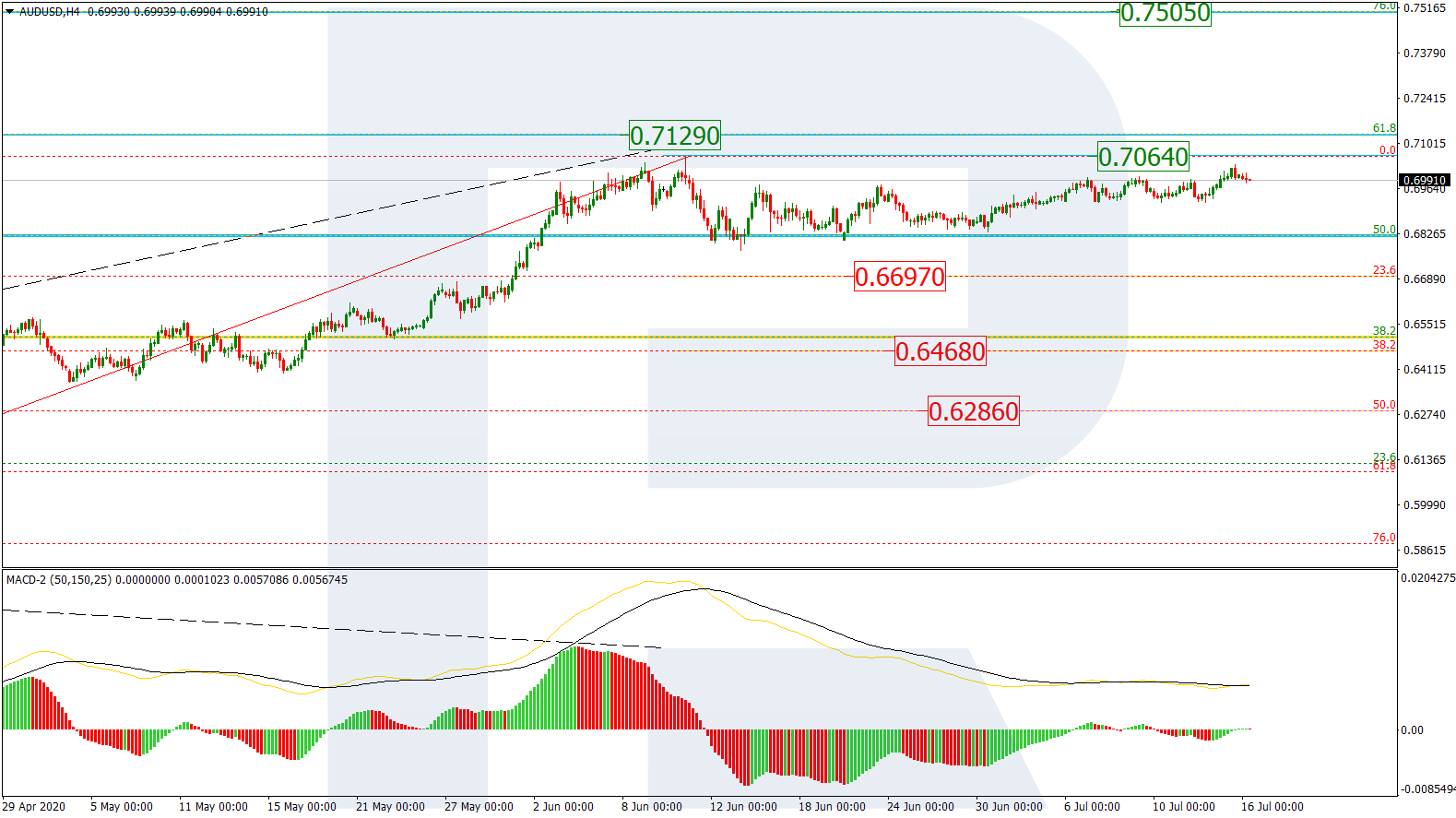

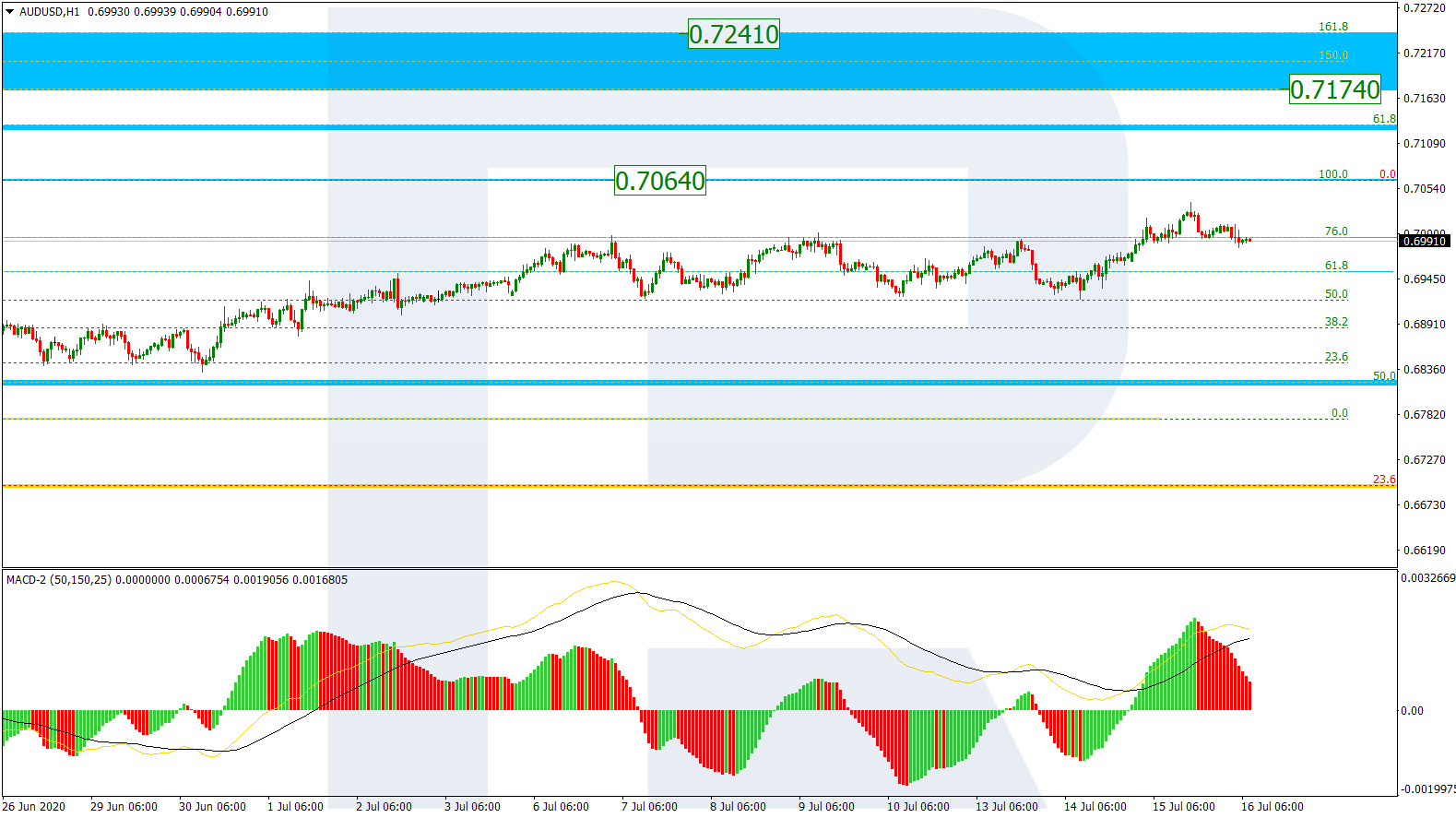

AUDUSD, “Australian Dollar vs US Dollar”

In the H4 chart, AUDUSD is slowly growing to reach the local high at 0.7064. If the asset breaks the high, it may continue trading upwards to reach the long-term 61.8% and 76.0% fibo at 0.7129 and 0.7505 respectively. Still, there is a possibility that the pair may rebound from the resistance area and start a new decline. In this case, the downside targets may be at 23.6%, 38.2%, and 50.0% fibo at 0.6697, 0.6468, and 0.6286 respectively.

The H1 chart shows another ascending impulse, which, after breaking 76.0% fibo, has almost reached the high. The current situation implies that after breaking the high at 0.7064, the price may continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 0.7174 and 0.7241 respectively.

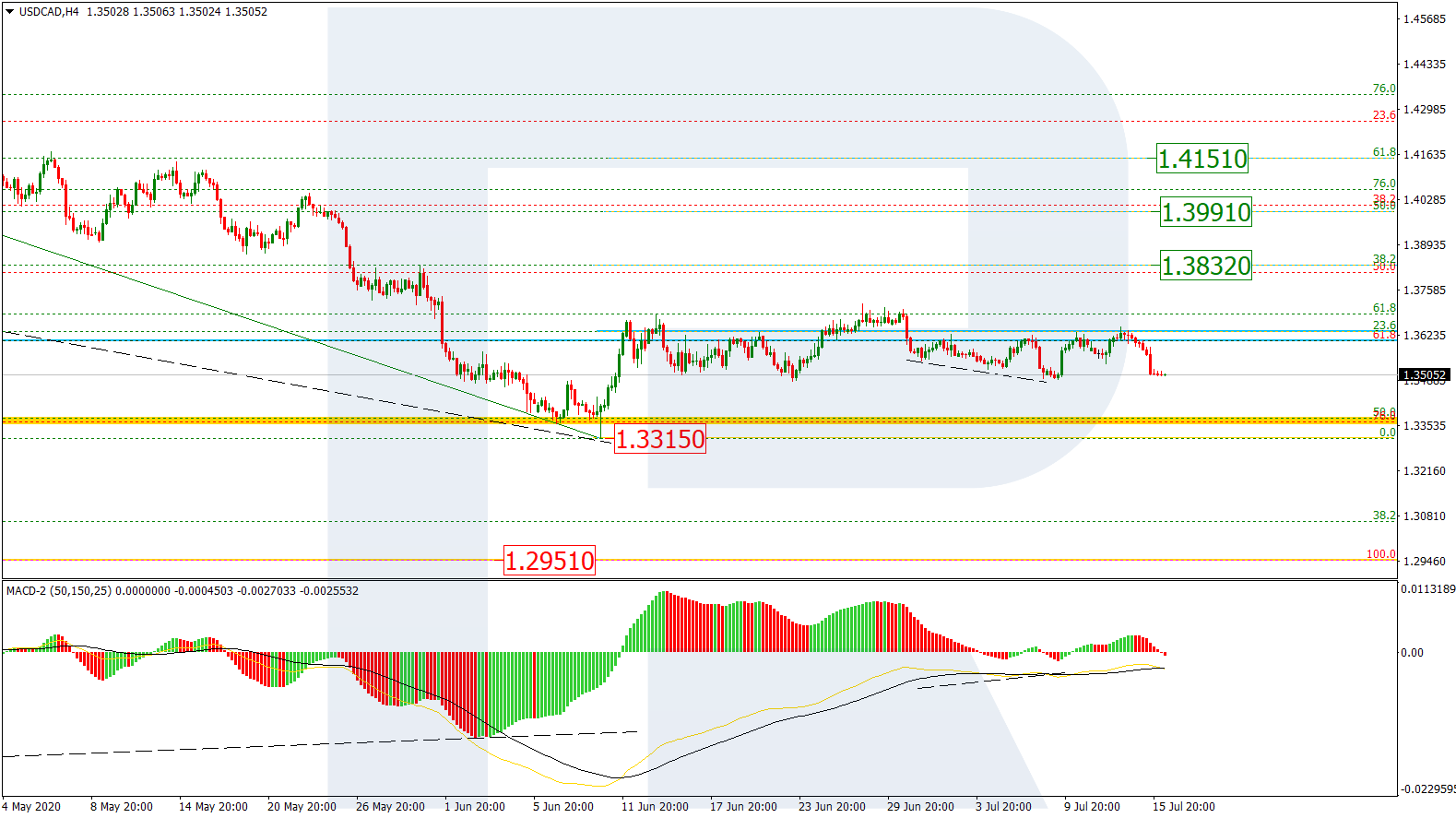

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, the divergence made the pair stop at 23.6% and start a new correctional downtrend. The previous convergence couldn’t force the price to skyrocket and, as a result, USDCAD fell again. After finishing the pullback, the price may jump towards 38.2%, 50.0%, and 61.8% fibo at 1.3832, 1.3991, and 1.4151 respectively. However, if the asset breaks the support, which is the low at 1.3315, the instrument may continue falling towards the fractal at 1.2951.

The H1 chart shows a new descending correctional movement after the divergence on MACD. The descending wave has already re-tested 50.0% fibo and may later continue towards 61.8% and 76.0% fibo at 1.3467 and 1.3411 respectively. If the price breaks the resistance at 1.3715, the mid-term uptrend may resume.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.