Fibonacci Retracements Analysis 20.01.2020 (GOLD, USDCHF)

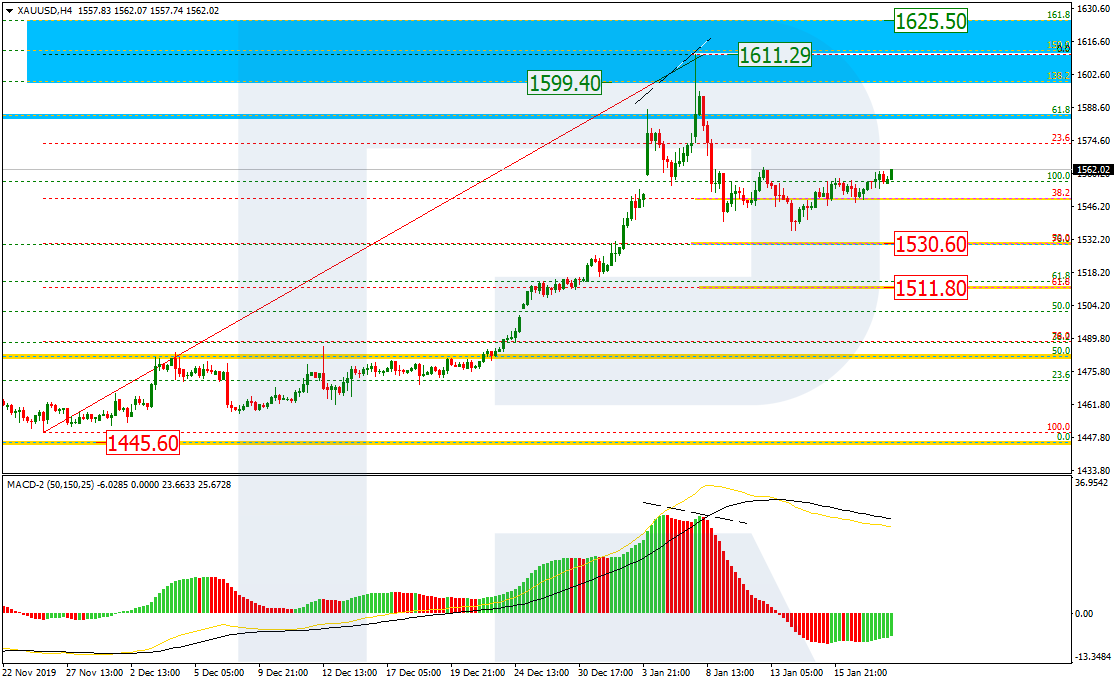

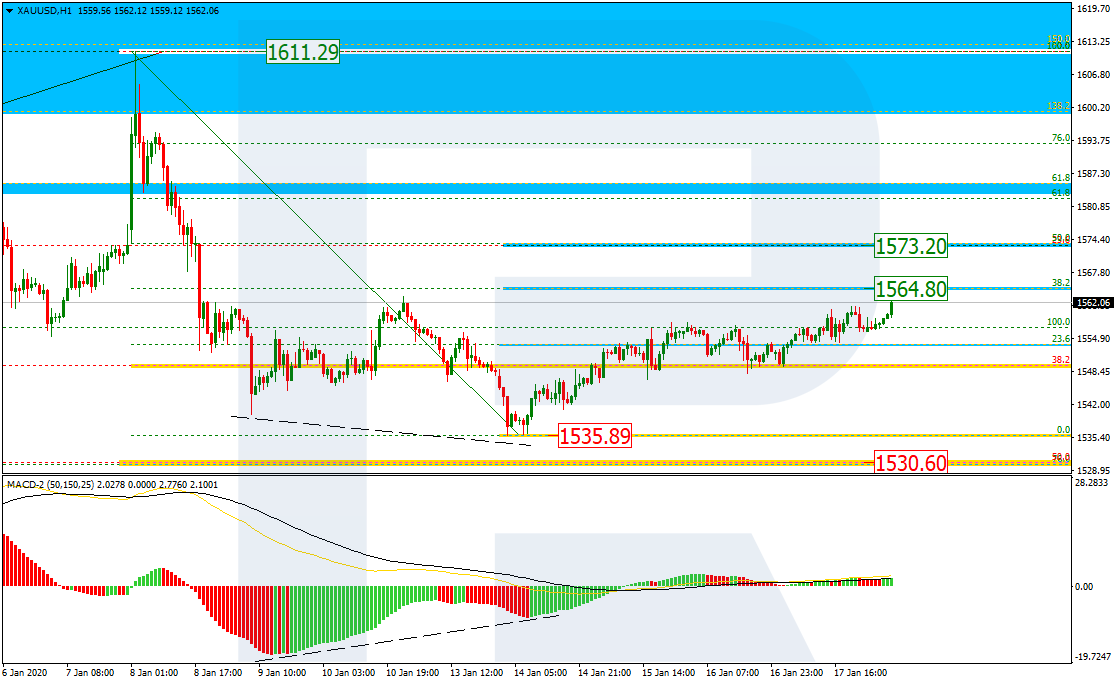

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, there is a correction inside another correction. The first correctional descending wave has reached 38.2% fibo, while the next one may head towards 50.0% and 61.8% fibo at 1530.60 and 1511.80 respectively. After finishing the pullback, the instrument may resume trading upwards to reach the current high at 1611.29 and the post-correctional extension area between 138.2 and 161.8% fibo at 1599.45 and 1625.70 respectively.

The H1 chart shows more detailed structure of the correction. The pair is heading towards 38.2% fibo at 1564.80 and may later continue growing to reach 50.0% fibo at 1573.20. the support is the local low at 1535.89.

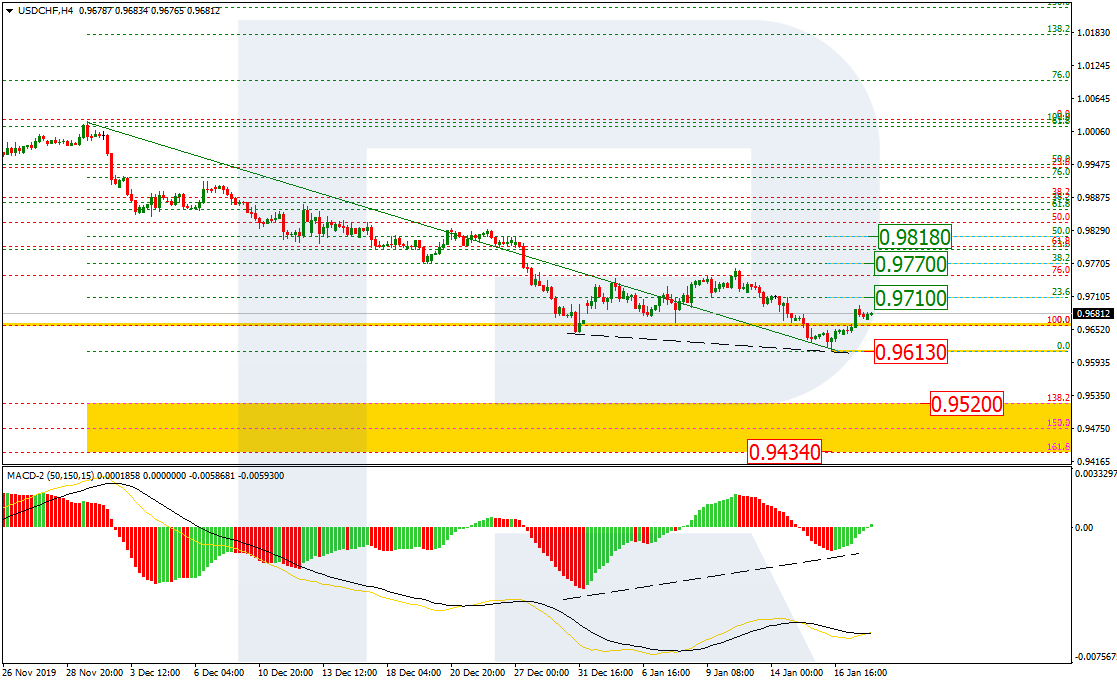

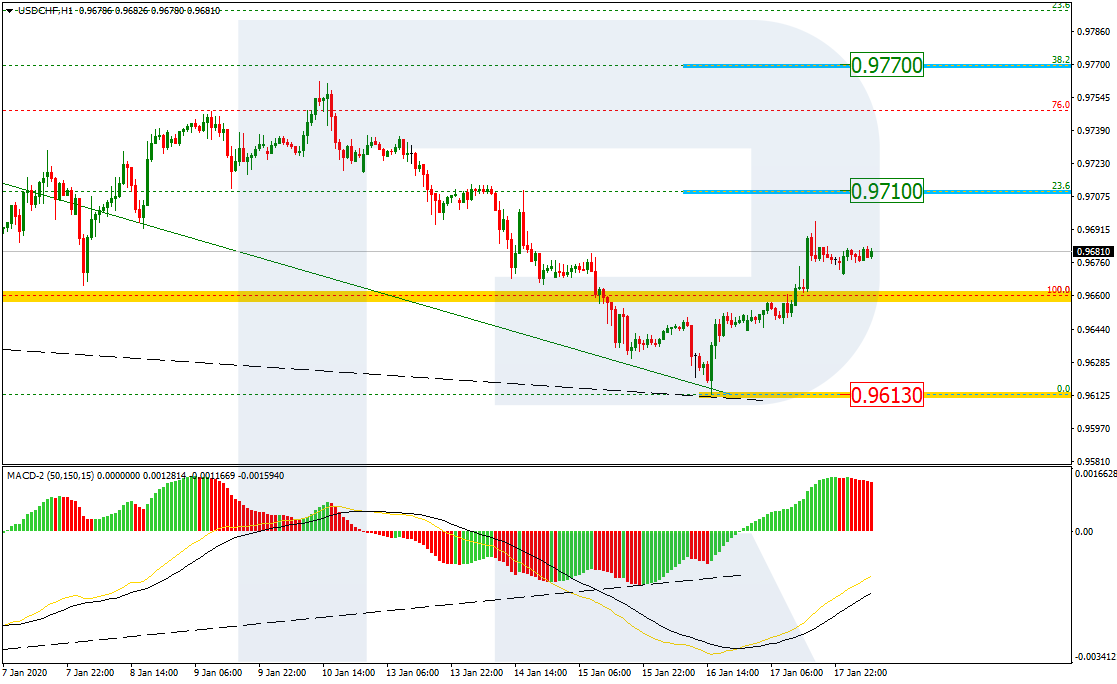

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the pair is intending to continue trading downwards to reach the post-correctional extension area between 138.2 and 161.8% fibo at 0.9520 and 0.9433 respectively. However, considering the convergence on MACD and a slight growth, one can expect a new correctional uptrend. This scenario is valid as long as the instrument hasn’t broken the low at 0.9613.

In the H4 chart we can see that the instrument is moving towards 23.6% and 38.2% fibo at 0.9710 and 0.9770 respectively.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.