Fibonacci Retracements Analysis 26.11.2021 (AUDUSD, USDCAD)

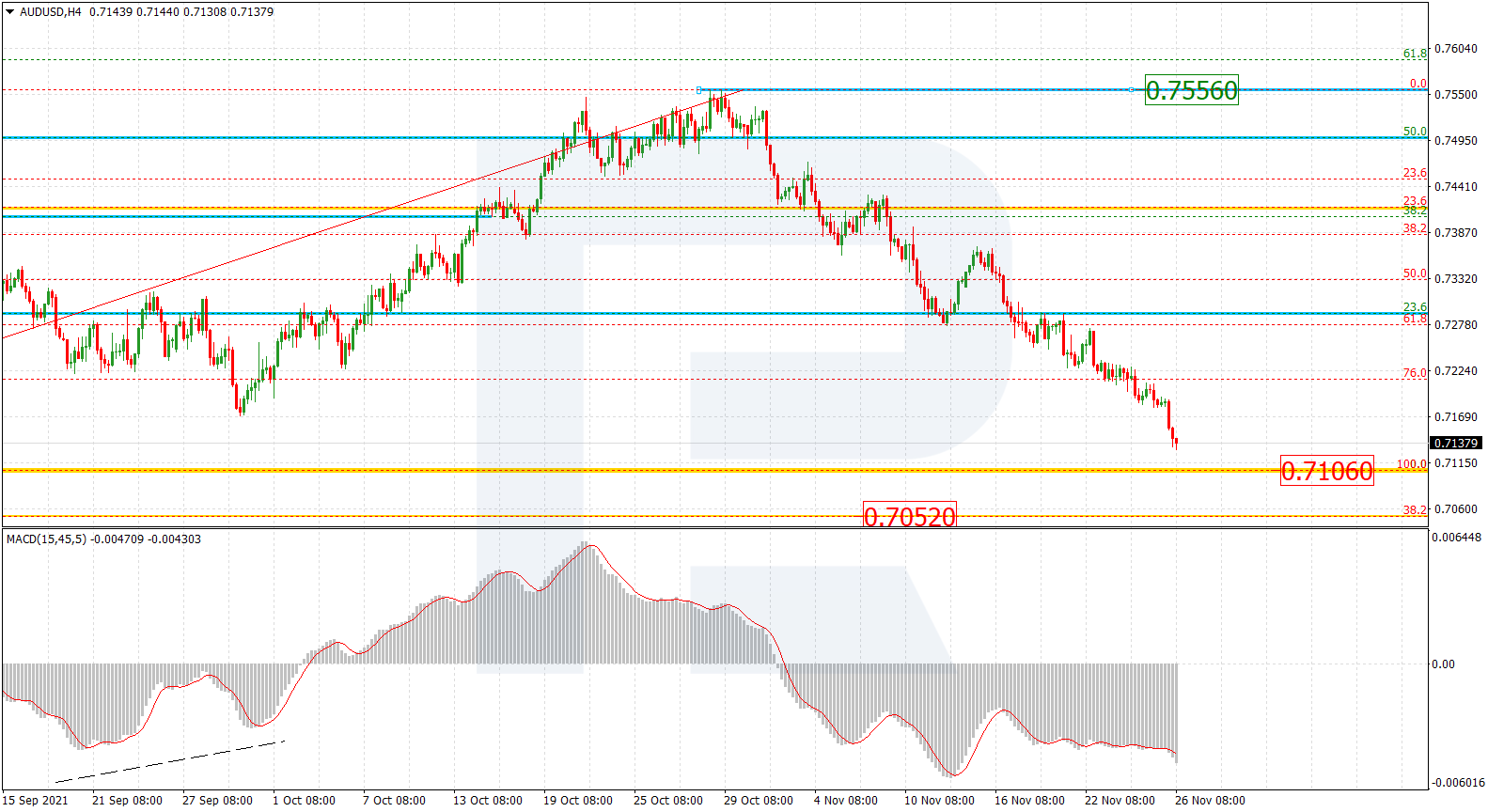

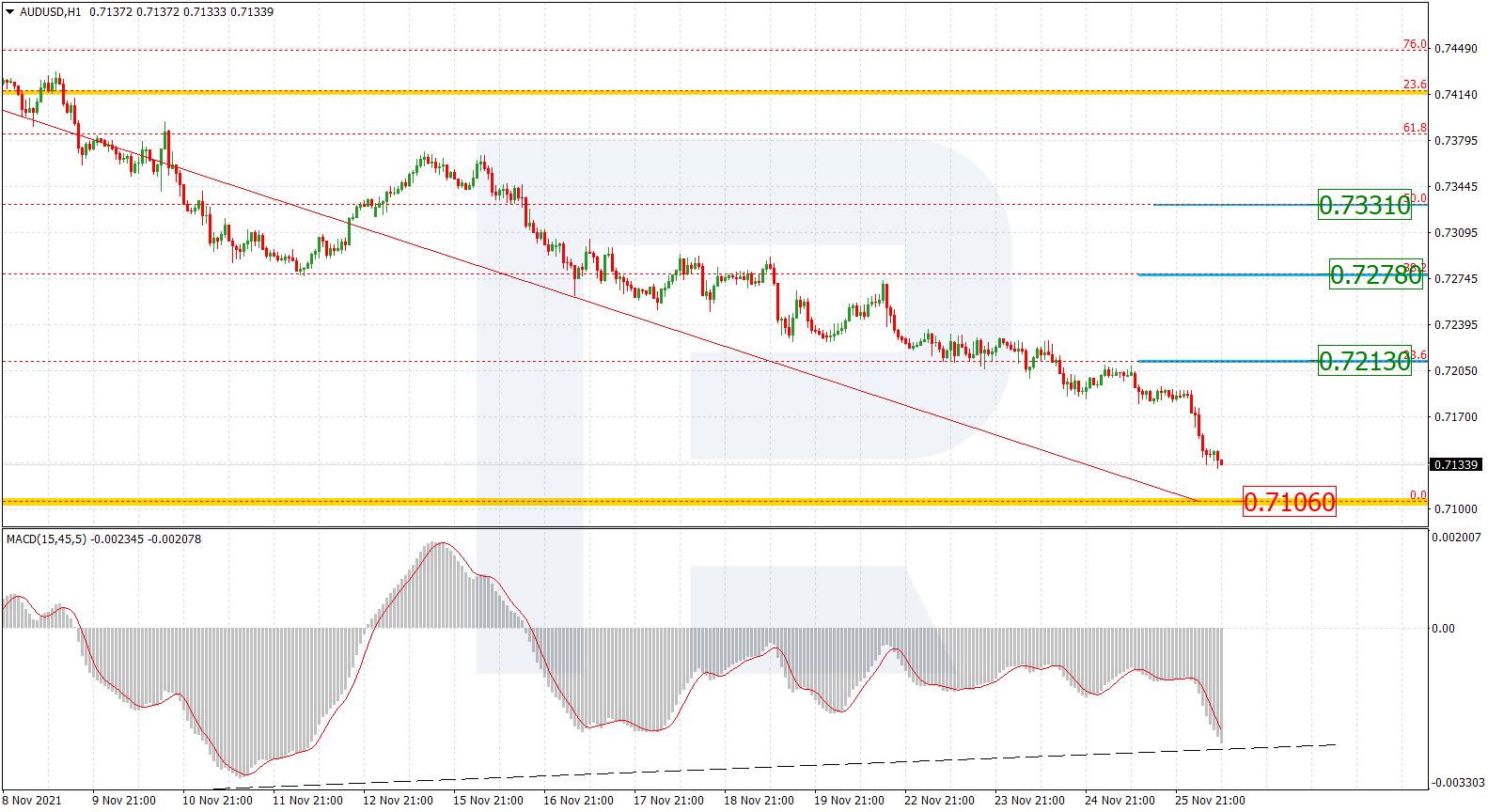

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after breaking 76.0% fibo, AUDUSD is approaching the low at 0.7106, a breakout of which will result in a further downtrend to test or to break the long-term 38.2% fibo at 0.7052. The resistance is the local high at 0.7556.

The H1 chart of AUDUSD shows convergence on MACD, which may indicate a possible pullback towards 23.6%, 38.2%, and 50.0% fibo at 0.7213, 0.7278, and 0.7331 respectively. A breakout of the local low at 0.7106 will lead to a further downtrend.

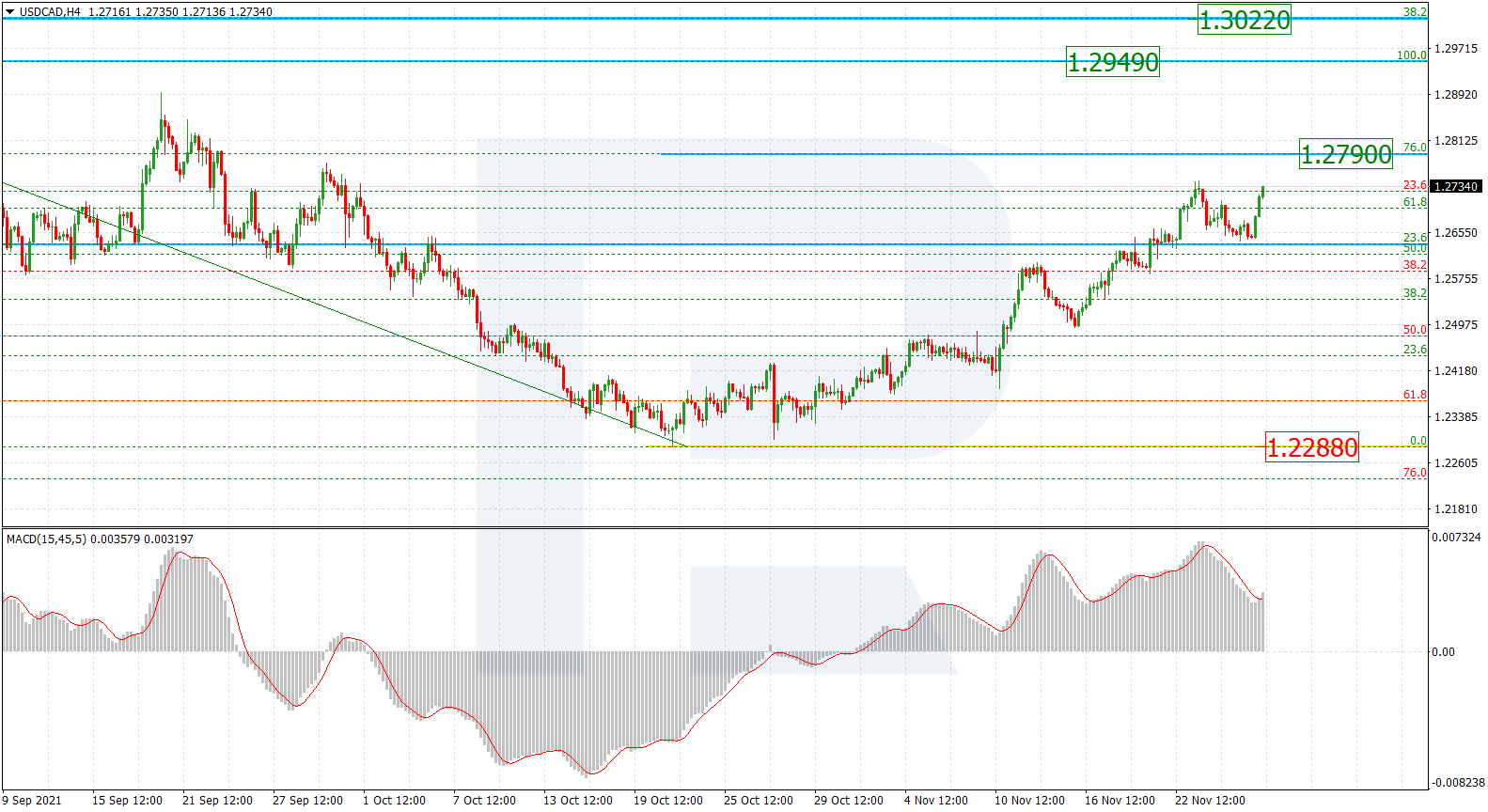

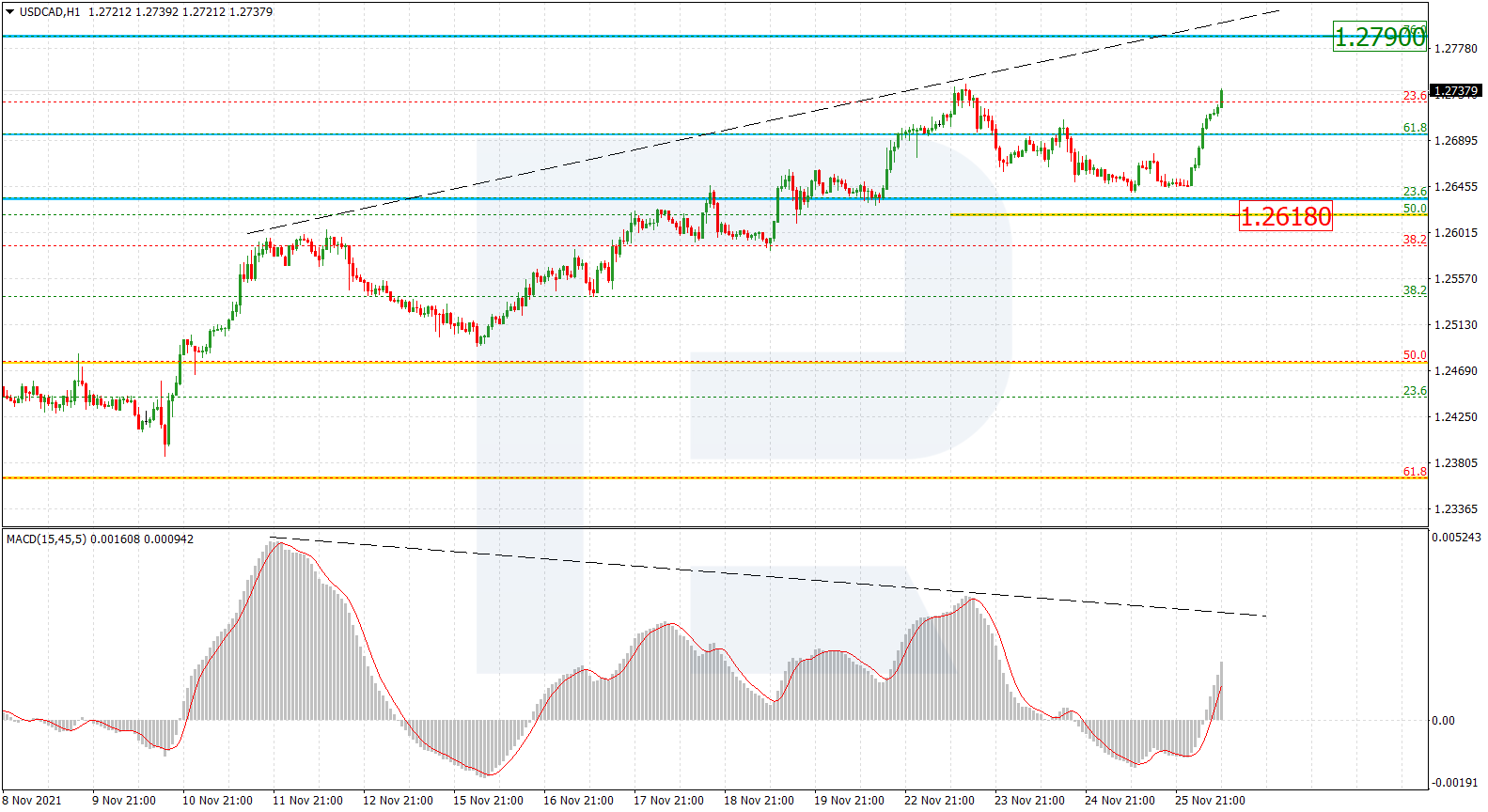

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after breaking 61.8% fibo, the mid-term rising wave in USDCAD continues moving towards 76.0% fibo at 1.2790. However, the key upside target is the high at 1.2949. Moreover, a breakout of the high will lead to a further uptrend to reach the long-term 38.2% fibo at 1.3022. The support is the low at 1.2288.

The H1 chart shows divergence on MACD. At the same time, the price is пакowing to reach 76.0% fibo at 1.2790. The support is 50.0% fibo at 1.2618.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.