Fibonacci Retracements Analysis 29.04.2021 (Brent, Dow Jones)

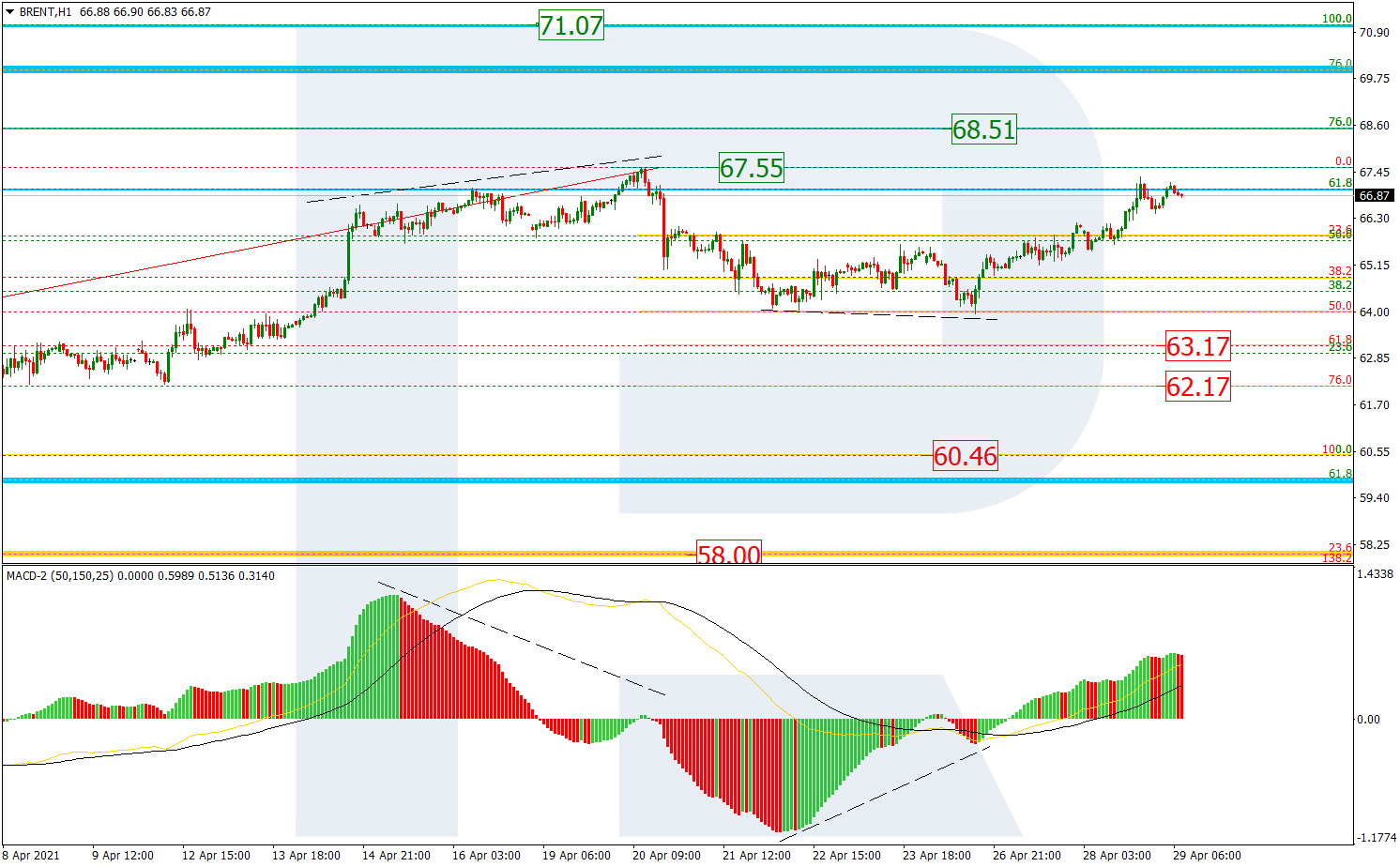

Brent

In the H4 chart, after completing a slight pullback, Brent is forming a new rising wave, which is heading to break the high at 71.07 and then continue towards the post-correctional extension area between 138.2% and 161.8% fibo at 75.13 and 77.36 respectively. On the other hand, a rebound from the high will result in a new decline towards 23.6% and 38.2% fibo at 58.00 and 49.94 respectively.

The H1 chart shows that convergence on MACD made the asset complete its correctional decline at 50.0% fibo and start a new ascending movement, which is now approaching the previous local high at 67.55. The scenario that implies a further downtrend towards 61.8% and 76.0% fibo at 63.17 and 62.17 respectively is rather unlikely. Most probably, the asset will break the high and continue growing to reach the mid-term 76.0% fibo at 68.51.

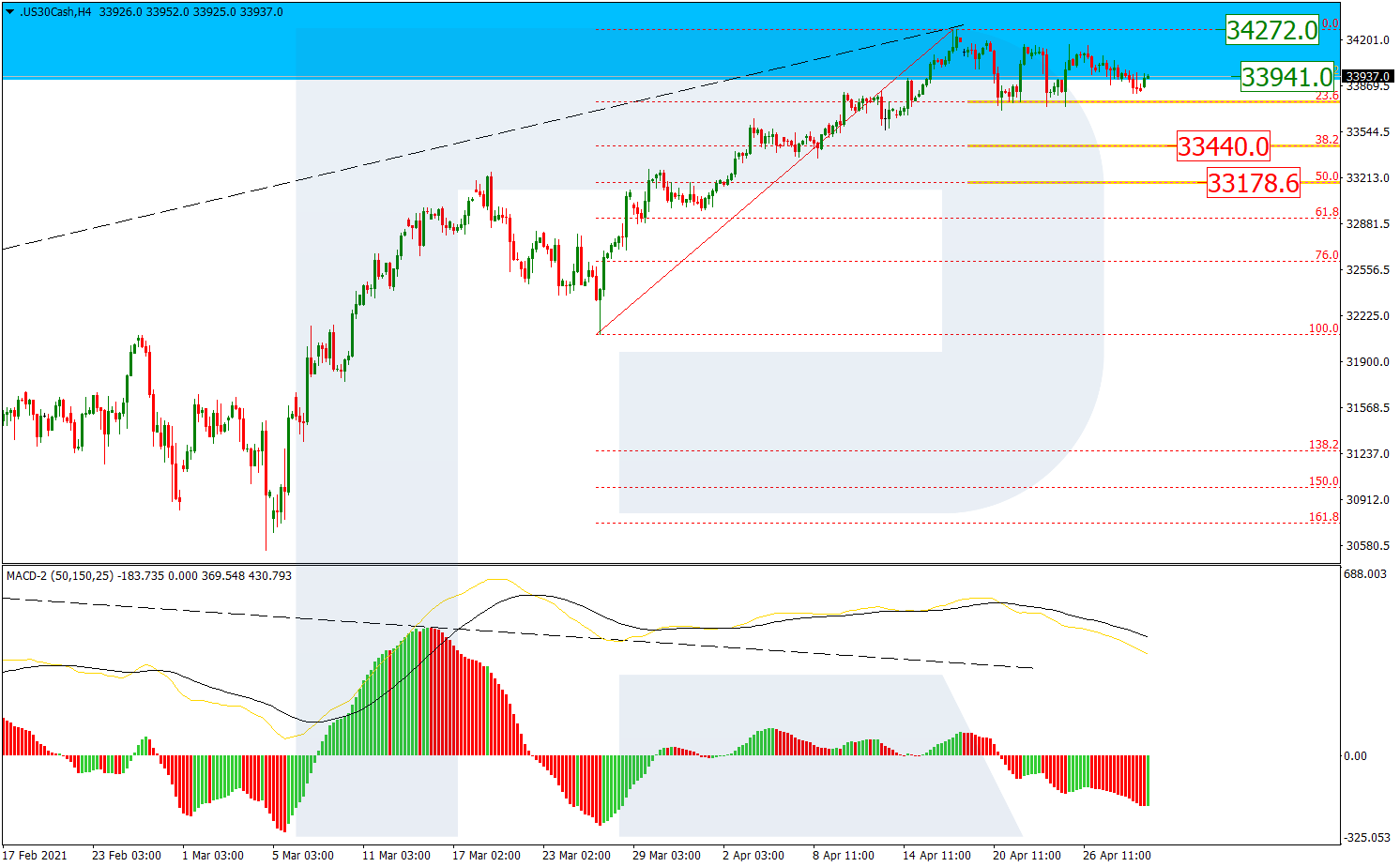

Dow Jones

As we can see in the H4 chart, Dow Jones continues forming a consolidation range after a divergence on MACD and is already moving within the post-correctional extension area between 138.2% and 161.8% fibo at 33941.0 and 36620.0 respectively. This consolidation range may be considered as a correction of the previous rising impulse. By now, the correction has already reached 23.6% fibo. In this situation, the price may break the range both to the downside and upside. In the first case, the asset may fall towards 38.2% and 50.0% fibo at 33440.0 and 33178.6 respectively. Otherwise, it may continue moving inside the post-correctional extension area.

The H1 chart shows a more detailed structure of the current correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.