Fibonacci Retracements Analysis 29.07.2021 (Brent, Dow Jones)

Brent

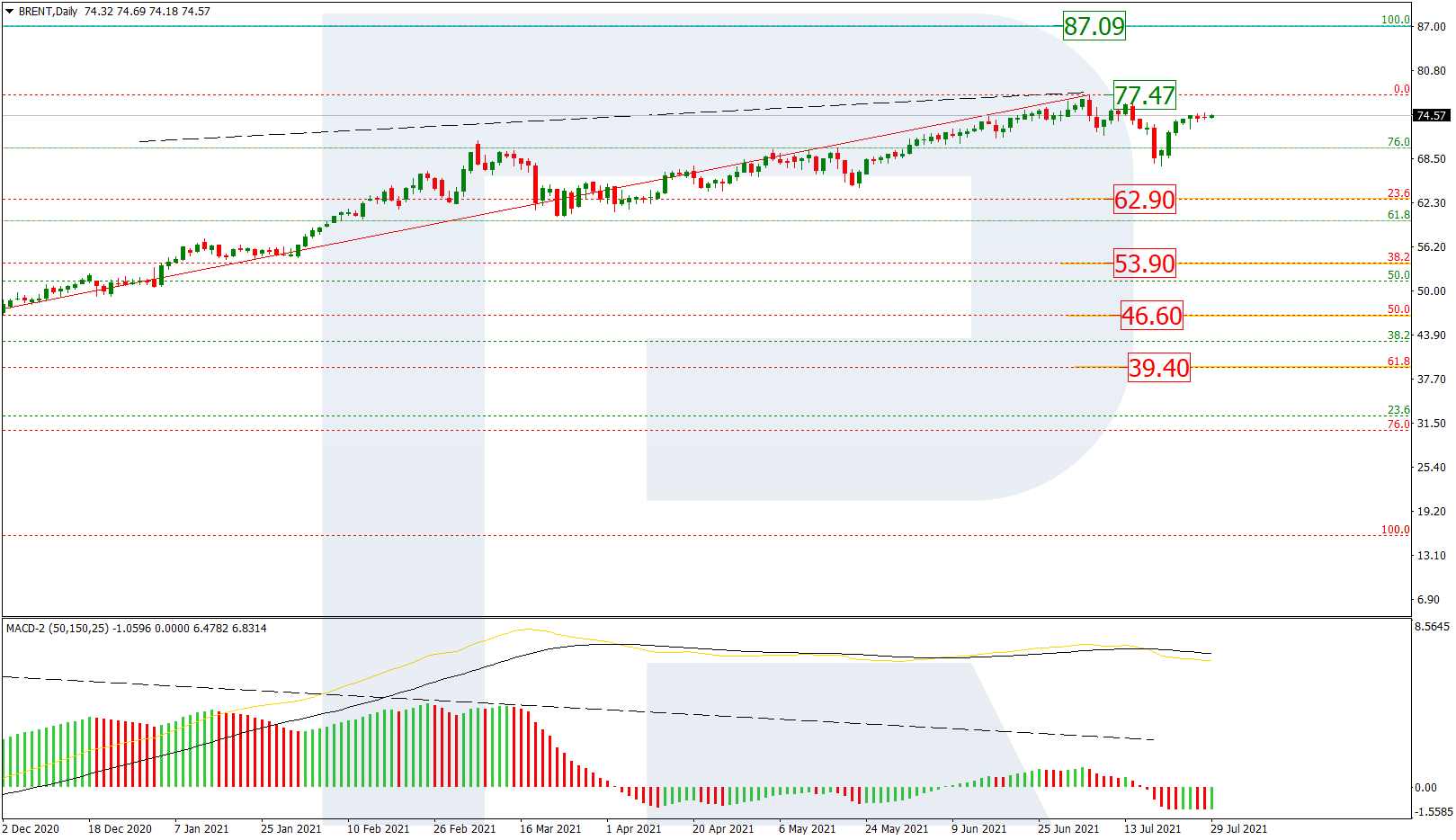

In the daily chart, after finishing the previous descending movement, Brent started moving upwards but then stopped close to the high at 77.47. This pause may be considered as consolidation before the asset breaks the high. After that, the price may continue growing towards the fractal high at 87.09. However, if the market rebounds from the high, it may start a new correction to the downside to reach 23.6%, 38.2%, 50.0%, and 61.8% fibo at 62.90, 53.90, 46.60, and 39.40 respectively.

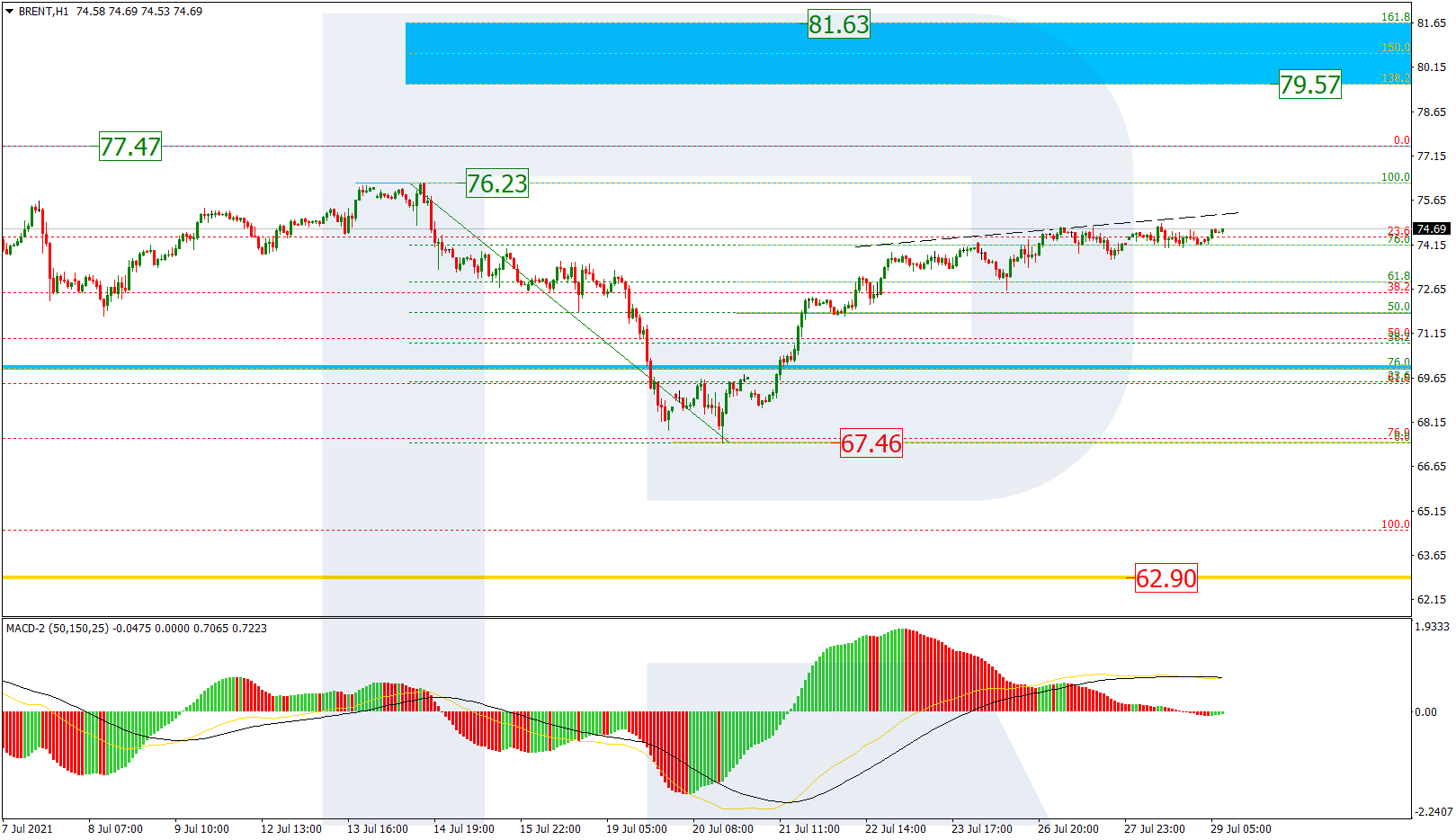

As we can see in the H1 chart, after breaking 76.0% fibo, the current rising wave is heading towards the local resistance at 76.23, a breakout of which will lead to a further uptrend to reach the key high. The support is the low at 67.46. If the price breaks it, the asset may start another descending wave.

Dow Jones

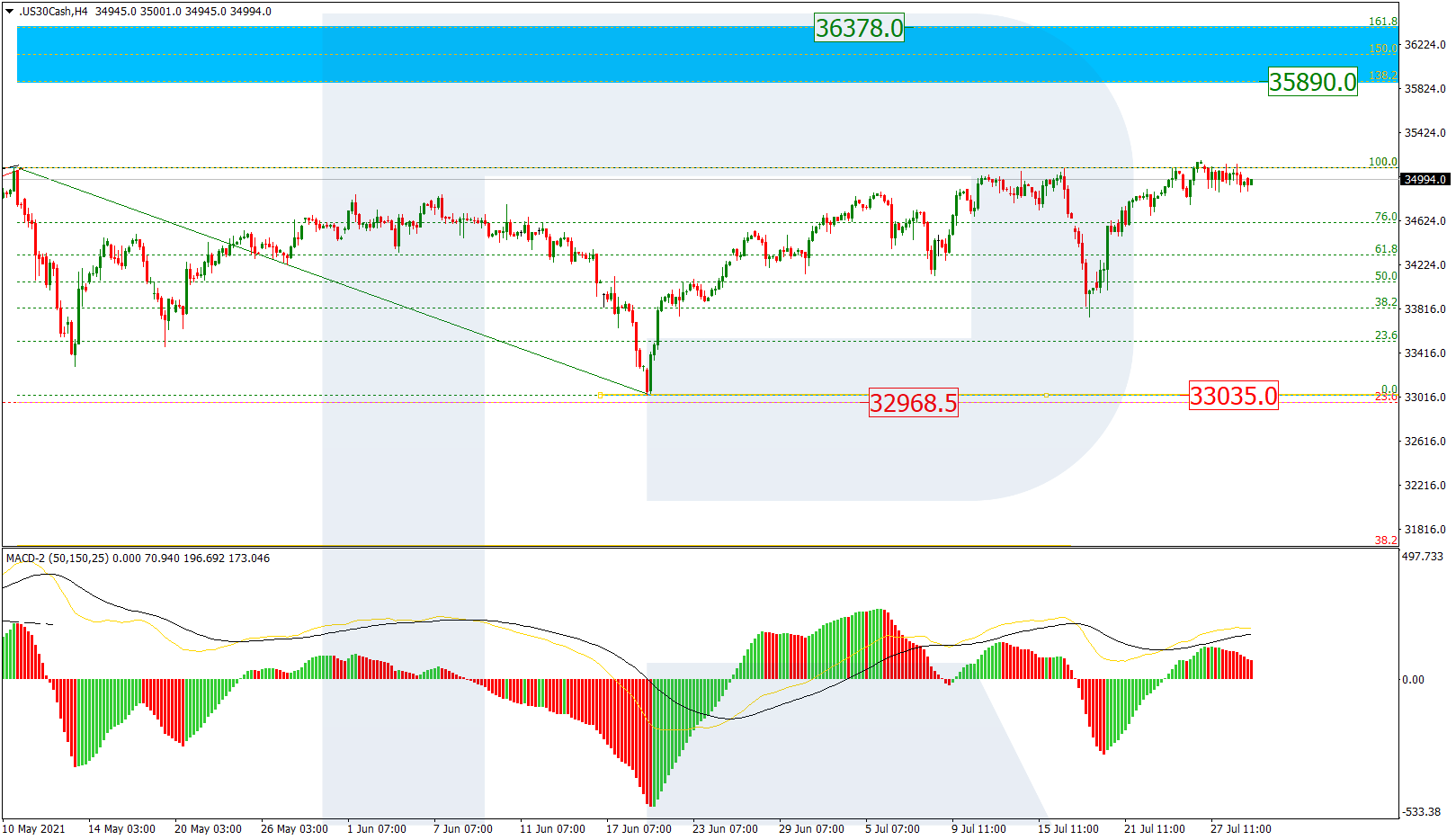

As we can see in the H4 chart, after testing the high, the asset has managed to break it. If the instrument breaks 35102.0 and fixes above it the price may continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 35890.0 and 36378.0 respectively. The support is at 33035.0.

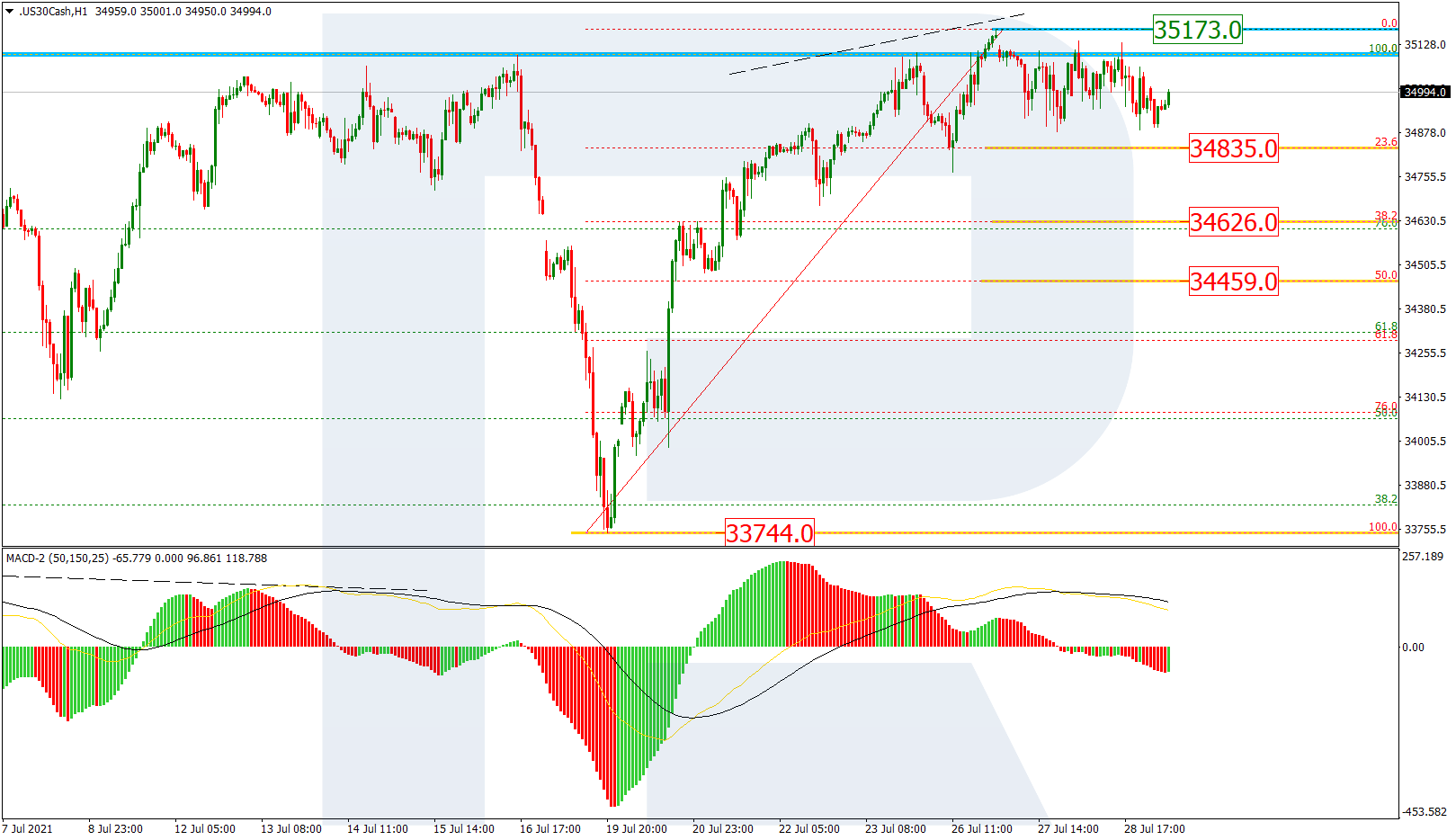

In the H1 chart, the asset is correcting within a sideways channel after divergence on MACD. If the price breaks this channel to the downside, it may continue the correction towards 23.6%, 38.2%, and 50.0% fibo at 34835.0, 34626.0, and 34459.0 respectively. The next upside target is the high at 35173.0. The local support is the low at 33744.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.