Fibonacci Retracements Analysis 10.11.2020 (EURUSD, USDJPY)

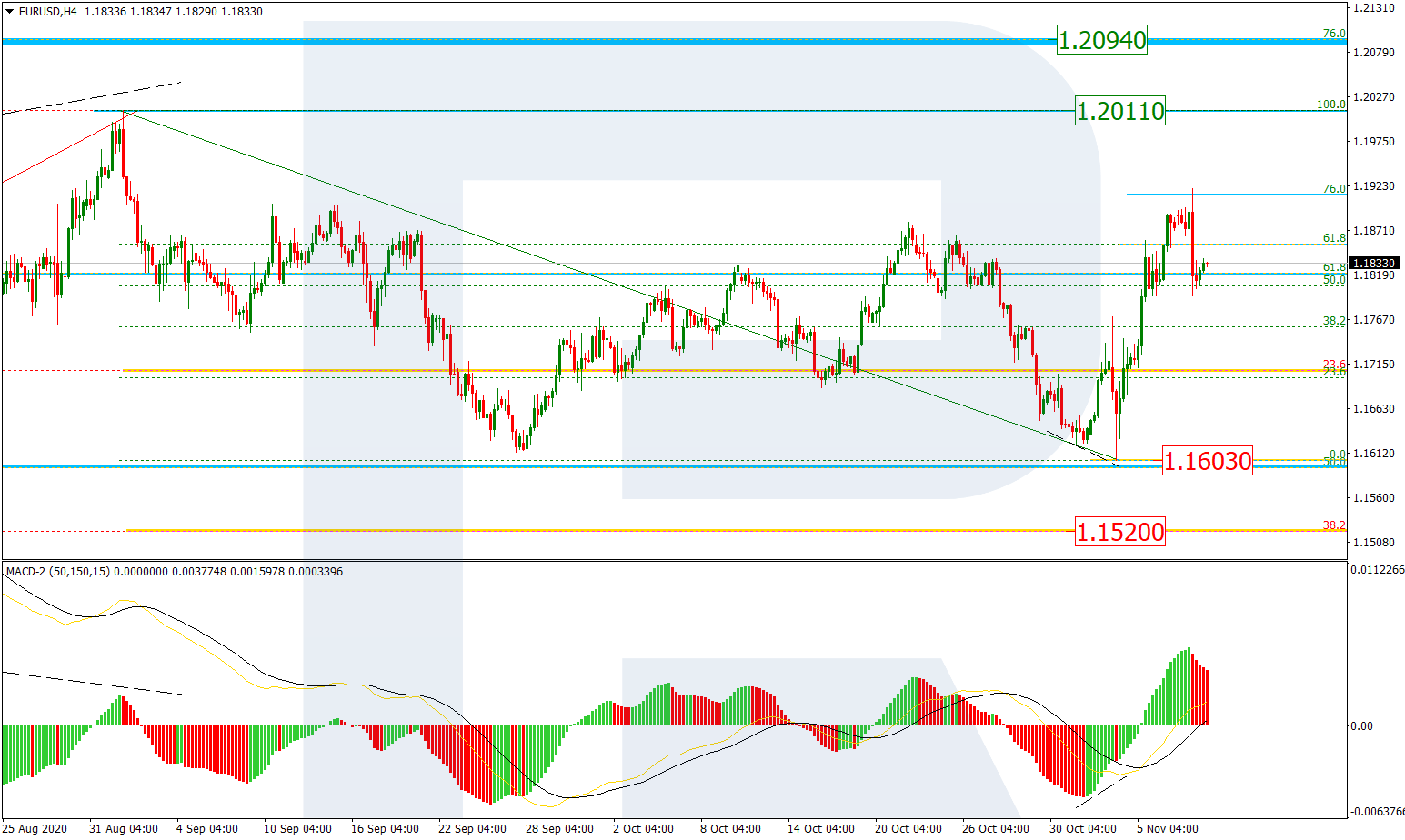

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, a convergence on MACD made EURUSD reverse after updating the low and grow towards 76.0% fibo. After testing this level and rebounding from it, the pair started a new correctional decline. The current movement may imply two possible scenarios. The first one says the asset may complete the correction quickly and then grow to break the high at 1.2011 or even reach the long-term 76.0% fibo at 1.2094. Another scenario suggests that the correction may transform into a proper descending wave to break the low at 1.1603 and then reach mid-term 38.2% fibo at 1.1520.

The H1 chart shows a more detailed structure of the current correctional decline after a divergence on MACD. The first descending wave has already reached 38.2% fibo and may continue towards 50.0% and 61.8% fibo at 1.1762 and 1.1724 respectively. A breakout of the high at 1.1920 will be a strong signal in favor of further ascending tendency.

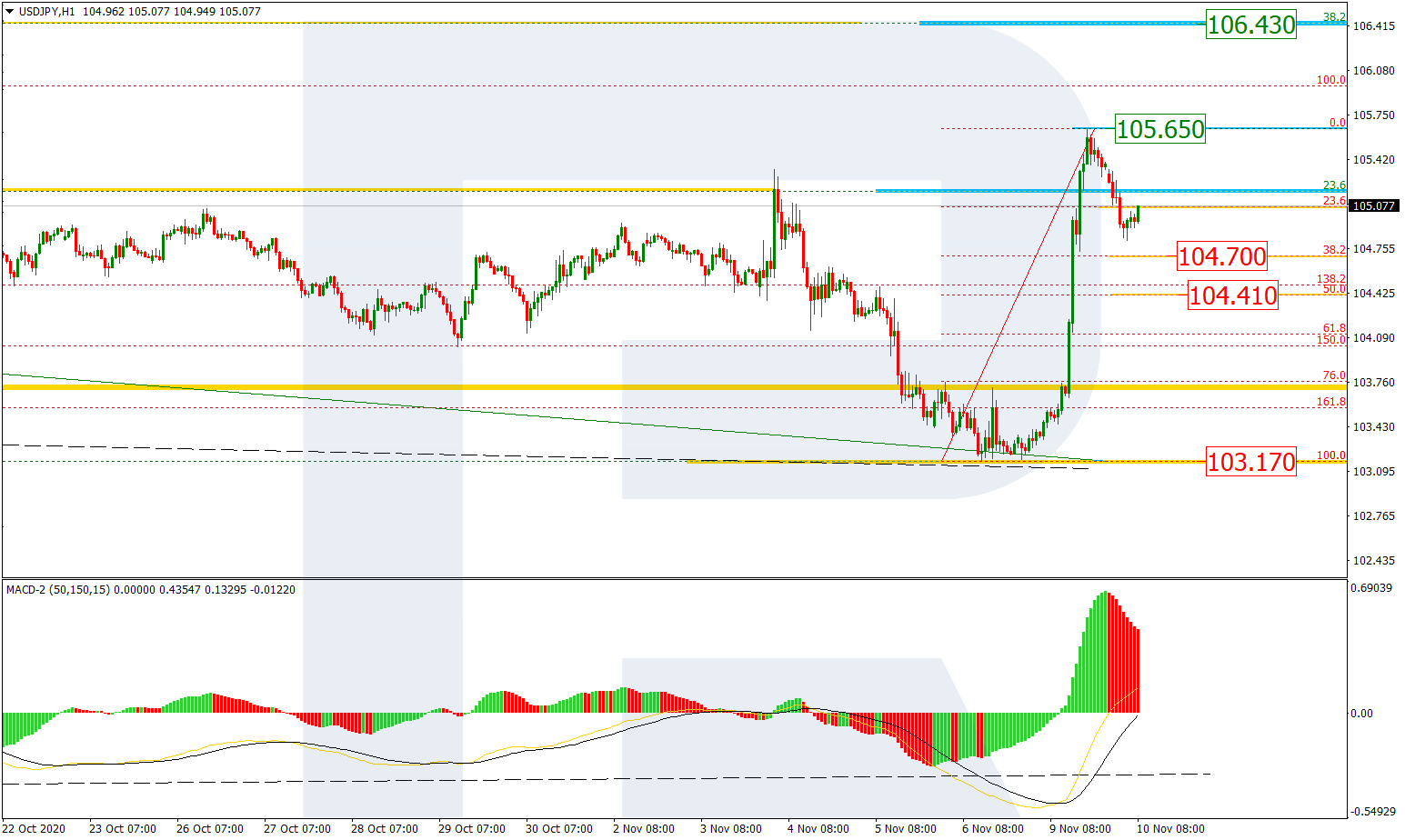

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the daily chart, a convergence on MACD made USDJPY skyrocket after updating the low. The first correctional impulse has reached 23.6% fibo. After testing this level, the pair may reach 38.2%, 50.0%, and 61.8% fibo at 106.43, 107.44, and 108.44 respectively. If the asset breaks the low at 103.17, the instrument may fall towards the long-term fractal low at 101.18.

The H1 chart shows a new descending correction after a strong rising impulse, which has already reached 23.6% fibo and may later continue towards 38.2% and 50.0% at 104.70 and 104.41 respectively. A breakout of the local resistance at 105.65 will signal that the correction is over. As a result, the asset will continue moving upwards to reach the mid-term 38.2% fibo at 106.43.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.