Fibonacci Retracements Analysis 22.03.2021 (GOLD, USDCHF)

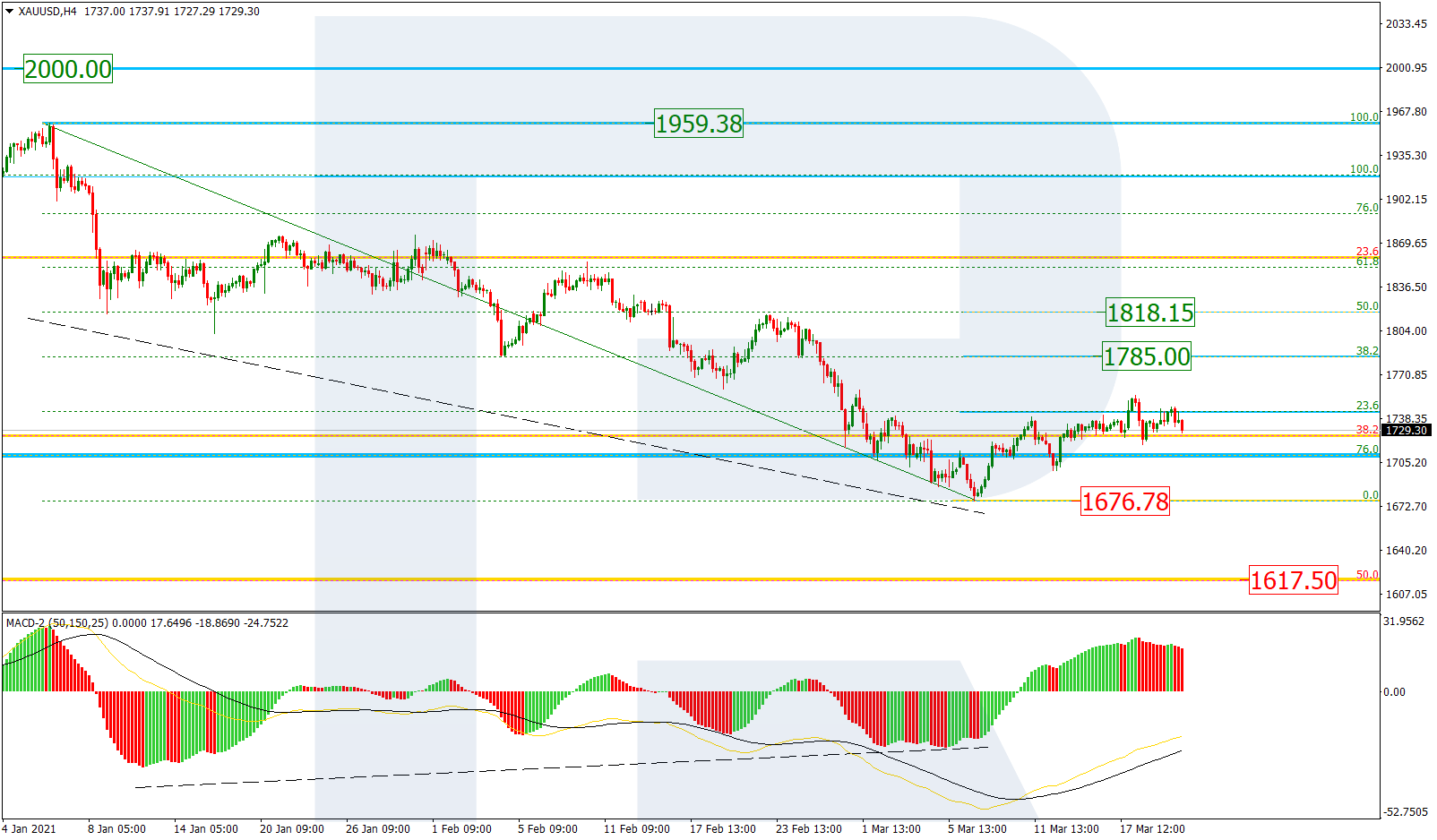

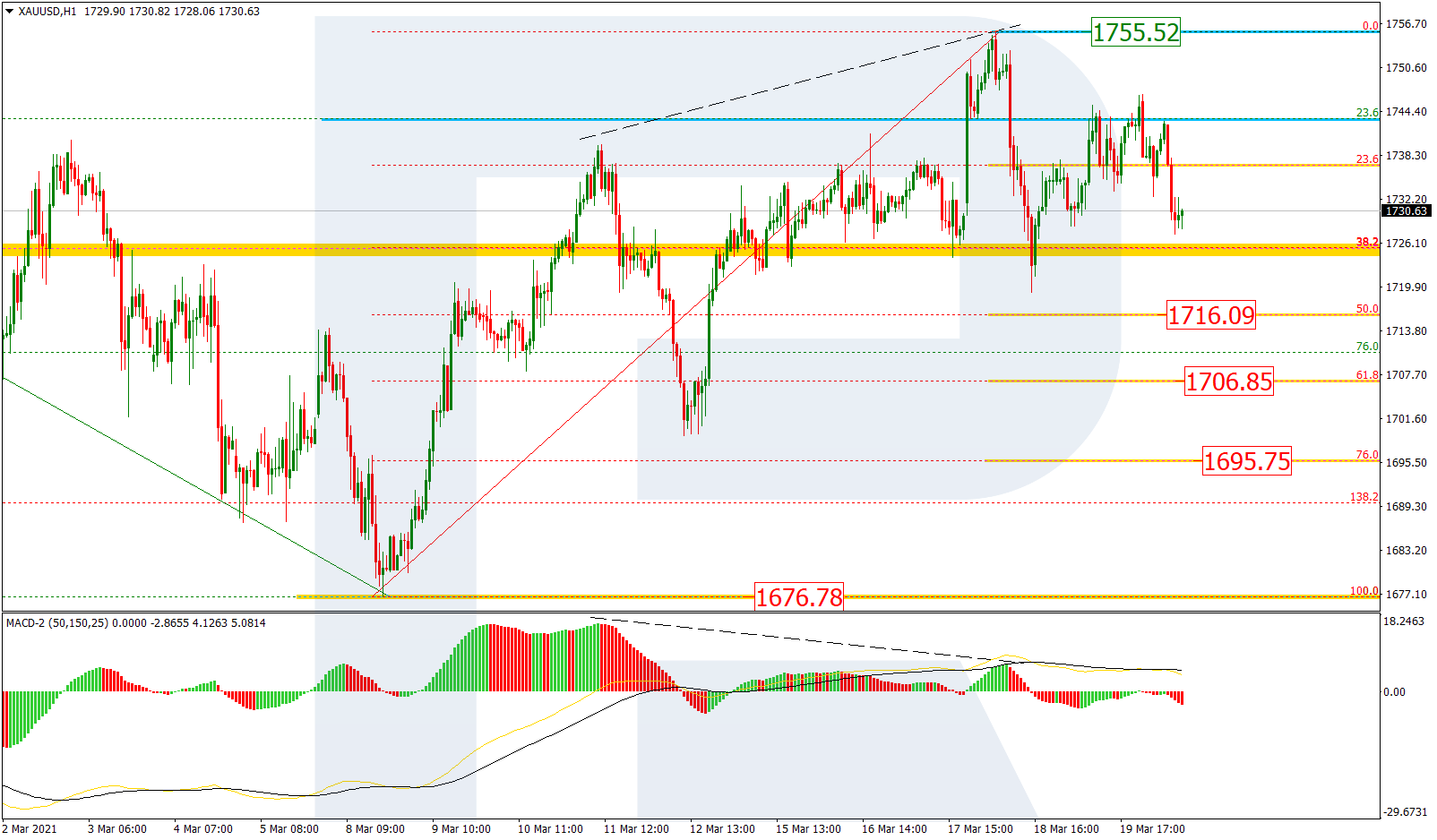

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the correctional uptrend has only reached 23.6% fibo. It seems as if in the nearest future the pair may form a new descending impulse to break the low at 1676.79 and then continue falling towards the key target, which is 50.0% fibo at 1617.50. However, this should distract us from another possible scenario, which implies a further correctional uptrend to reach 38.2% and 50.0% fibo at 1785.00 and 1818.15 respectively.

In the H1 chart, the asset is falling after a local divergence but this might be just an internal correction. The first descending impulse has reached 38.2% fibo, while the next one may be heading towards 50.0%, 61.8%, and 76.0% fibo at 1716.09, 1706.85, and 1695.75 respectively. However, if the price grows and breaks the local high at 1755.52, XAUUSD may extend its mid-term correctional uptrend.

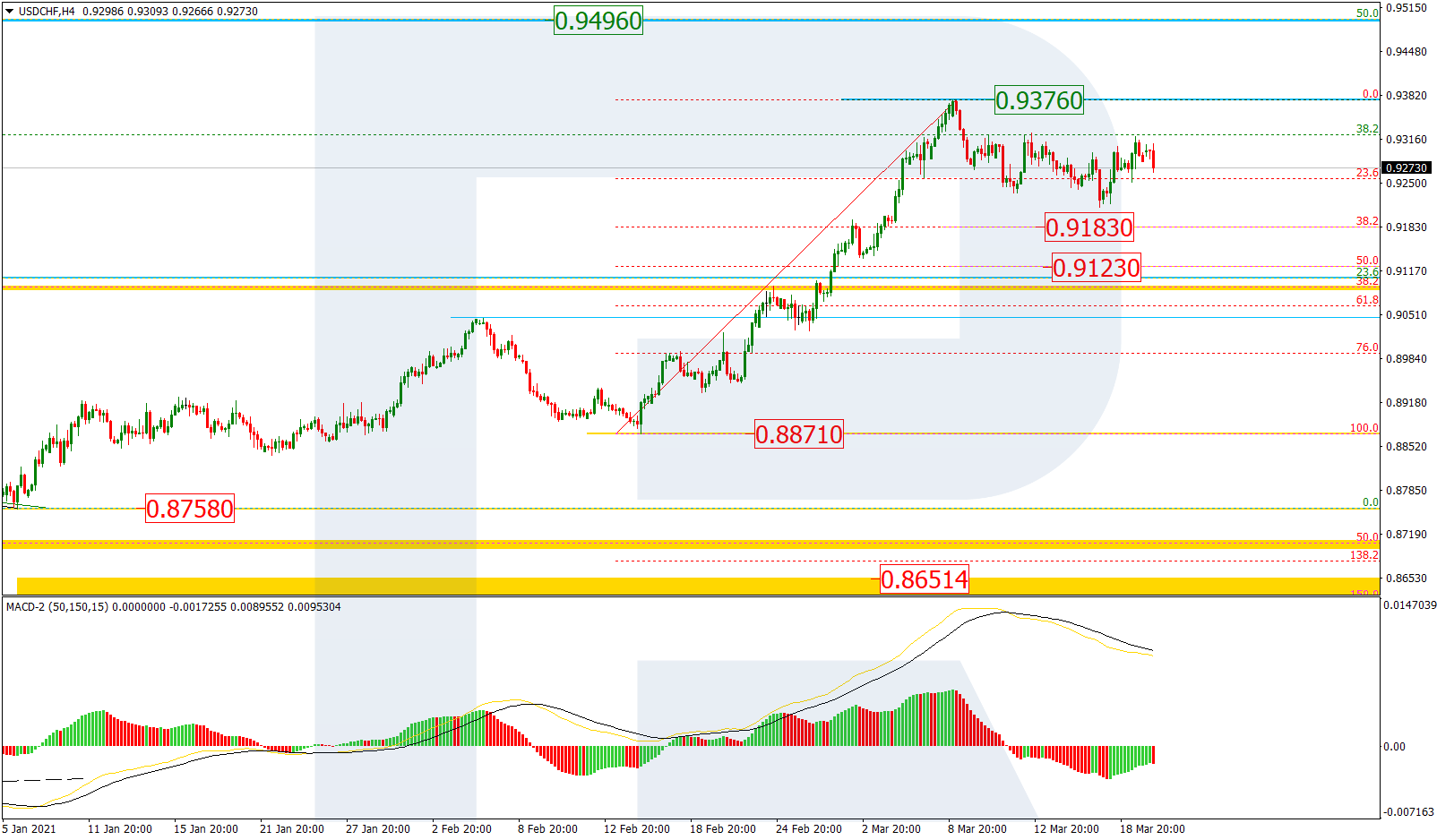

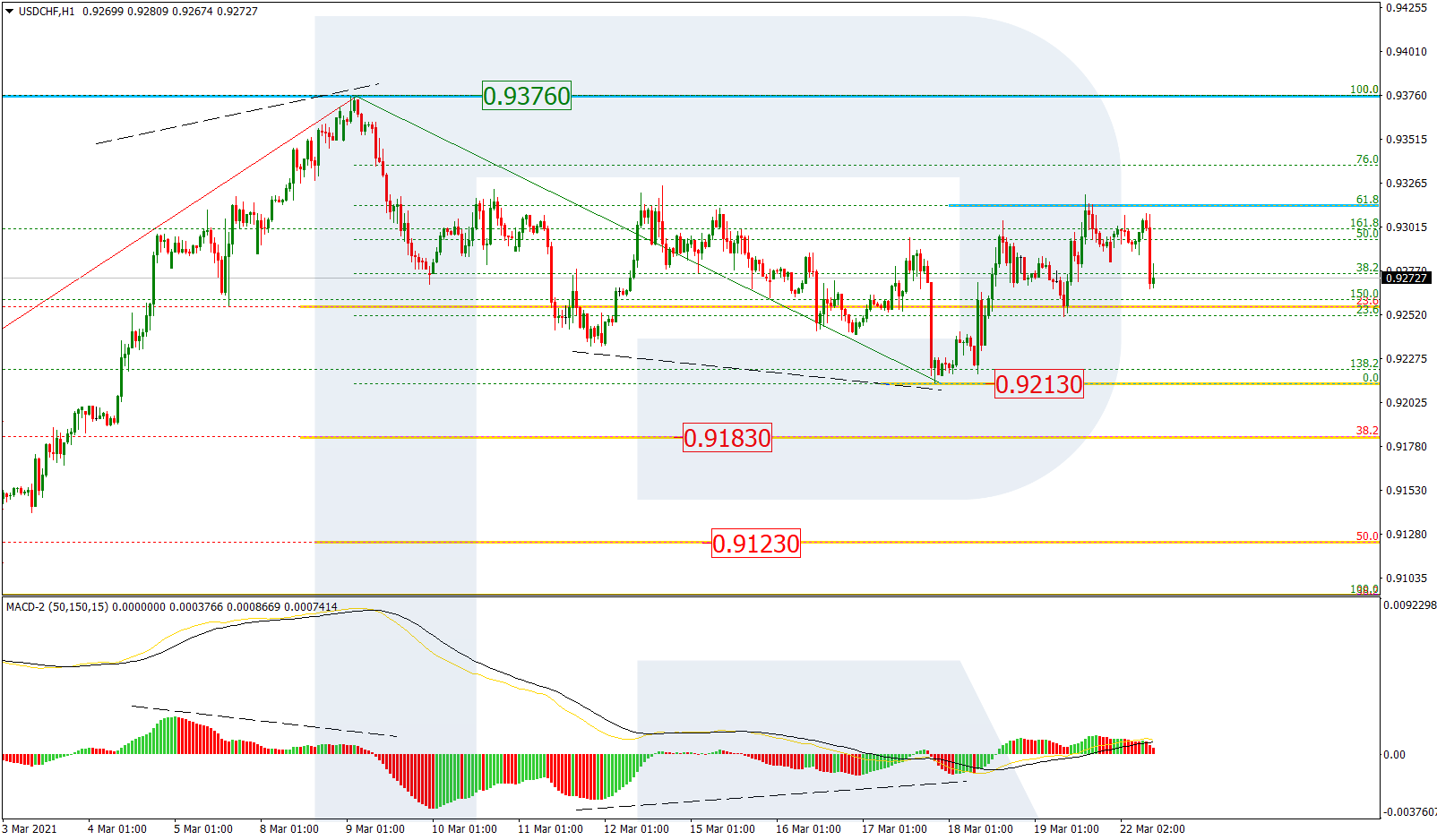

USDCHF, “US Dollar vs Swiss Franc”

The H4 chart shows that USDCHF continues correcting downwards after completing a quick rising wave. After reaching 23.6% fibo, the asset has completed another pullback and may be getting ready for a new decline to reach 38.2% and 50.0% fibo at 0.9183 and 0.9123 respectively. However, if the asset breaks the resistance at 0.9376, the correction will be over and the instrument may continue its mid-term growth towards 50.0% fibo at 0.9496.

As we can see in the H1 chart, the local pullback reached 61.8% fibo and may be followed by a new descending impulse to break the local low at 0.9213. After breaking this level, the asset may continue the descending correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.