Fibonacci Retracements Analysis 29.03.2021 (GOLD, USDCHF)

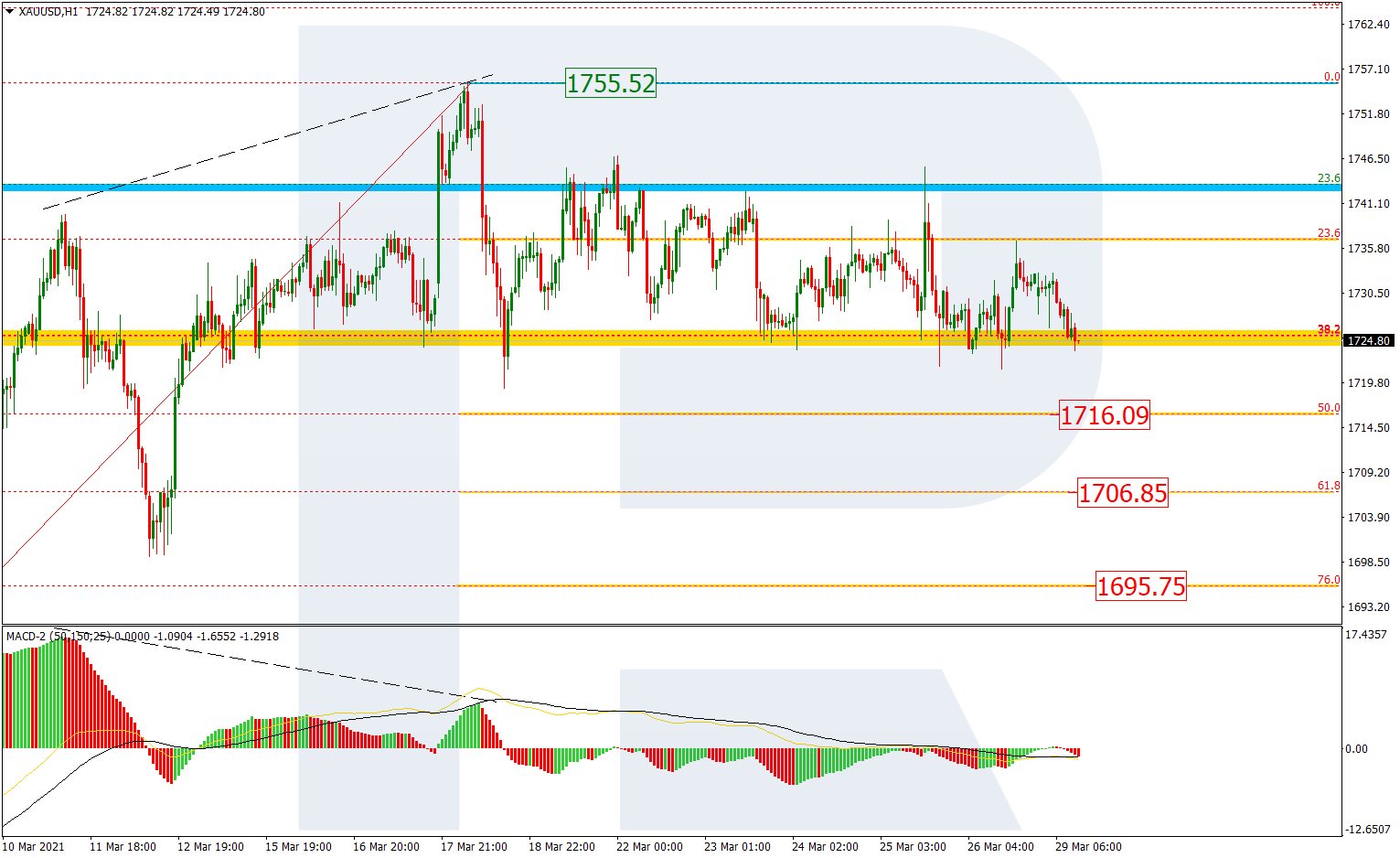

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the situation hasn’t changed much since last Monday. After reaching 23.6% fibo, XAUUSD is still moving there and forming the consolidation range. In this case, both upward and downwards scenarios are possible. The first one implies a further ascending correction towards 38.2% and 50.0% fibo at 1785.00 and 1818.15 respectively. The second scenario suggests a new descending impulse and a breakout of the low at 1676.78. Later, the market may continue falling to reach its mid-term target, which is 50.0% fibo at 1617.50.

The H1 chart shows a more detailed structure of the current short-term correction after a divergence. At the moment, the asset is trading between 23.6% and 38.2% fibo and may soon resume falling towards 50.0%, 61.8%, and 76.0% fibo at 1716.09, 1706.85, and 1695.75 respectively. The resistance is the local high at 1755.52.

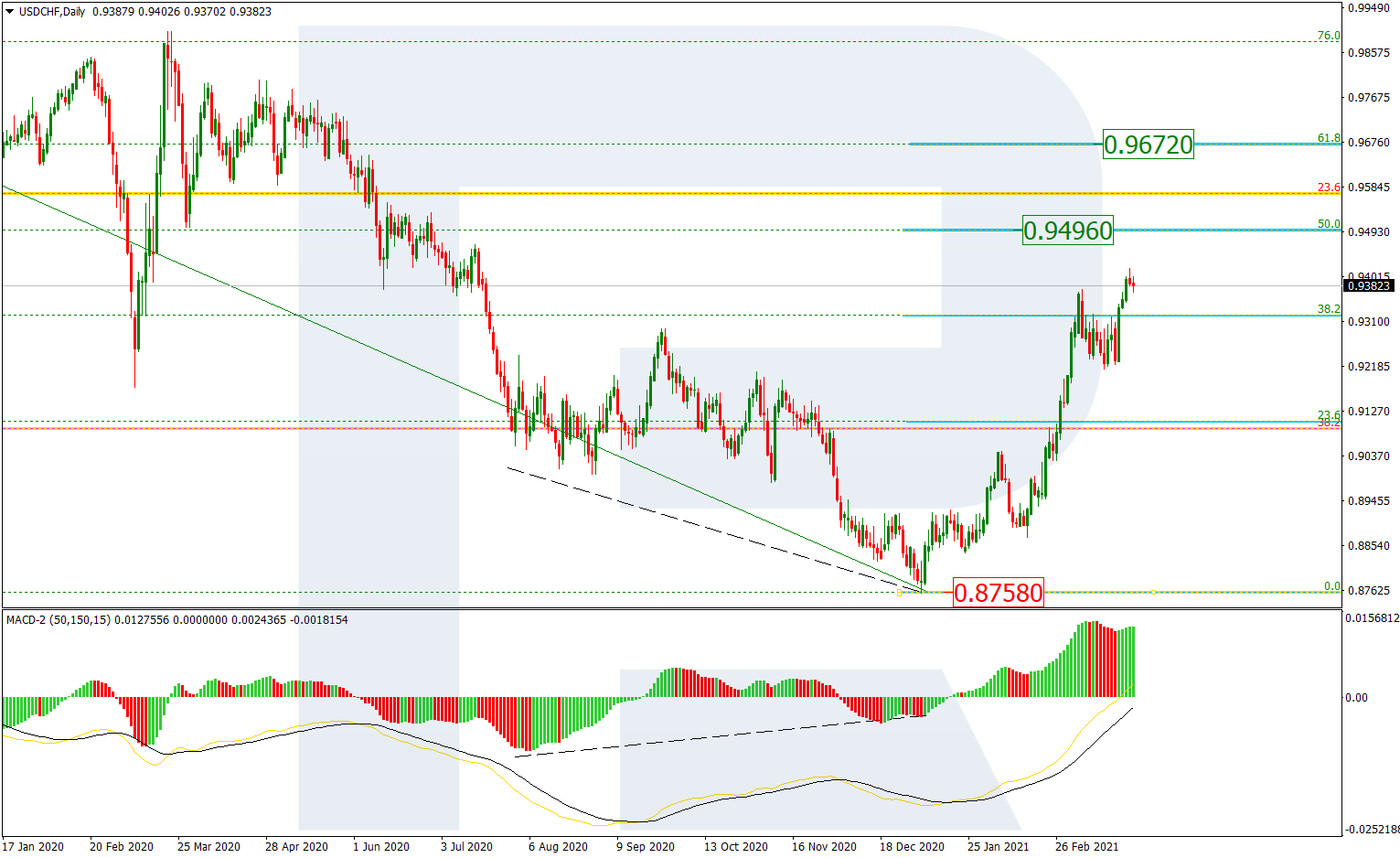

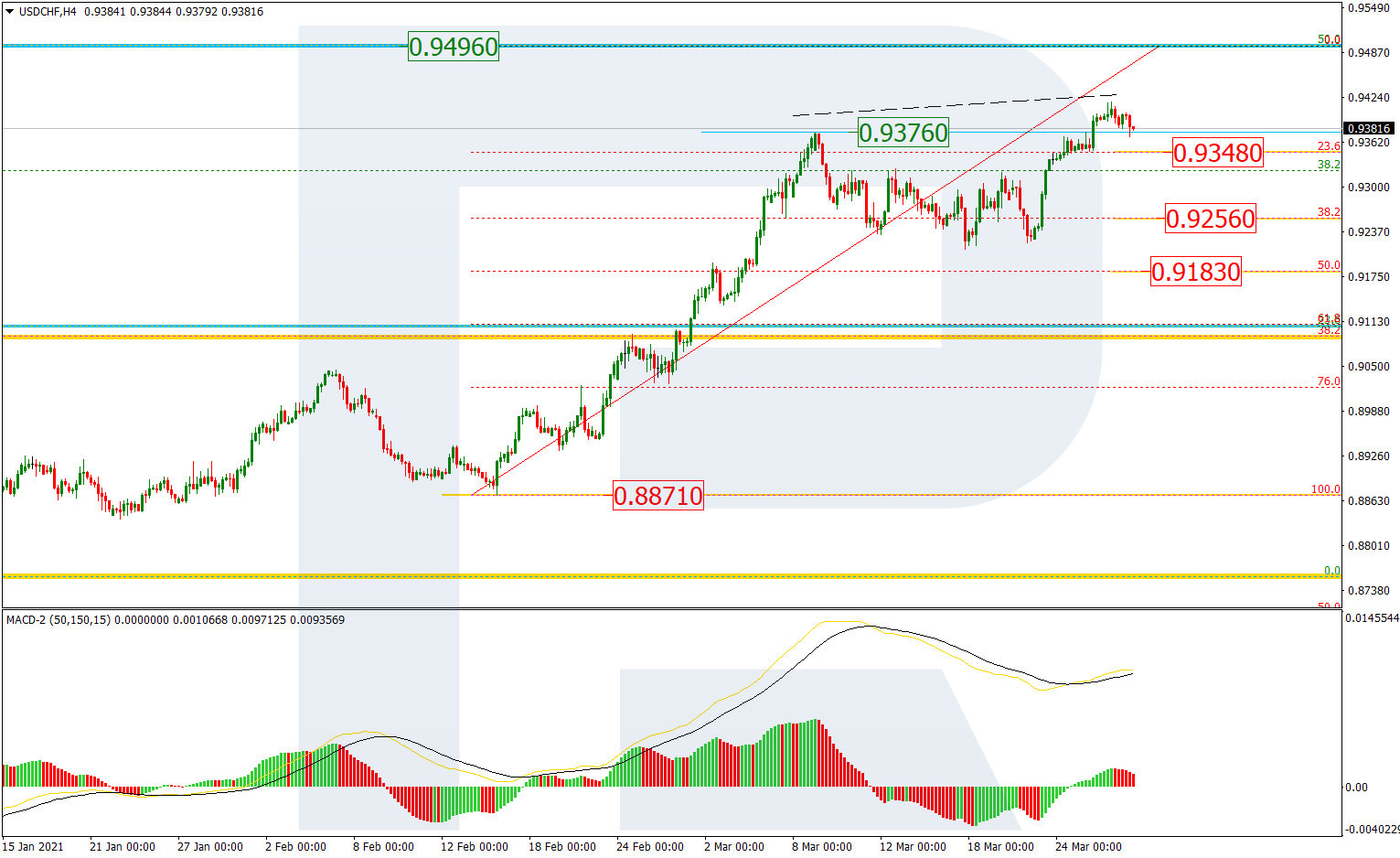

USDCHF, “US Dollar vs Swiss Franc”

The daily chart shows that USDCHF continues the ascending tendency after completing a short-term pullback. After breaking 38.2% fibo, the asset is heading towards 50.0% and 61.8% fibo at 0.9496 and 0.9672 respectively. The key support is the low at 0.8758.

As we can see in the H4 chart, after breaking the previous local high at 0.9376, the pair is heading towards 50.0% fibo at 0.9496. At the same time, there is a divergence on MACD, which may indicate a new pullback after the price reaches its target. The correctional targets may be 23.6%, 38.2%, and 50.0% fibo at 0.9348, 0.9256, and 0.9183 respectively.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.