Ichimoku Cloud Analysis 29.03.2021 (EURJPY, BRENT, NZDCAD)

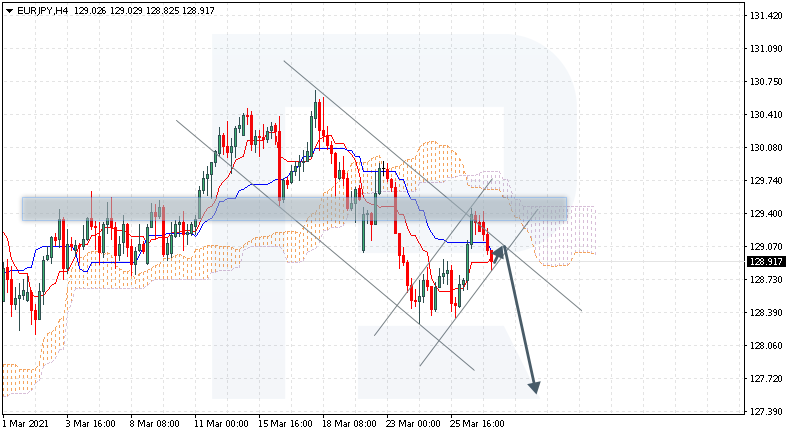

EURJPY, “Euro vs Japanese Yen”

EURJPY is trading at 128.91; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 129.10 and then resume moving downwards to reach 127.55. Another signal in favor of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 129.95. In this case, the pair may continue growing towards 130.85. To confirm further decline, the asset must break the rising channel’s downside border and fix below 128.55.

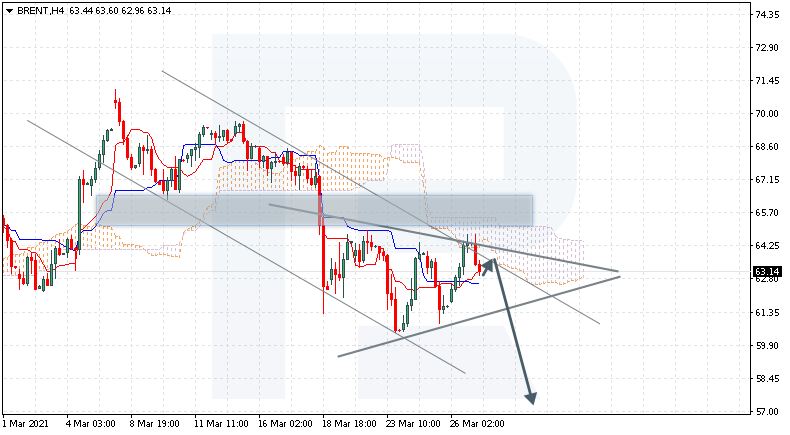

BRENT

Brent is trading at 63.14; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s downside border at 64.35 and then resume moving downwards to reach 57.05. Another signal in favor of a further downtrend will be a rebound from the upside border of the Triangle pattern. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 66.25. In this case, the pair may continue growing towards 69.55. To confirm further decline, the asset must break the pattern’s downside border and fix below 61.05.

NZDCAD, “New Zealand Dollar vs Canadian Dollar”

NZDCAD is trading at 0.8803; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 0.8825 and then resume moving downwards to reach 0.8625. Another signal in favor of a further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 0.8925. In this case, the pair may continue growing towards 0.9005. To confirm further decline, the asset must break the rising channel’s downside border and fix below 0.8745.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.