Ichimoku Cloud Analysis 27.10.2020 (NZDCHF, GBPAUD, USDCNH)

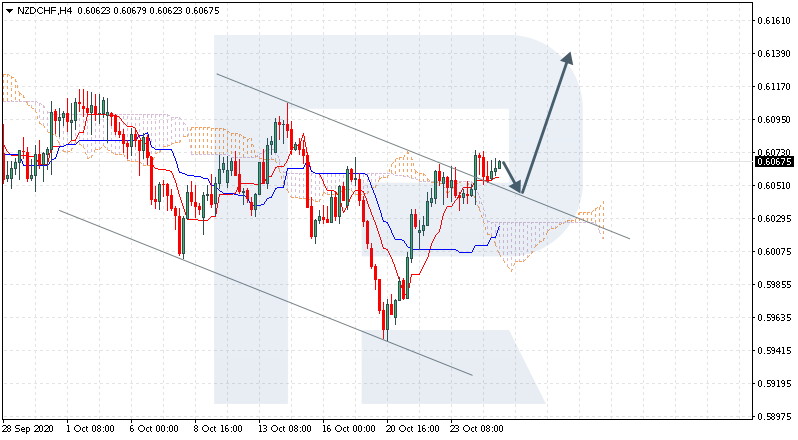

NZDCHF, “New Zealand Dollar vs Swiss Franc”

NZDCHF is trading at 0.6067; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 0.6040 and then resume moving upwards to reach 0.6140. Another signal in favor of further uptrend will be a rebound from the descending channel’s upside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 0.5975. In this case, the pair may continue falling towards 0.5885.

GBPAUD, “Great Britain Pound vs Australian Dollar”

GBPAUD is trading at 1.8267; the instrument is moving inside Ichimoku Cloud, thus indicating a sideways tendency. The markets could indicate that the price may test the cloud’s downside border at 1.8255 and then resume moving upwards to reach 1.8665. Another signal in favor of further uptrend will be a rebound from the rising channel’s downside border. However, the bullish scenario may no longer be valid if the price breaks the cloud’s downside border and fixes below 1.8170. In this case, the pair may continue falling towards 1.8085. To confirm further growth, the asset must break the cloud’s upside border and fix above 1.8425.

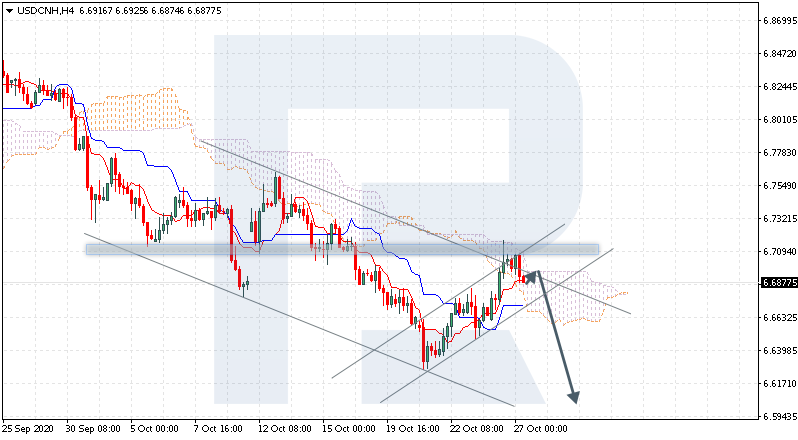

USDCNH, “US Dollar vs Chinese Yuan”

USDCNH is trading at 6.6877; the instrument is moving inside Ichimoku Cloud, thus indicating a sideways tendency. The markets could indicate that the price may test the cloud’s upside border at 6.6885 and then resume moving downwards to reach 6.6205. Another signal in favor of further downtrend will be a rebound from the descending channel’s upside border. However, the bearish scenario may no longer be valid if the price breaks the cloud’s upside border and fixes above 6.7085. In this case, the pair may continue growing towards 6.7175. To confirm further decline, the asset must break the rising channel’s downside border and fix below 6.6625.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.