Murray Math Lines 27.07.2011 (USD/CHF, GBP/JPY, GOLD)

27.07.2011

Analysis for July 27th, 2011

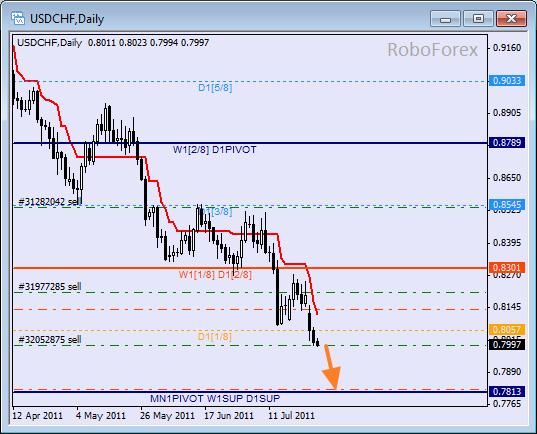

USD/CHF

After breaking and fixing itself below the 1/8 level at the daily chart, the price keeps moving towards the 0/8 level, where Take Profit on sell orders is. The market may reach this level during the week.

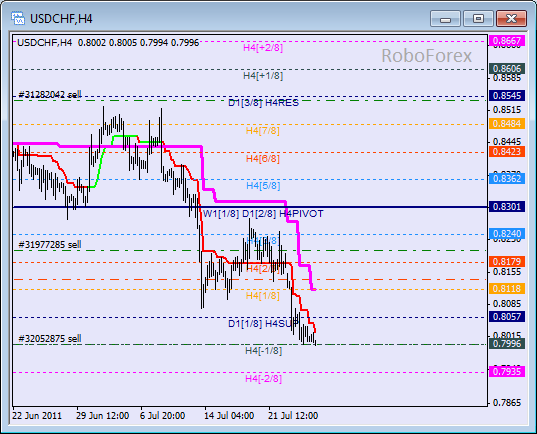

At the H4 chart the price entered oversold zone, just below the 0/8 level. If the descending movement continues and the price breaks the +2/8 level, the lines will be redrawn and be similar to other charts.

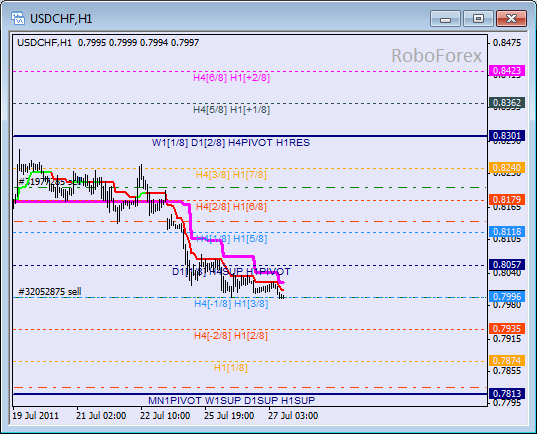

At the H1 chart the price keeps consolidating between the 4/8 level and Super Trends’ lines and I opened the third sell order. The target here is the 0/8 level, the same as at the daily chart.

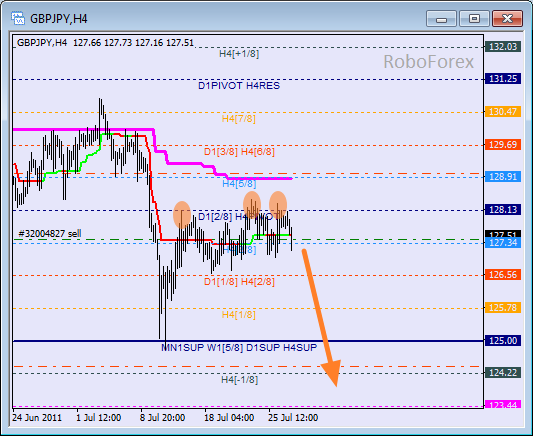

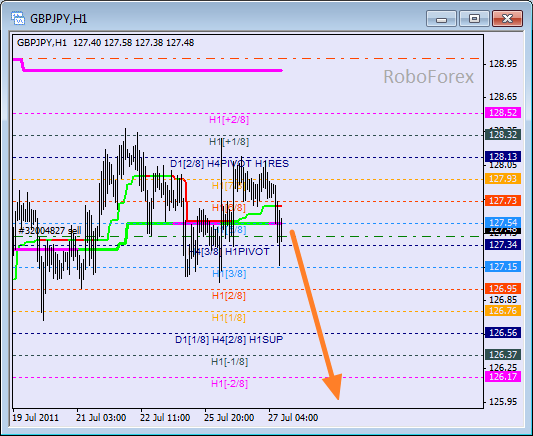

GBP/JPY

Yesterday the market rebounded from the 4/8 level again, the third time in a row. Now the price is attempting to break H4 Super Trend’s line and fix itself below it. If the price succeeds, down-trend may resume its movement.

At the H1 chart lines squeezed. The forecast is still bearish. If the descending trend continues and the price breaks the +2/8 level, the lines will be redrawn

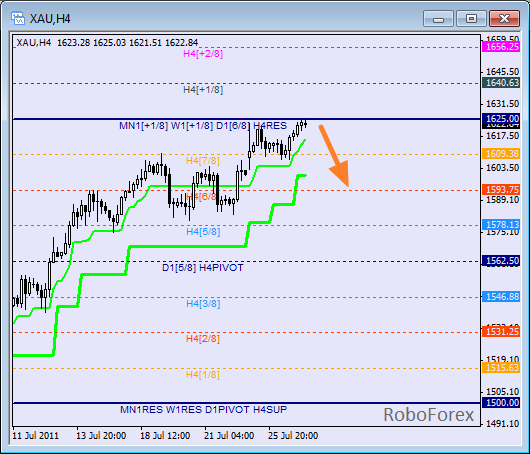

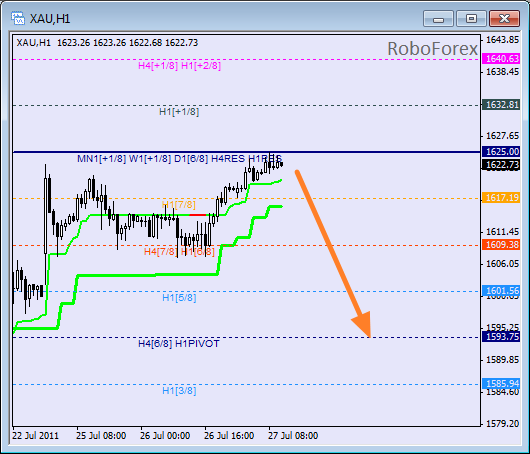

GOLD

The market wasn’t able to break the 8/8 level, thus indicating a possible correction. The first target may be the 6/8 level. If the price rebounds from it, we can expect up-trend to continue. But if the market is able to break the 8/8 level anyhow, it will be a signal for the price to continue growing.

At the H1 chart the price is at the 8/8 level and is trying to rebound from it. If the price succeeds, it will be able to move downwards to the 4/8 level. If the market breaks Super Trends’ lines and fixes itself below them, the correction may take place.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.