Murray Math Lines 01.08.2011 (USD/CHF, AUD/USD, GOLD)

02.08.2011

Analysis for August 1st, 2011

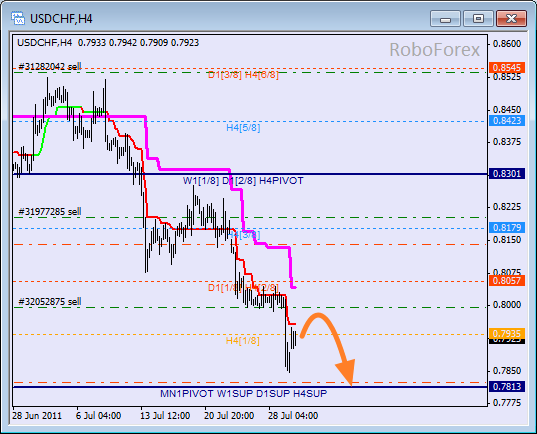

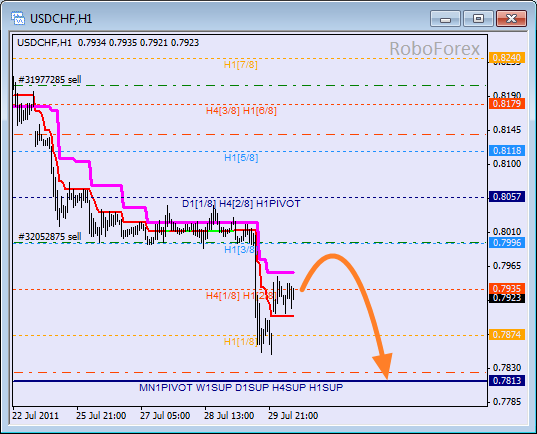

USD/CHF

As we expected, after the price had broken the -2/8 level, the lines at the 4 chart were redrawn. The market was several dozens of pips short to reach the 0/8 level. Most likely, after a slight correction, the market will retry to reach the level.

There is a possibility that the market may try to test H4 Super Trend’s line. If the market rebounds from it, down-trend will continue. The target is still the 0/8 level.

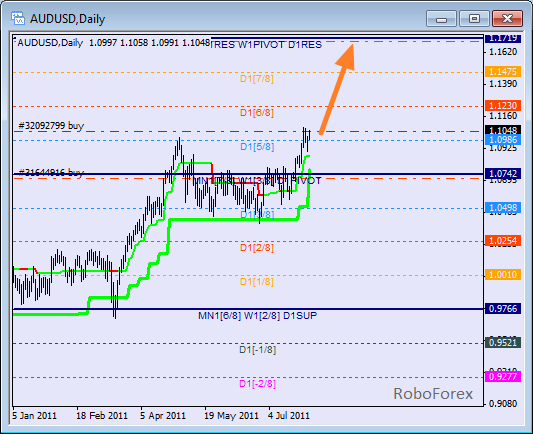

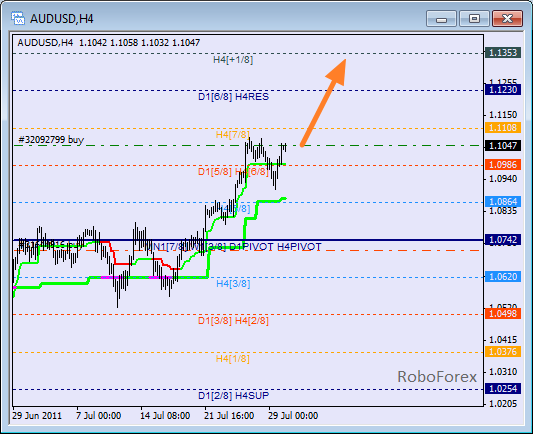

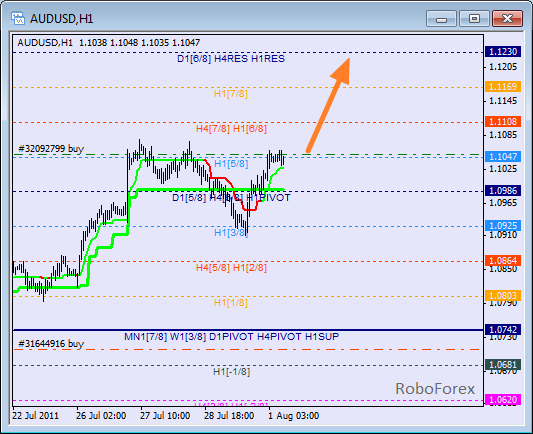

AUD/USD

At the daily chart the price has broken the 5/8 level and now can continue moving upwards to the 8/8 level, where Take Profit on buy orders is. The price may continue growing during the week.

The market tried to break H4 Super Trend, but bulls prevented the market from breaking it and the price is growing again. The forecast is still bullish. In the near term, the price may grow up to the 8/8 level, and then, after breaking it, even higher.

H1 and H4 Super Trends have made a “Golden Cross”, thus confirming that the price is moving the bulls’ way. While the price was being slightly corrected, I decide to open the second buy order, Stop Loss and Take Profit levels are the same as the first one. As the price moves up, I’ll move the stop on both orders higher.

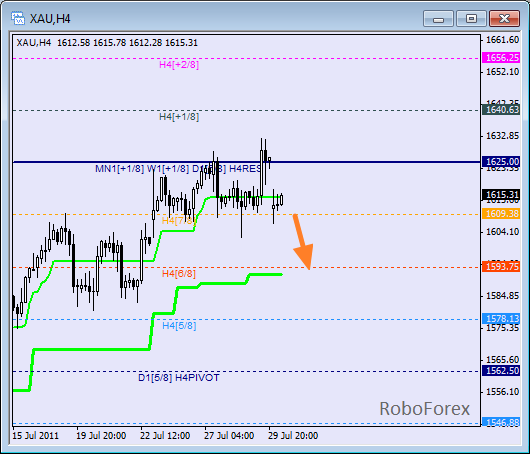

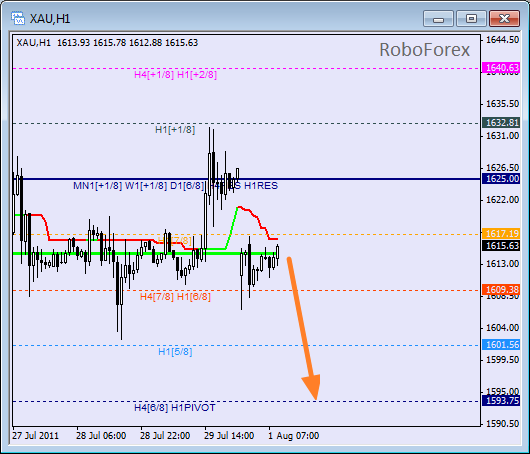

GOLD

During the market trading opening there was a gap down from the 8/8 level, which is a good indicator of the correction. That’s why the closest target for the next several days is the 6/8 level, which is the same as daily Super Trend’s line. If the price rebounds from these levels, up-trend may continue.

The price became more stable after the gap, but the market can’t enter the gap zone yet. This is good for bears, because after such a consolidation the price may continue moving downwards to the 4/8 level. If Super Trends are able to form “Dead Cross”, bulls will be off the market, for at least a couple of days.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.