Brent continues its upward correction, rising above 72.00 USD

Brent price fell impressively within the downtrend last week. The price has now gone into an upward correction, but once it is complete, the decline could continue. Find out more in our Brent analysis for today, 17 September 2024.

Brent forecast: key trading points

- US data: the market is awaiting the API oil stock statistics today

- Current trend: oil prices are correcting within the downtrend

- Brent forecast for 17 September 2024: 75.00 and 70.00

Fundamental analysis

Brent quotes are showing corrective growth after falling to the 68.00-68.50 USD area. Oil prices are supported by an upswing in the US stock market and expectations of the beginning of the US Federal Reserve monetary policy easing, which may help improve economic conditions in the country.

US oil inventory statistics from the American Petroleum Institute (API) are due today. A decrease in oil reserves may provide short-term support to Brent quotes, while an increase will send the asset price down. Tomorrow, market participants will receive oil stock statistics from the Energy Information Administration (EIA) and learn about the Federal Reserve’s interest rate decision.

Brent technical analysis

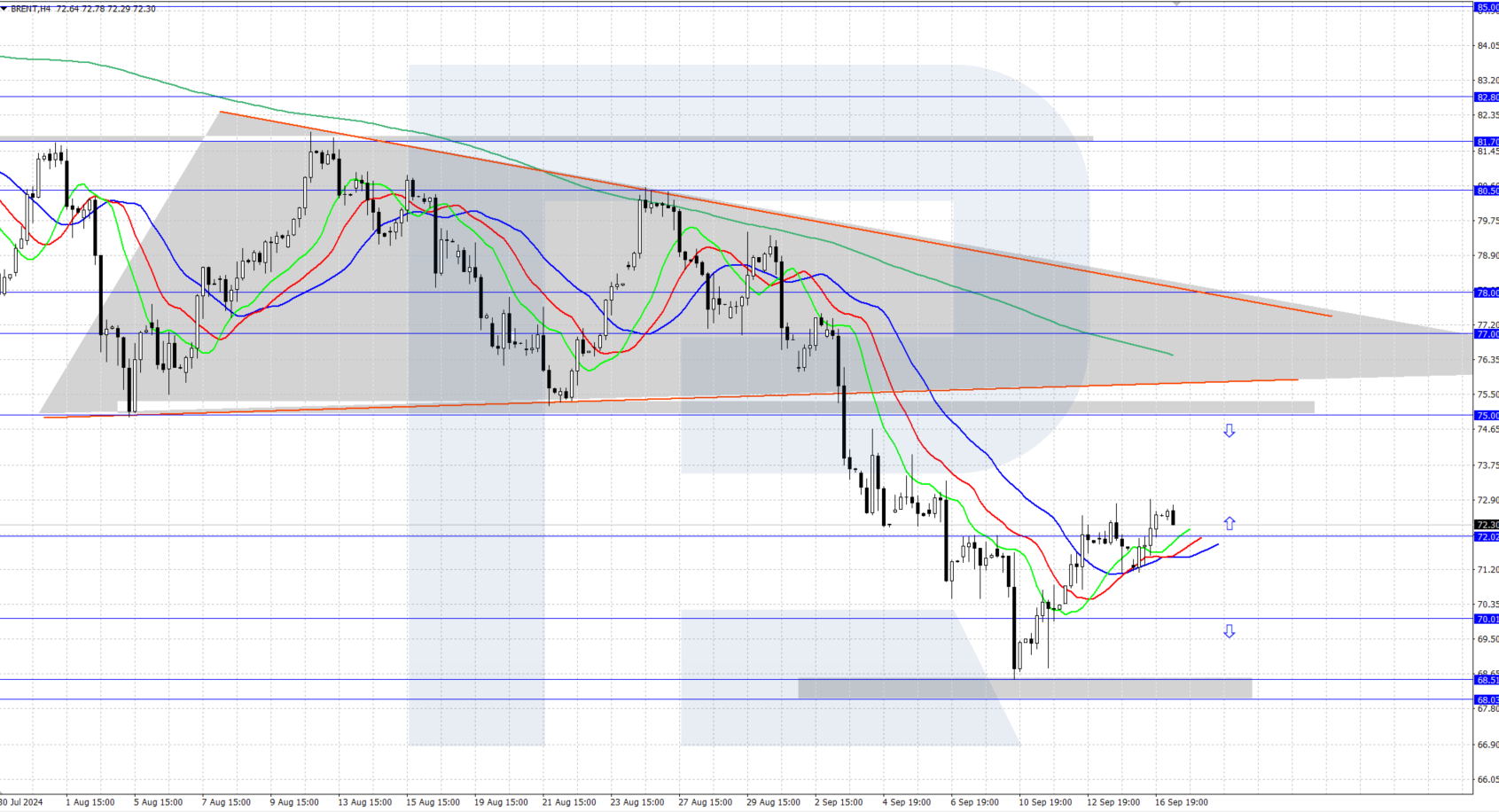

Brent rises moderately at the start of the week, with the quotes currently hovering slightly above 72.00 USD. A triangle pattern formed on the H4 chart last week, and the quotes broke below it, dipping to the target area of 68.00-68.50 USD. The pattern’s target has been reached, with an upward correction currently underway.

The short-term Brent price forecast suggests that as long as the price is above 70.00 USD, the upward correction could continue towards the 75.00 USD resistance level. If bears push the price below 70.00 USD, a decline to the 68.00-68.50 USD support area may follow.

Summary

Oil prices are correcting after a decline, rising above 72.00 USD. The API US oil stock statistics may impact their further movements today.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.