Brent crude oil declines moderately, falling below 72.00 USD

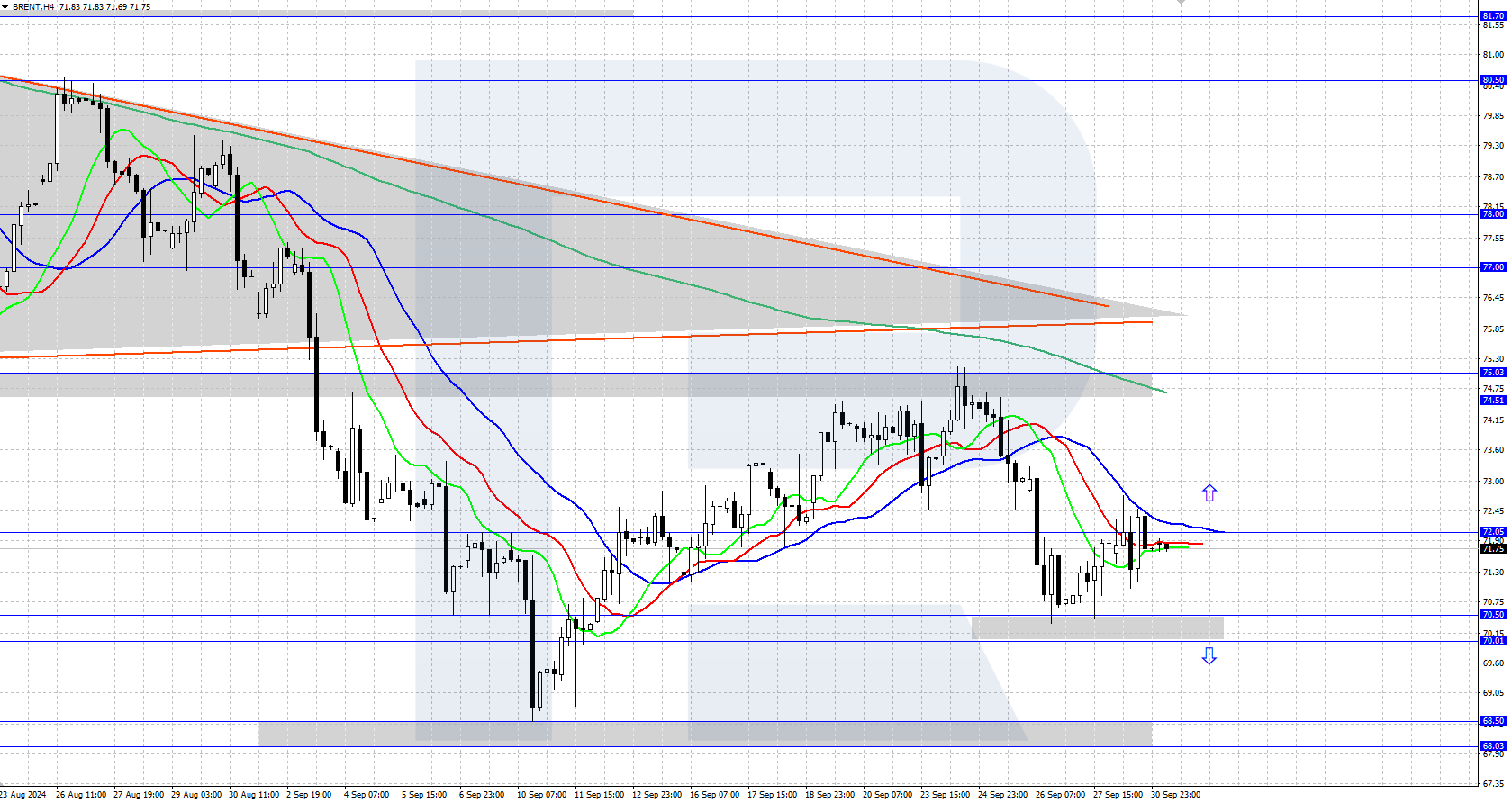

Brent price failed to overcome the resistance level at 75.00 USD last week and turned downwards. The daily trend is downward, and the decline may continue - read about it in our Brent analysis for today, October 1, 2024.

Brent forecast: key trading points

- US data: today, the market is waiting for the API oil inventories data, which could provide a crucial signal for traders.

- Current trend: declining in a downtrend

- Brent forecast for 1 October 2024: 75.00 and 70.00

Fundamental analysis

Brent quotes are showing a gradual decline after last week's reversal downward from the resistance level at 75.00 USD. Today's API oil inventories statistics are highly anticipated by the market, as they could have a notable impact on Brent's price forecast. A decline in inventories may offer short-term support, while an increase could contribute to further price declines.

Additionally, this week’s US labour market data, particularly ADP employment data on Wednesday and Nonfarm Payrolls and Unemployment Rate on Friday, could further influence Brent’s movement. Oil prices are expected to react to the stock market's response to this economic news. A rise in equities could bolster Brent prices, while a fall could lead to further declines.

Brent technical analysis

Brent oil completed its upward correction and reversed downward from the resistance level of 75.00 USD. Prices have since fallen to the 70.00 USD area, where temporary support from buyers was found. The daily trend remains bearish, suggesting further declines may occur.

As part of the short-term Brent forecast, if the bulls manage to push prices above 72.00 USD, we could see a retest of the 75.00 USD resistance. However, if the bears succeed in driving prices below 70.00 USD, a further decline toward the support area of 68.00-68.50 USD is possible.

Summary

Brent quotes have formed a downward reversal from the 75.00 USD resistance level. Today’s API oil reserves data could significantly influence Brent’s price forecast. Traders should watch for signals from this report, which could either support or undermine the current trend in Brent oil prices.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.