Brent crude oil continues to correct amid lower consumption in China

After pulling back, Brent continues to trade around 84.50. The Federal Reserve chair’s speech may trigger a further correction.

Brent trading key points

- A speech by US Federal Reserve Chair Jerome Powell

- A speech by US Federal Open Market Committee (FOMC) official Mary C. Daly

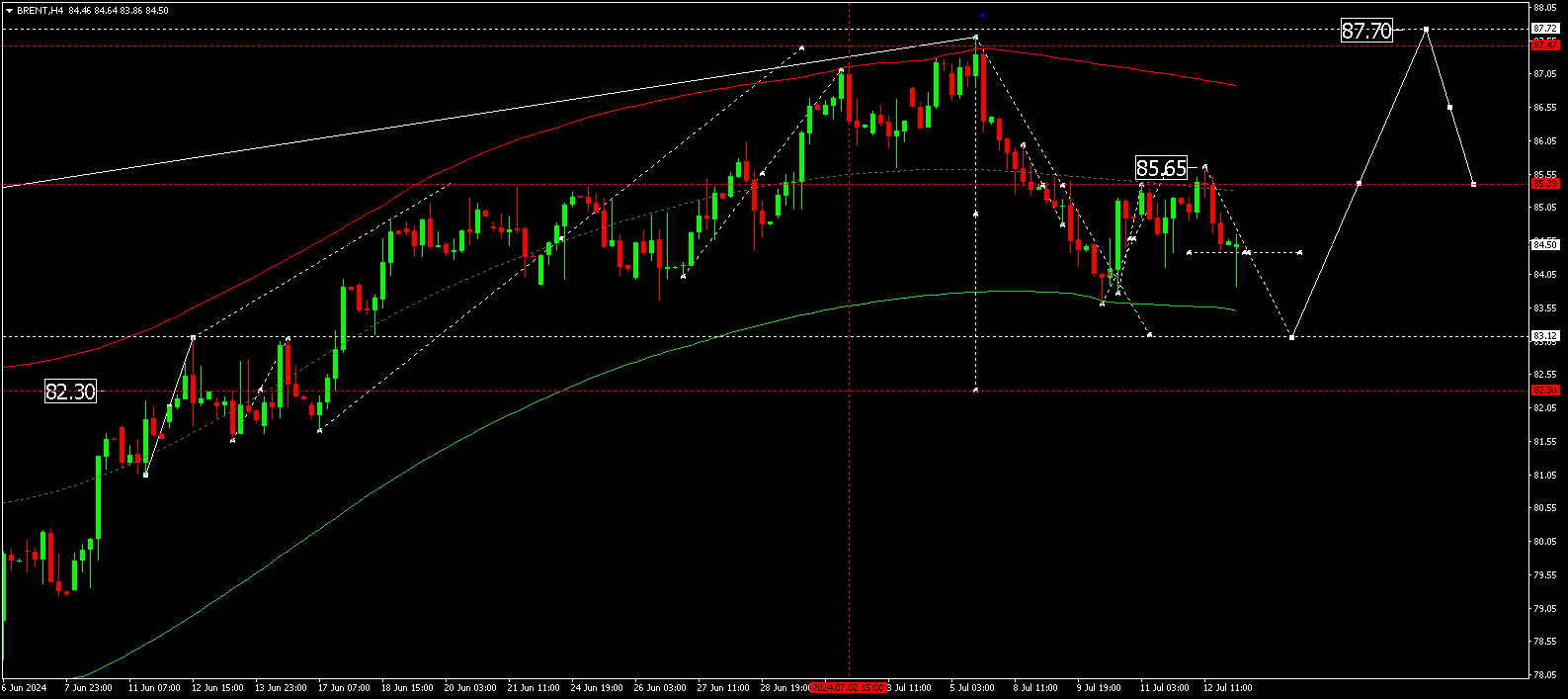

- Brent price targets: 83.12 and 87.87

Fundamental analysis

The speech by US Federal Reserve Chair Jerome Powell may positively impact the US dollar, which will affect oil prices.

Brent crude oil continues to correct amid increased global consumption and decreased demand in China. At this stage, a speech by US Federal Open Market Committee (FOMC) official Mary C. Daly may be another factor able to significantly influence the prices.

The strengthening of the US dollar may push down Brent crude oil prices.

Brent technical analysis

On the H4 chart, Brent rose to 85.65 (testing from below). Today, 15 July 2024, a decline structure could develop, aiming for (at least) 83.13. The wave could extend to 82.30, marking the completion of the downward potential. Once the price reaches the above level, a new growth wave could start, targeting 87.72 and potentially continuing to 90.00.

Summary

Economic and technical indicators suggest a further correction to the 83.12 target. Once the correction is complete, a growth wave could start, aiming for 87.87.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.