Gold (XAUUSD) analysis: gold is poised for a surge to new all-time highs

Gold has the potential to rise to 2,500 USD. With no significant news expected today, market participants are awaiting US Federal Reserve Chair Jerome Powell’s speech. His words will be closely scrutinised for any hints about how the Fed’s chair assesses the economy following the release of weaker-than-expected indicators.

XAUUSD forecast: key trading points

- Market focus: a speech by US Federal Reserve Chair Jerome Powell

- Current trend: there is a strong uptrend with the potential to hit an all-time high of 2,500 USD

- XAUUSD forecast for 16 August 2024: 2,550

Fundamental analysis

XAUUSD quotes are in an uptrend, poised to reach a new all-time high. The US economic data supports a rise in gold prices, prompting the Federal Reserve to lower interest rates.

The consumer price index (CPI) stood at 0.2% last month, reaching 2.9% year-over-year, below the expected 3.0%. The producer price index (PPI) data has previously shown that inflation is steadily going down. Therefore, the regulator has no arguments left in favour of keeping the key rate at the current level. It will be particularly interesting to hear the opinion of the Federal Reserve chair on this issue. Given all the indicators, the XAUUSD price forecast is optimistic.

XAUUSD technical analysis

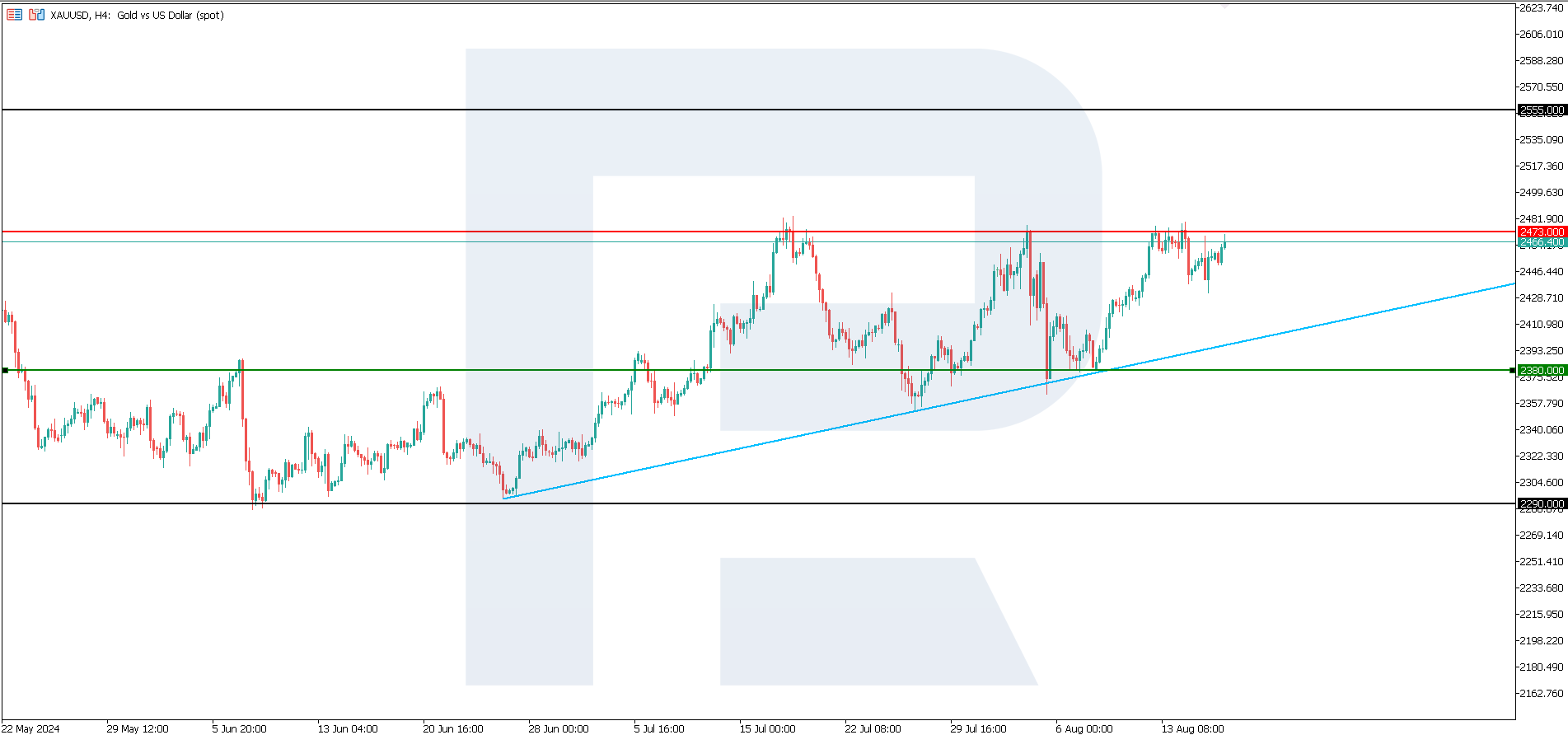

The XAUUSD H4 chart shows sustained growth within an uptrend, with the quotes approaching the current resistance level at 2,473 USD. It can be stated that the growth trend, which started in September 2023, is becoming global.

If the price breaks above the resistance level, it could target 2,500. Subsequently, the quotes will highly likely head to 2,550. if the trend suddenly reverses, the price is expected to break below the 2,380 support level, with a decline target at 2,290. However, such a scenario is extremely unlikely, with a further rise in XAUUSD price expected in this situation.

Summary

Today’s XAUUSD analysis suggests a further price rise to new all-time highs at 2,550. The market’s reaction to Jerome Powell’s opinion on the US economic outlook may adjust the forecast for next week.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.