Silver (XAGUSD) prices rise, securing above 31.00 USD

XAGUSD prices completed a downward correction, and following Gold, they reversed upwards, with growth likely to continue. More details in our XAGUSD analysis for today, 21 November 2024.

XAGUSD forecast: key trading points

- Market focus: another escalation of the conflict in the Middle East drives up Silver and Gold prices

- Current trend: reversal to the uptrend

- XAGUSD forecast for 21 November 2024: 30.00 and 32.30

Silver fundamental analysis

XAGUSD quotes appear to have completed a downward correction and reversed upwards toward a long-term trend. Prices are now supported by another round of escalation in the conflict in the Middle East, which is strengthening safe-haven assets like Gold and Silver.

Geopolitical events may further impact Silver prices, driving them up during periods of conflict escalation. Additionally, the Federal Reserve’s monetary policy easing supports precious metal prices. Since the beginning of the year, Silver has gained about 30% in total. According to the Silver Institute’s forecast, the Silver market deficit may reach 215 million ounces by the end of 2024.

XAGUSD technical analysis

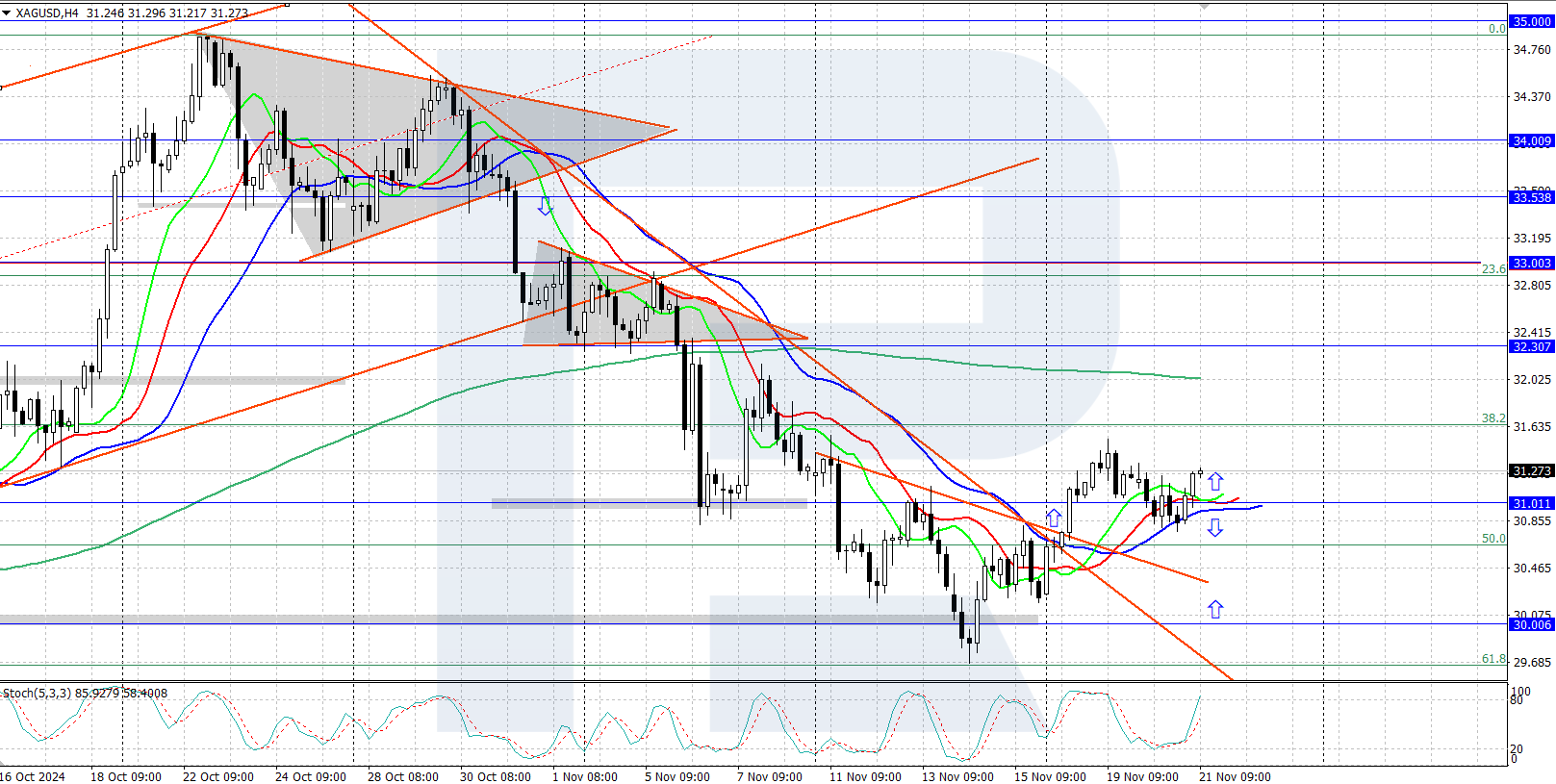

On the H4 chart, the XAGUSD pair has completed a downward correction, hovering around 31.00 USD. Asset prices dipped to 30.00 USD last week, where they encountered strong demand from buyers, forming a local trough with an inverse head-and-shoulders pattern. Following a slight correction, the uptrend is now expected to resume.

The short-term Silver price forecast suggests that prices could rise further to around 32.30 USD if bulls hold the price above 31.00 USD. If bears gain a foothold below 31.00 USD, the decline might continue towards 30.00 USD.

Summary

XAGUSD quotes have completed their downward movement and reversed upwards, securing above 31.00 USD. An inverse head-and-shoulders pattern formed on the chart. Following a slight correction, the uptrend is expected to resume.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.