XAUUSD: Gold continues to strengthen after completing a correction

Gold (XAUUSD) continues to strengthen amid limited news coverage, with a potential growth target of 2,650. Find out more in our XAUUSD analysis for today, 24 December 2024.

XAUUSD forecast: key trading points

- The Richmond Fed Manufacturing Index: previously at -14, projected at -10

- Current trend: upward movement

- XAUUSD forecast for 24 December 2024: 2,650 and 2,595

Fundamental analysis

Following the correction, Gold is consolidating its position against the US dollar, initiating a new growth wave.

The Richmond Fed Manufacturing Index assesses the business environment in the Fifth Federal Reserve District. The indicator is based on a monthly comparison of key aspects such as new orders, order backlogs, inventories, and shipments. The bank conducts a monthly survey of approximately 200 participants to derive the index. If the index exceeds forecasts, this is interpreted as a positive signal for the US dollar, while weaker-than-expected figures may negatively impact its exchange rate.

The forecast for 24 December 2024 takes into account that the index may improve from the previous reading. However, it is worth remembering that the projected figure of -10 remains in negative territory, which cannot be considered favourable for the US dollar. Nonetheless, a stronger-than-forecast actual reading could support the US dollar in the XAUUSD pair.

Given the upcoming holidays, the fundamental analysis of the XAUUSD rate on 24 December 2024 anticipates the traditional pre-New Year rally and suggests increased volatility.

XAUUSD technical analysis

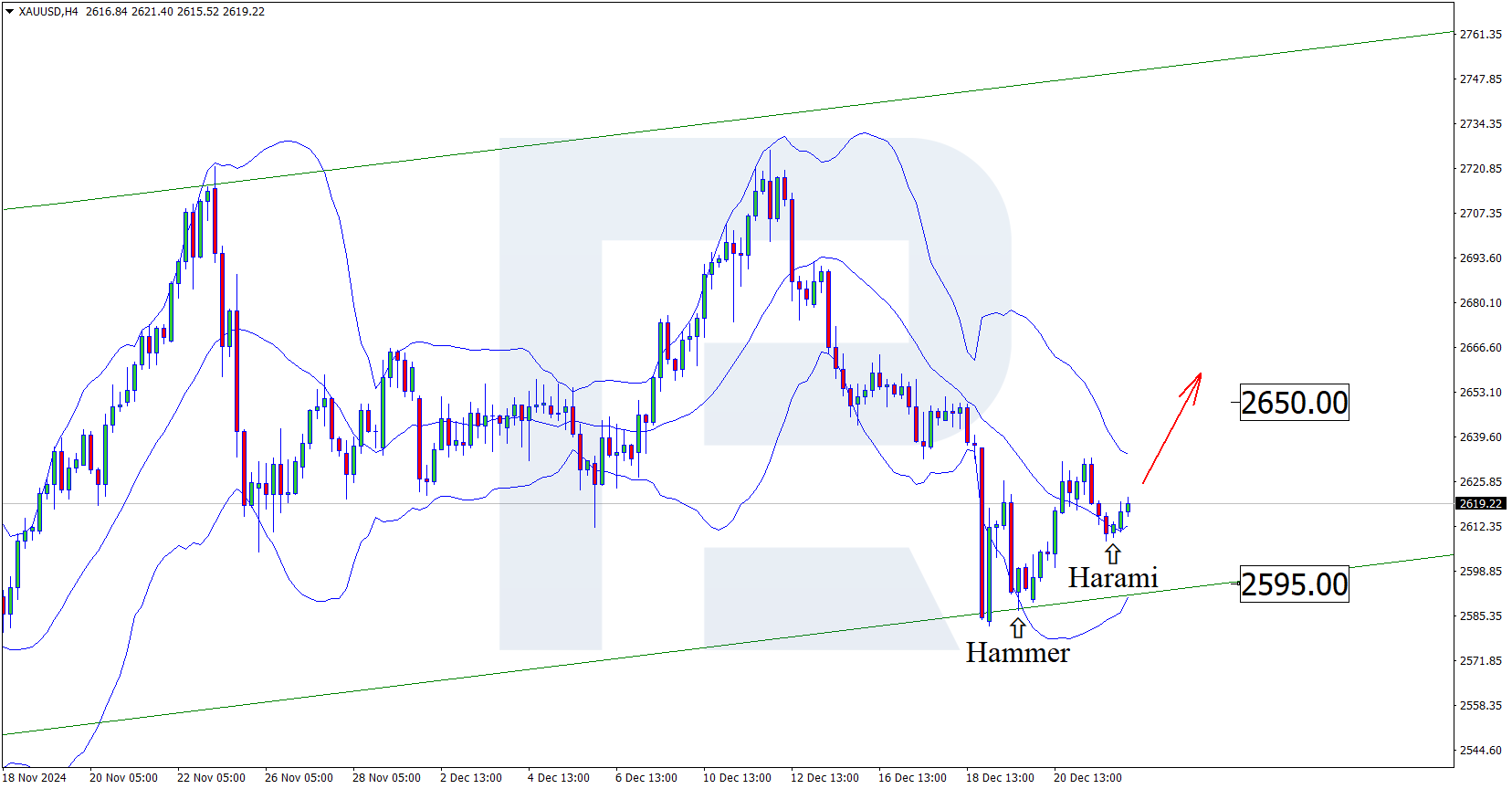

Having tested the middle Bollinger band, the price formed a harami reversal pattern on the XAUUSD H4 chart. It continues its upward movement, validating the signal from the reversal pattern. This trend will likely persist as the quotes remain within the ascending channel after a pullback.

The growth target will likely be the next resistance level at 2,650. A breakout above this level could signal the potential for a stronger ascending wave.

However, before continuing the uptrend, the price may correct towards 2,595. After completing this corrective wave, Gold may soon reach a new historical maximum.

Summary

Together with the technical analysis of XAUUSD, the expectation of a pre-New Year rally supports a scenario of growth towards the 2,650 USD level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.