Gold (XAUUSD) continues to rise after a correction

The stabilising PPI and John C. Williams’s speech may weaken the US dollar and push Gold prices towards 2,692. Discover more in our XAUUSD analysis for today, 14 January 2025.

XAUUSD forecast: key trading points

- US Producer Price Index (PPI): previously at 0.4%, projected to remain unchanged

- A speech by FOMC member John C. Williams

- Current trend: moving higher

- XAUUSD forecast for 14 January 2025: 2,692 and 2,658

Fundamental analysis

Today’s XAUUSD analysis indicates that the pair is nearing the end of its correction and may soon begin a new upward movement.

The US PPI is a key inflation indicator tracking the average price change for goods and services of domestic producers. It records price changes from the sellers’ perspective and covers three production sectors: manufacturing, commodities, and processing. The PPI is often regarded as a leading inflation gauge, as rising costs for production and services typically filter through to consumers. According to the forecast, US PPI data is expected to remain steady at 0.4%.

Today, 14 January 2025, Federal Reserve Bank of New York President and FOMC member John C. Williams is expected to deliver a speech. Given his earlier statements, he will likely discuss the Federal Reserve’s current monetary policy and future actions.

In December 2024, Williams noted the need to proceed with interest rate cuts, emphasising that these decisions will depend on incoming economic data and the current policy, which restrains positive economic momentum.

He also stressed the importance of achieving the 2.0% inflation target and pointed out that while the Fed’s policy remains restrictive, it has successfully guided inflation towards this goal. In today’s speech, Williams will likely address the following issues:

- Assessment of current economic conditions and inflation trends

- The Federal Reserve’s future interest rate-cutting plans and the conditions required for these cuts

- The impact of the fiscal policy and other external factors on the US economy

However, the specifics of his address will only become clear after his speech, which could significantly affect XAUUSD quotes.

XAUUSD technical analysis

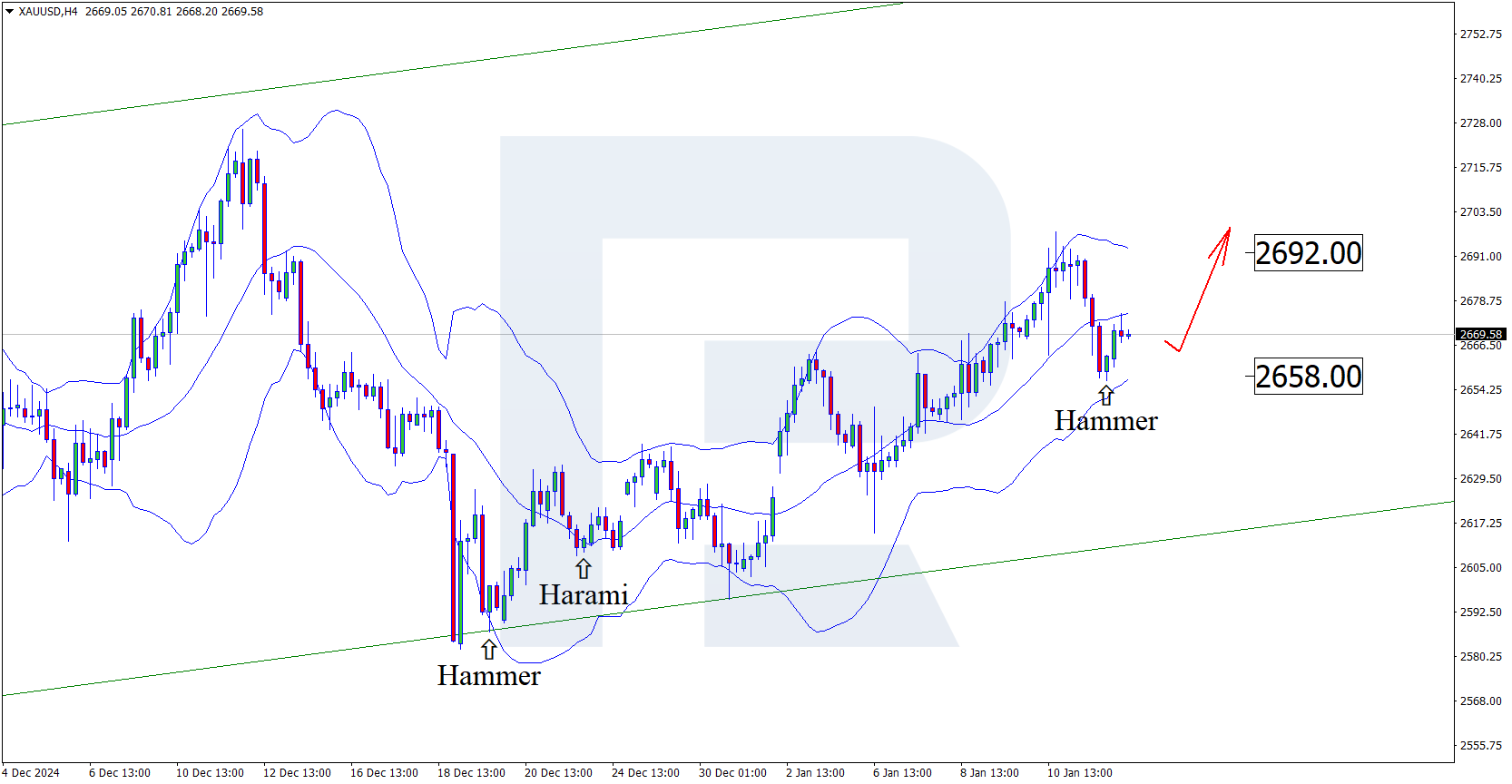

XAUUSD prices tested the 2,697 level last week before starting a corrective phase.

The price has formed a Hammer reversal pattern near the lower Bollinger band on the XAUUSD H4 chart. At this stage, it continues to rise following the pattern signal. The uptrend will likely continue since the quotes remain within an ascending channel after pulling back.

The next resistance level for growth could be 2,692. A breakout above this level would open the potential for a more substantial upward movement.

However, an alternative scenario is possible: the price could retrace to 2,658 before continuing its ascent. Once the corrective wave is complete, Gold may reach a new all-time high in the near term.

Summary

XAUUSD forecast for 14 January 2025 suggests that, amid John C. Williams’s speech, XAUUSD quotes may complete the correction and maintain their upward momentum.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.