Gold (XAUUSD) continues its upward rally, with the nearest target at 2,600 USD

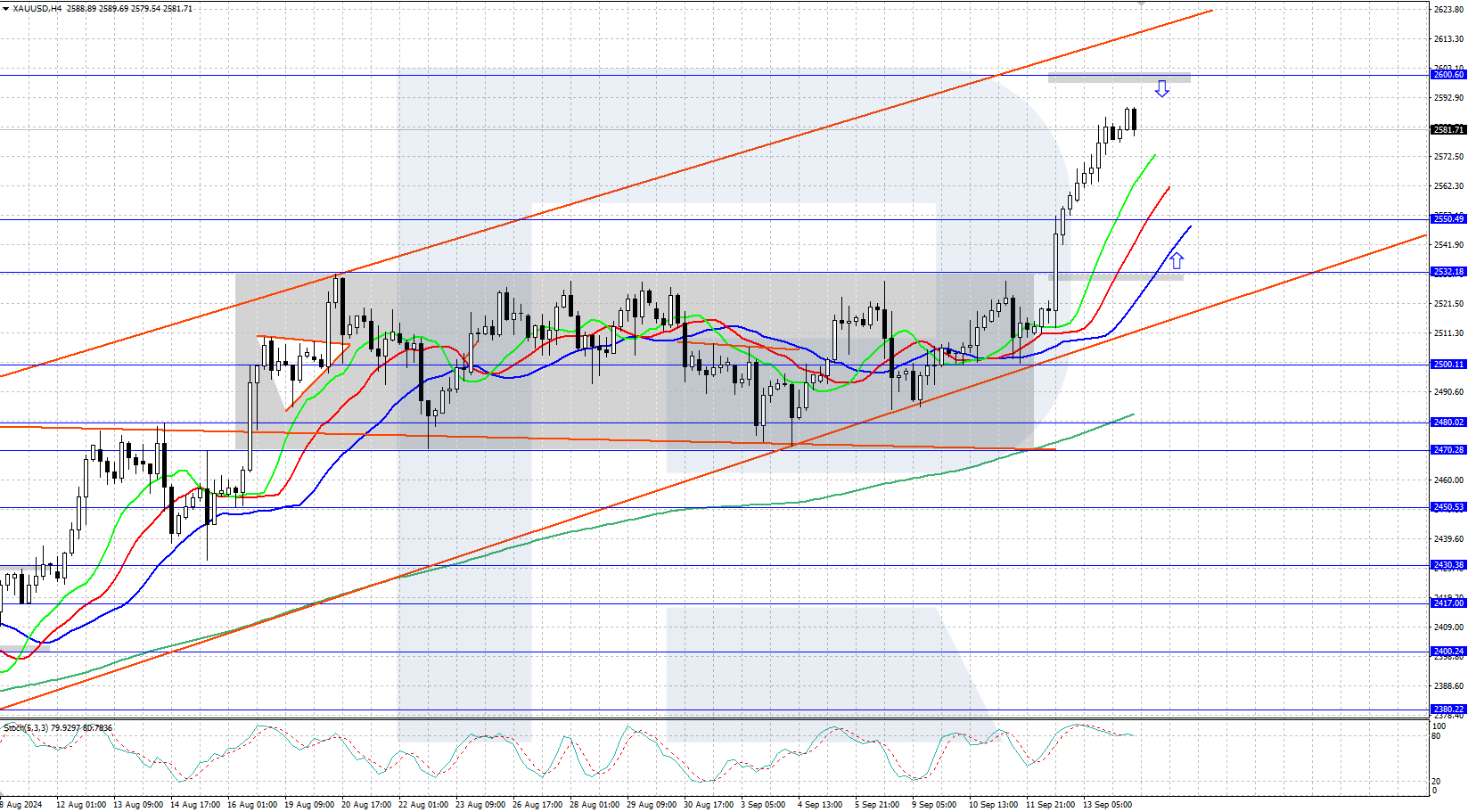

XAUUSD price broke above the sideways range following the US PPI release last week, surpassing its all-time high of 2,532 USD. Now the uptrend continues. Find out more in our XAUUSD analysis for today, 16 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await the US Fed interest rate decision this week

- Current trend: strong upward momentum is developing after the price exited the sideways range

- XAUUSD forecast for 16 September 2024: 2,600 and 2,532

Fundamental analysis

XAUUSD quotes continue to trade in an uptrend, supported by demand from global central banks and the beginning of the US Federal Reserve monetary policy easing. The consumer price index (CPI) and the producer price index (PPI) released last week showed a moderate fall in US inflation.

The Federal Reserve interest rate decision will be the main event for the markets this week. The rate cut is a done deal, while the cut size is the only thing in question: 0.25% or 0.50%. If interest rates are lowered by 0.50%, gold will receive a good incentive for further growth. In case of a 0.25% rate cut (which the market has already priced in), a downward correction may start.

XAUUSD technical analysis

On the daily chart, the XAUUSD pair demonstrates a steady uptrend. After breaking above the sideways range, gold price is actively rising, aiming for the target of the previously formed triangle pattern near 2,600 USD.

The short-term XAUUSD price forecast suggests that gold could reach the 2,600 USD level soon if bulls continue to push quotes up. However, bears may attempt to seize the initiative and, if they succeed, a downward correction could follow, aiming for 2,550 USD. The key support level is at 2,532 USD.

Summary

Gold prices are rallying upwards, reaching the 2,590 USD level at the Asian session. This week, the market will focus on the US Federal Reserve interest rate decision.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.