AUDUSD is poised for growth, supported by global positive sentiment

AUDUSD is strengthening for the second consecutive day, with the market favouring risk. Find out more in our analysis for 12 September 2024.

AUDUSD forecast: key trading points

- The AUDUSD pair resumed growth

- The market no longer expects an RBA interest rate cut in November

- AUDUSD forecast for 12 September 2024: 0.6650 and 0.6580

Fundamental analysis

The AUDUSD rate is rising to 0.6692 on Thursday.

The pair has retreated from multi-week lows and is currently following the general upswing in global capital markets as risk appetite improves.

Yesterday’s US ambiguous inflation report did not impress investors. The focus is on the decision of the European Central Bank, which will meet today, and on the upcoming Federal Reserve meeting.

Additionally, market participants have lowered their expectations for the Reserve Bank of Australia’s future actions, with few now expecting the RBA to cut borrowing costs in November. This week, RBA Assistant Governor Sarah Hunter said that the employment market remains tight. At the same time, she noted that wage growth appeared to have passed its peak. Hunter believes the wage parameters will slow in the future, which will positively affect inflation.

The AUDUSD forecast does not rule out a local rise in the pair.

AUDUSD technical analysis

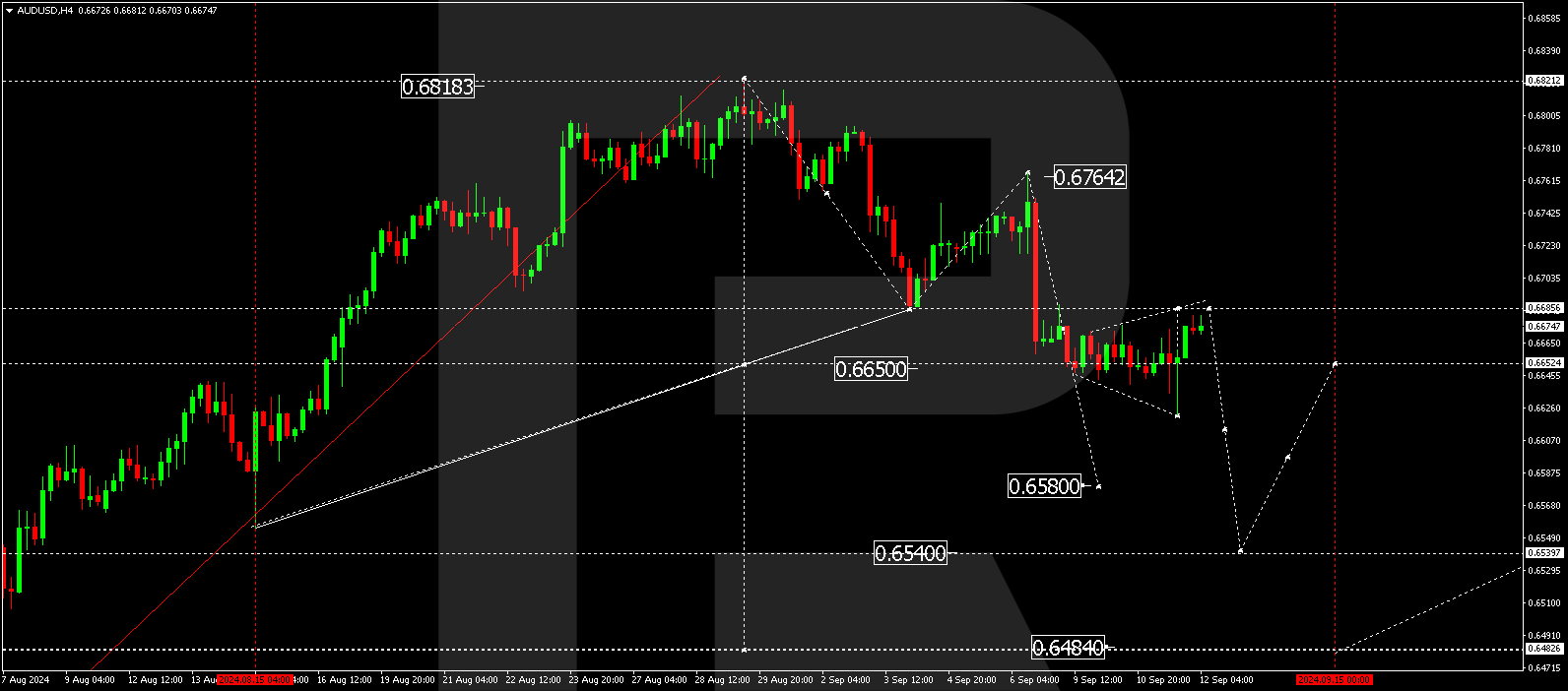

The AUDUSD H4 chart shows that the market has completed a downward wave, reaching 0.6622. A correction towards 0.6686 is expected today, 12 September 2024. Once the correction is complete, the AUDUSD rate is expected to decline to 0.6650. Breaking below this level may signal a continuation of the trend towards 0.6580 and potentially further towards the local target of 0.6540.

Summary

The AUDUSD pair is rising for the second consecutive day, supported by a growing risk appetite. Technical indicators in today’s AUDUSD forecast suggest that the wave could continue towards the 0.6650 and 0.6580 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.