AUDUSD maintains its upward momentum

The Federal Reserve interest rate change and stabilising unemployment in Australia supported the Australian dollar. Find out more in our analysis for 19 September 2024.

AUDUSD forecast: key trading points

- Australia’s employment change: previously at 48,900, currently at 47,500

- Australia’s unemployment rate: previously at 4.2%, currently at 4.2%

- US initial jobless claims: previously at 230,000, projected at 230,000

- AUDUSD forecast for 19 September 2024: 0.6825 and 0.6855

Fundamental analysis

Australia’s employment indicator reflects changes in the number of officially employed people over the reporting period. The reading was projected at 26,400 but came in at 47,500. After the release of the statistics, the AUDUSD rate continued its upward trajectory.

The unemployment rate in Australia remained flat at 4.2%. Analysis for 19 September 2024 shows that the unchanged unemployment rate did not have a negative impact on the Australian dollar.

US initial jobless claims for the past week are projected to be 230,000, unchanged from the previous reporting period.

Stabilising unemployment in Australia helps strengthen the Australian dollar against the US dollar. The 0.5% Federal Reserve interest rate cut became an additional driver of growth in the AUDUSD pair. The AUDUSD forecast for 19 September 2024 appears positive, with the quotes having the potential to continue their ascent.

AUDUSD technical analysis

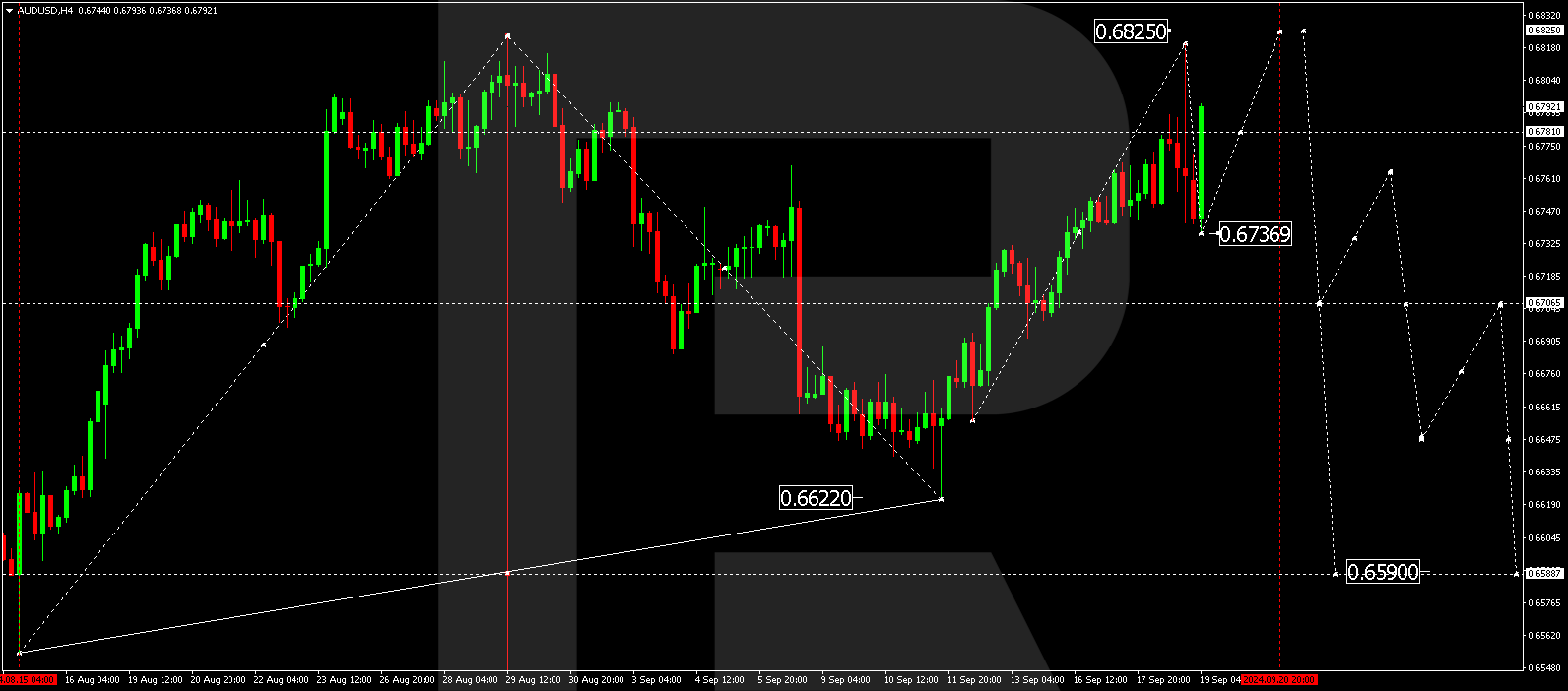

The AUDUSD H4 chart shows that the market has pushed the price to 0.6819 on the fundamental background. The price has corrected towards 0.6737 today, 19 September 2024. Following the correction, a growth wave structure is forming, aiming for 0.6825 and potentially continuing towards 0.6855. Once the price reaches this level, a downward wave towards 0.6780 is expected to start. Breaking below this level may signal a continuation of the wave towards 0.6700 and potentially further towards the first target of 0.6590.

Summary

The US interest rate cut and the AUDUSD technical analysis in today’s AUDUSD forecast suggest that the growth wave could continue towards the 0.6825 and 0.6855 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.