AUD falls again, marking the fifth consecutive day of decline

The AUDUSD pair continues to lose ground. The market is selling off risky assets.

AUDUSD trading key points

- AUD is declining for the fifth consecutive day

- Australia’s employment market is sending mixed signals

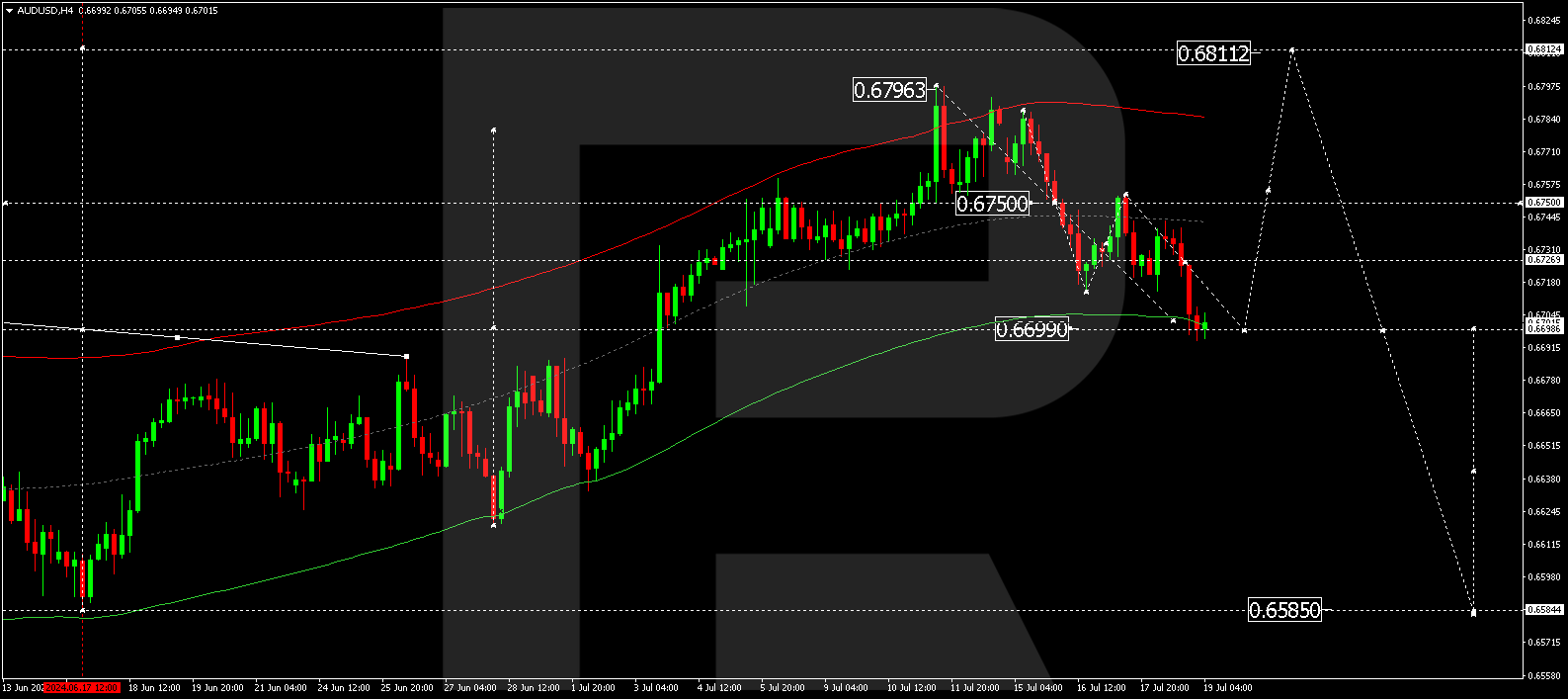

- AUDUSD price targets: 0.6750 and 0.6811

Fundamental analysis

The Australian dollar, in the pair with its US counterpart, has been steadily and uninterruptedly falling for five days. The AUDUSD pair reached 0.6698, the lowest level in the last two weeks. The sell-off is associated with the strengthening of the US dollar.

According to recent data, Australia’s unemployment rate rose from 4.0% to 4.1%. At the same time, June’s job growth is notable, indicating heightened tension in the employment sector, which elevates concerns about an interest rate hike by the Reserve Bank of Australia.

Investors are now pricing in a 20% possibility of an RBA interest rate hike in August, whereas the figure did not exceed 12% a couple of days ago.

The baseline scenario suggests that the RBA will ease monetary conditions much later than other major regulators.

AUDUSD technical analysis

On the H4 chart, the AUDUSD pair has completed a decline wave, reaching 0.6699. A consolidation range is expected to form above this level today, 19 July 2024. With an upward breakout, a growth wave could start, aiming for 0.6750 and potentially continuing to 0.6811.

Summary

The Australian dollar came under pressure from the USD and employment market data. Technical analysis for the AUDUSD pair suggests a growth wave to the 0.6750 and 0.6811 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.