AUDUSD sell-offs have ended: investors await inflation data

The AUDUSD pair halted its decline. The AUD rate experienced its worst week since November. For a detailed analysis, please refer to our forecast dated 26 July 2024.

AUDUSD trading key points

- AUD has been falling for 9 consecutive sessions

- The RBA will make efforts to prevent an economic recession

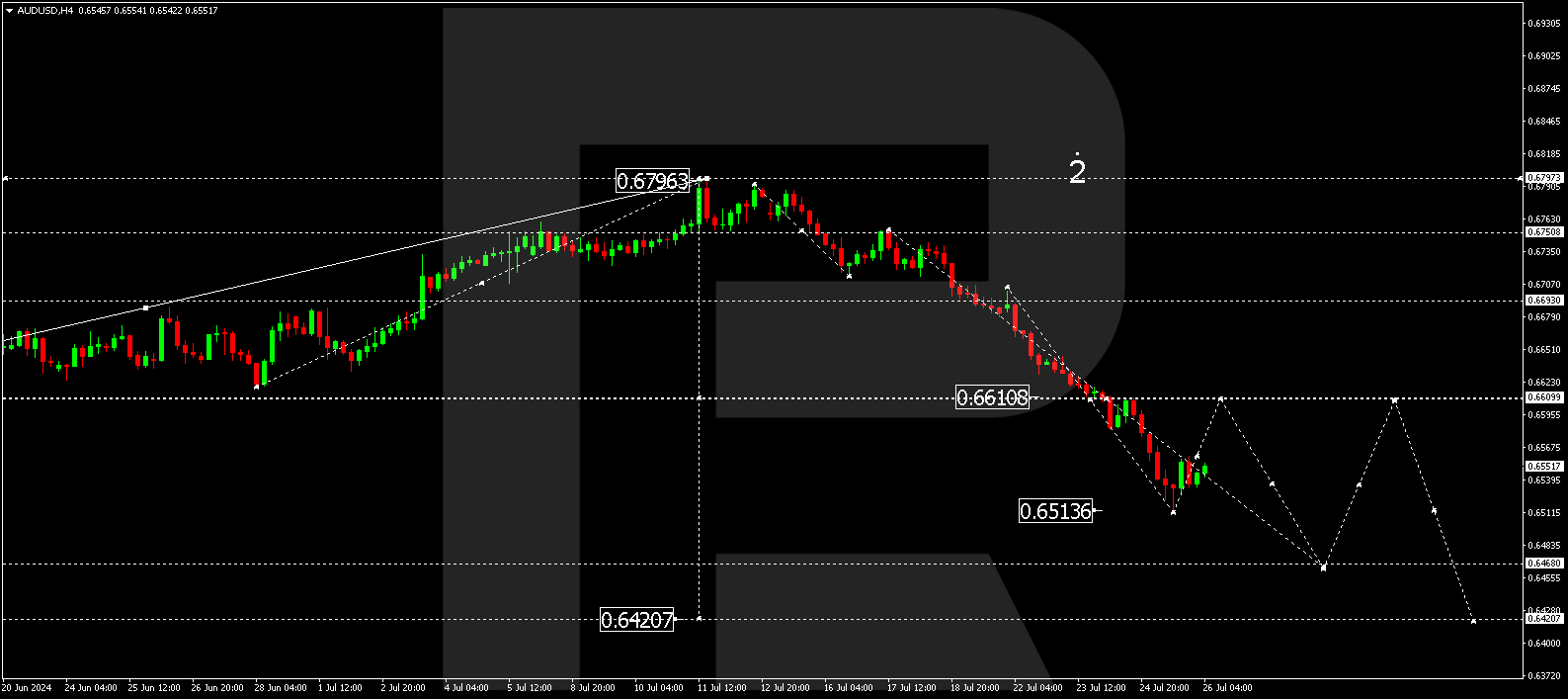

- AUDUSD forecast for 26 July 2024: 0.6610, 0.6468, and 0.6420

Fundamental analysis

The AUDUSD pair has stabilised after a massive decline, hovering around 0.6552. The fall has been observed for nine consecutive trading sessions.

This week will be the worst for the AUD since November last year, with losses of about 2%. The decline of the Australian dollar was driven by a global sell-off of risky assets, the unwinding of carry trades against the yen, and weak economic data from China, Australia’s major trading partner.

Next week, Australia will release Q2 2024 inflation data, which will likely provide investors with more insight into future monetary policy actions of the Reserve Bank of Australia.

Some market participants still believe the RBA may raise interest rates in August. However, a new wave of tightening may increase the risks of economic recession.

AUDUSD technical analysis

On the AUDUSD H4 chart, a consolidation range has formed around 0.6610. The AUDUSD rate, breaking below the range, reached the wave’s local target of 0.6512. A correction is expected today, 26 July 2024, aiming for 0.6610 (testing from below) and followed by another decline wave towards 0.6468. Once the price reaches this level, the AUDUSD pair is expected to see a new growth structure or a consolidation range, potentially continuing to 0.6420.

Summary

The AUDUSD pair appears weak following a wave of sell-offs. The indicator-based AUDUSD technical analysis suggests a corrective wave towards 0.6610 and a new decline wave towards the 0.6468 and 0.6420 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.