USD losing ground as price growth slows

The EURUSD rate is undergoing correction on Friday, 12 July 2024, after surging on Thursday amid weak US inflation.

EURUSD trading key points

- The US consumer price index (CPI) rose by 3% in June

- The likelihood of a Federal Reserve interest rate cut reached 90%

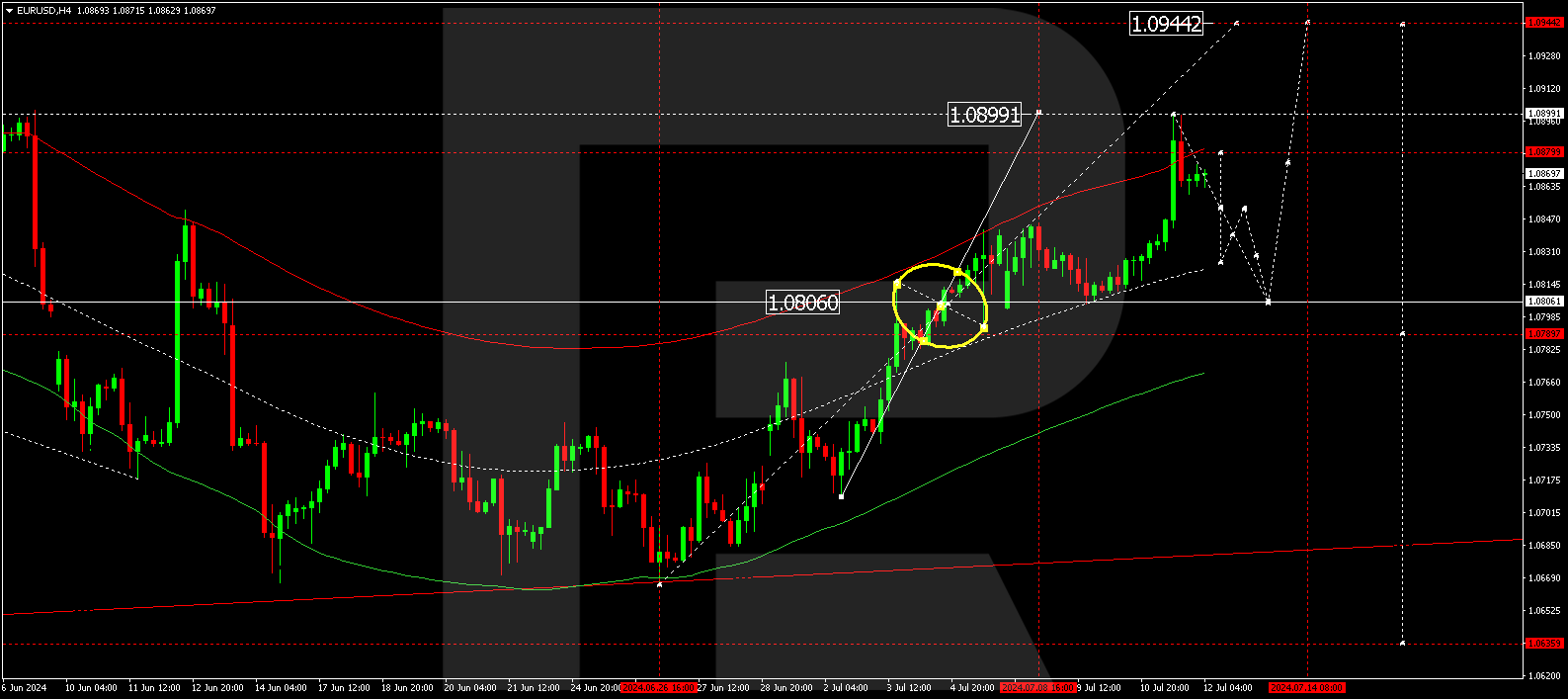

- EURUSD price targets: 1.0806 and 1.0940

Fundamental analysis

The US dollar weakened significantly following the release of lower-than-expected June inflation data, which may lead to a shift in the Federal Reserve’s monetary policy in September 2024.

The US consumer price index rose 3% year-over-year in June, marking the lowest reading over the last year. The slowdown in the inflation rate surprised many investors, and the market responded with the instant US currency crash. Traders now estimate the likelihood of a Federal Reserve interest rate cut at over 90%, noticeably higher than the 73% recorded on Wednesday.

The Federal Reserve monitors inflation indicators essential in monetary policy decision-making. The US Federal Reserve inflation target is 2%.

EURUSD technical analysis

On the H4 chart, the EURUSD pair exited a consolidation range and reached the local target of 1.0899. Today, 12 July 2024, a correction towards 1.0806 (testing from above) is forming, after which another growth structure could develop, with a target at 1.0940, marking the completion of growth potential. The price is expected to start declining to 1.0777, the first target.

Summary

The fall in US inflation to the lowest level in a year pushes the EURUSD pair further up due to a potential Federal Reserve interest rate cut in September. Technical indicators point to a further correction towards the 1.0806 target. A growth wave could start once the correction is complete, aiming for 1.0940.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.