EUR reaches new peaks: decreased sympathy for the US dollar

The EURUSD pair continues its ascent, with the market awaiting a Federal Reserve interest rate cut and working against the US dollar.

EURUSD trading key points

- Statistics signal an imminent Federal Reserve interest rate cut

- The ECB will keep the borrowing costs unchanged

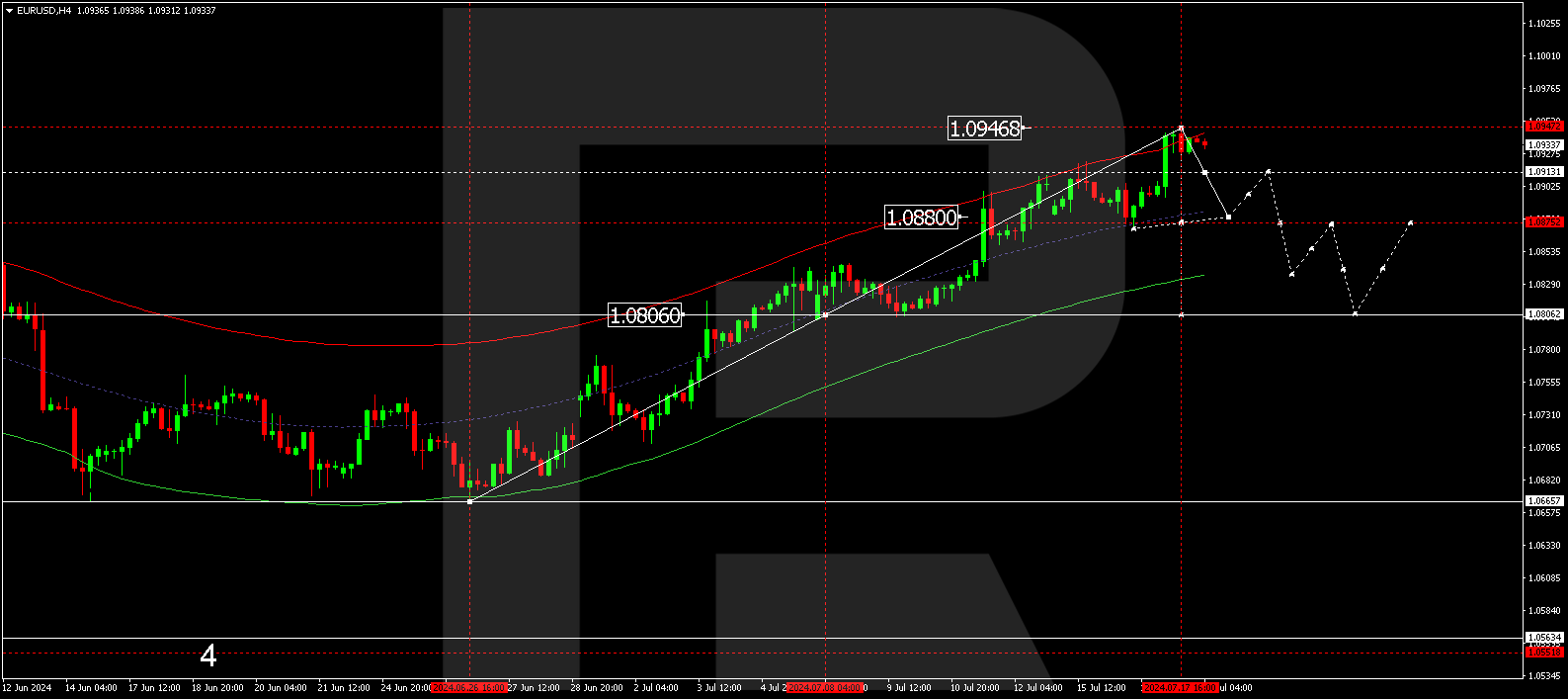

- EURUSD price targets: 1.0880, 1.0840, and 1.0806

Fundamental analysis

The EURUSD pair rose to 1.0932 on Thursday.

The euro maintains previous momentum, bolstered by inflation, retail sales, and industrial production statistics.

The data raises expectations of an imminent Federal Reserve interest rate cut, exerting pressure on the USD position. Investors believe the Federal Reserve’s likelihood of easing monetary policy in September is nearly 100%.

Today, the market focus will shift from the US to the eurozone. The European Central Bank will hold a regular meeting and decide on the interest rate, which is highly likely to remain unchanged at 4.25% per annum, with the deposit rate remaining flat at 3.75%. It is worth paying attention to ECB President Christine Lagarde’s statements at a press conference.

Crucial US statistics due today include weekly jobless claims. The indicator may have risen to 229,000 from 222,000 a week earlier.

EURUSD technical analysis

On the H4 chart, the EURUSD pair has completed a growth wave towards 1.0948, reaching the wave’s estimated target (adjusted for an extension). A decline wave could start today, 18 July 2024, aiming for the first target of 1.0880. Subsequently, the price might rise to 1.0910 (testing from below) before declining to 1.0840 and potentially continuing the trend towards 1.0806.

Summary

The EURUSD pair is moving in line with the rally. Technical indicators suggest a new decline wave to the 1.0880, 1.0840, and 1.0806 target.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.