Positive expectations for the eurozone economy support EURUSD

The EURUSD rate slightly rose on Tuesday, 23 July 2024, trading above the key support level of 1.0875.

EURUSD trading key points

- The ECB’s decision to keep interest rates unchanged and Lagarde’s remarks about a “wide open” September meeting continue to support the euro

- Eurozone, Germany, and France PMIs are expected to improve, and consumer confidence in the eurozone is projected to peak

- EURUSD price targets: 1.0870, 1.0820, and 1.0777

Fundamental analysis

The European Central Bank’s decision to maintain the current monetary policy and Christine Lagarde’s statement that the upcoming verdict on 12 September remains open, continue to bolster the euro.

Eurozone, Germany, and France PMI data are expected to show a more substantial decline in manufacturing and further growth in the services sector. Additionally, the consumer confidence level in the eurozone is projected to reach its highest level since February 2022. The GfK consumer climate and Ifo business climate indicators are also expected to improve in Germany.

Investors believe that the Federal Reserve will lower interest rates in September and may do so twice by the end of the year amid slowing US inflation. US key economic indicators such as PMI, GDP, and the PCE price index are due this week and may heighten pressure on the US dollar if they are worse than forecasted.

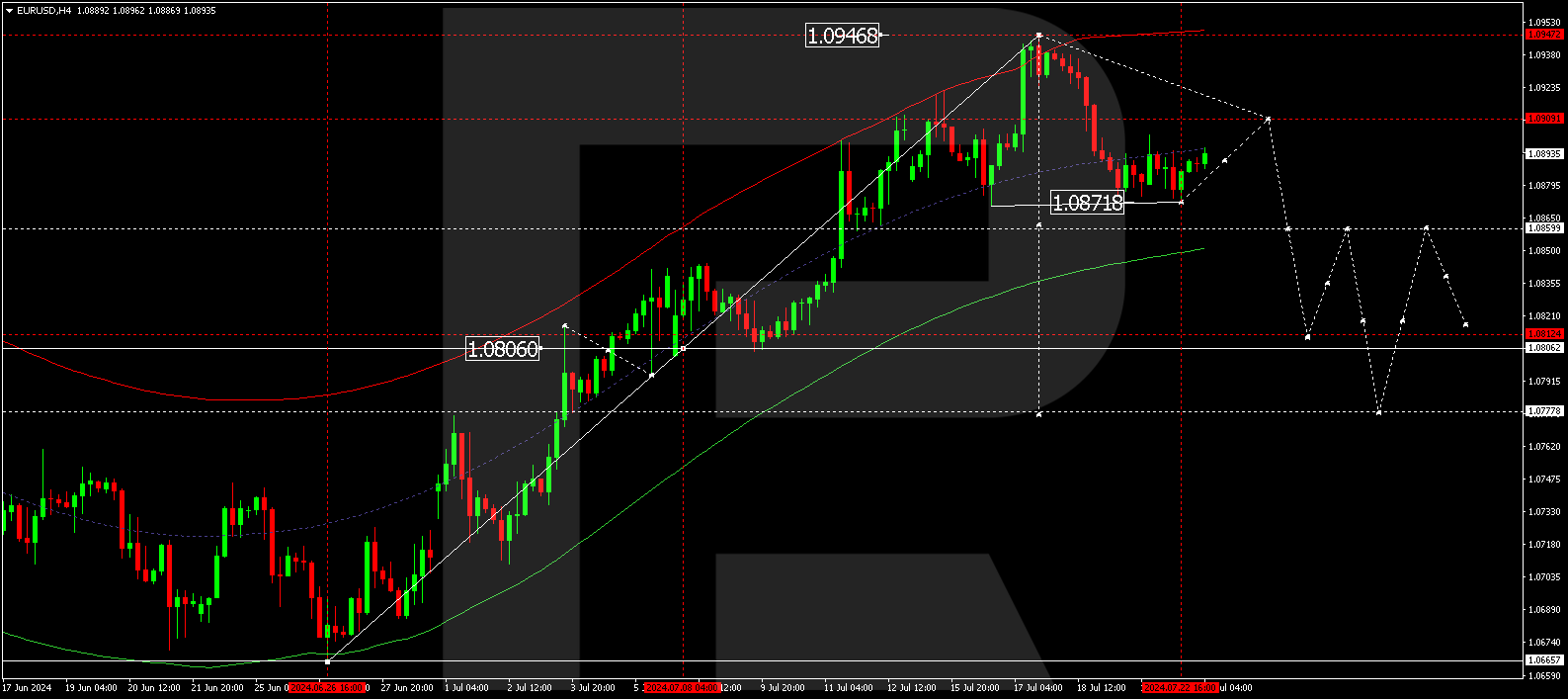

EURUSD technical analysis

On the H4 chart, the EURUSD pair has completed a decline wave, reaching 1.0872. A growth wave is forming today, 23 July 2024, aiming for at least 1.0906 (testing from below). Once the price hits this level, a new decline wave towards 1.0870 could develop. Breaking below this level will open the potential for the price to reach the local target of 1.0820. A decline wave structure could develop, with the first target at 1.0777.

Summary

Optimistic expectations about the eurozone’s economic data and a potential Federal Reserve interest rate cut still prevent a possible decline in the euro. Technical indicators suggest a corrective wave in the EURUSD pair might continue, with targets at 1.0820 and 1.0777.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.