GDP stays afloat despite fundamental data

A decrease in the number of claims for unemployment benefits and a stable unemployment rate increase the chances of the British pound strengthening.

GBPUSD trading key points

- UK average earnings (including May bonuses): previously at 5.9%, currently at 5.7%

- UK claimant count change: previously at 51.9 thousand, currently at 32.3 thousand

- UK unemployment rate (May): previously at 4.4%, currently at 4.4%

- US initial jobless claims: previously at 222,000, forecasted at 229,000

- GBPUSD price targets: 1.2945, 1.2850, and 1.2800

Fundamental analysis

Average earnings in the UK (including May bonuses) decreased by 0.2% from the previous value, in line with the forecast.

The UK claimant count change exceeded expectations but was lower than the previous reading. These data did not significantly affect the GBPUSD rate, with the pair continuing to trade around 1.3000.

The unemployment level remained flat, aligning with the forecast and having little impact on the price.

Data, including US initial jobless claims, is due after the US trading session opens. A preliminary forecast shows an increase to 229,000, which could negatively impact the US dollar.

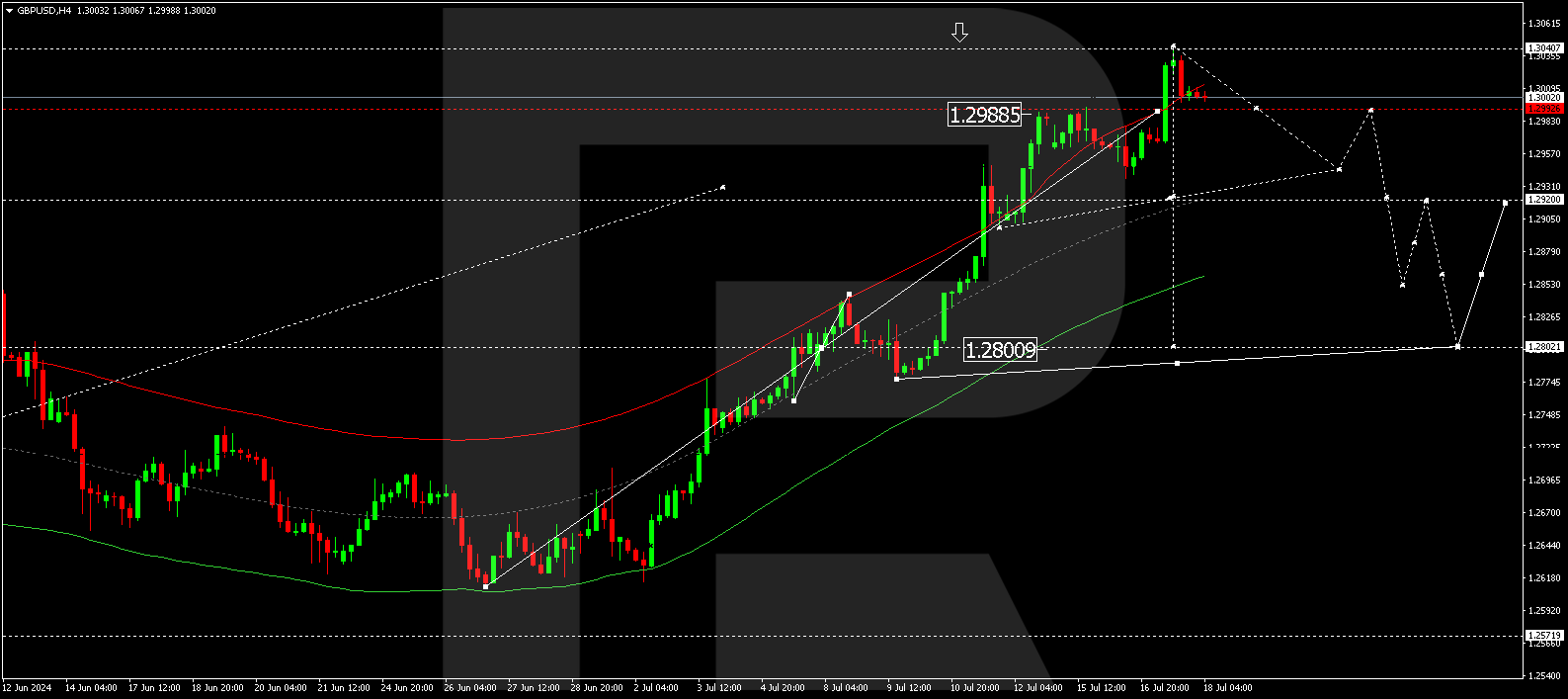

GBPUSD technical analysis

Analysis of 18 July 2024 shows that the GBPUSD pair has reached the growth wave’s local target of 1.3040 (adjusted for an extension). A correction towards 1.2945 could start today. Once the correction is complete, the price might rise to 1.2990. Subsequently, a decline wave is expected, aiming for 1.2850 and potentially continuing to 1.2800.

Summary

Fundamental data and technical indicators suggest a decline in the GBPUSD rate to the 1.2945, 1.2850, and 1.2800 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.