The weak news environment in New Zealand is unfavourable for NZDUSD

The NZDUSD pair continues to correct ahead of US news. Positive data will trigger a decline in the NZDUSD rate.

NZDUSD trading key points

- New Zealand’s Food Price Index (FPI) (m/m): currently at 1.0% compared to the previous reading of -0.2%

- US consumer price index (CPI) in June (m/m): previously stood at zero, forecasted at 0.1%

- US initial jobless claims: previously stood at 238,000, forecasted at 236,000

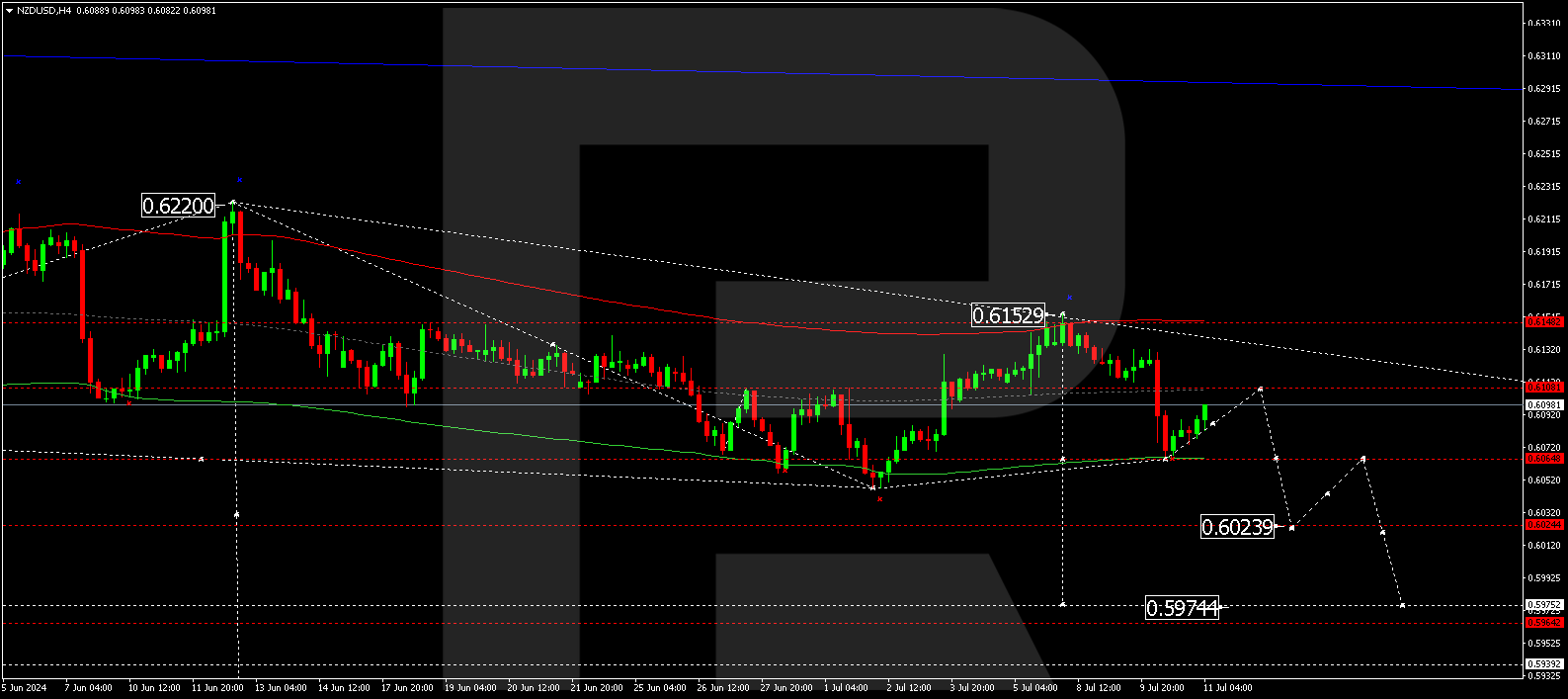

- NZDUSD price targets: 0.6108, 0.6024, and 0.5974

Fundamental analysis

Despite New Zealand’s Food Price Index (FPI) (m/m) exceeding forecasts, it had little impact on strengthening the New Zealand dollar.

In the absence of other news concerning the New Zealand dollar, the focus shifts to US statistics. The US Consumer Price Index is projected to increase slightly (0.1%). Given the previous report’s zero reading, this represents a positive development for the US dollar. The strengthening of the US dollar may push the NZDUSD rate lower.

US initial jobless claims are expected to decrease, bolstering investor sentiment and strengthening the US dollar.

The US news outlook could turn negative for the New Zealand dollar, further pressuring the NZDUSD rate downward.

NZDUSD technical analysis

On the H4 chart, the NZDUSD pair has completed a decline wave, reaching 0.6064. Today, 11 July 2024, a correction towards 0.6108 is expected. Once the correction is complete, a new decline wave could start, aiming for the local target of 0.6024. Subsequently, the price might rise to 0.6064 (testing from below) before declining to 0.5977, the estimated target.

Summary

At this stage, NZDUSD technical analysis aligns with US news, suggesting that the trend will continue to the 0.6024 and 0.5974 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.