NZDUSD is in positive territory: the market favours risk

The NZDUSD pair has recovered quite well. The market is once again interested in risk. Find out more in our analysis dated 2 August 2024.

NZDUSD trading key points

- The NZDUSD rate halts its decline

- The market awaits RBNZ interest rate cuts in August and October

- NZDUSD forecast for 2 August 2024: 0.5888 and 0.5802

Fundamental analysis

The NZDUSD rate has noticeably recovered after its previous decline. The pair is hovering around 0.5953 on Friday.

July’s decline in the NZDUSD rate was relatively stable, driven by weak reports from China, a general exit of investors from carry trade positions in the Japanese yen, and an unfavourable sentiment towards risky assets. The New Zealand dollar is now recovering amid stabilised demand for risky assets and improved market sentiment.

The Reserve Bank of New Zealand will hold a meeting on 14 August. Investors believe there is a 36% likelihood of an interest rate cut at this meeting. Expectations for the October meeting are relatively high, with another reduction in borrowing costs anticipated.

NZDUSD technical analysis

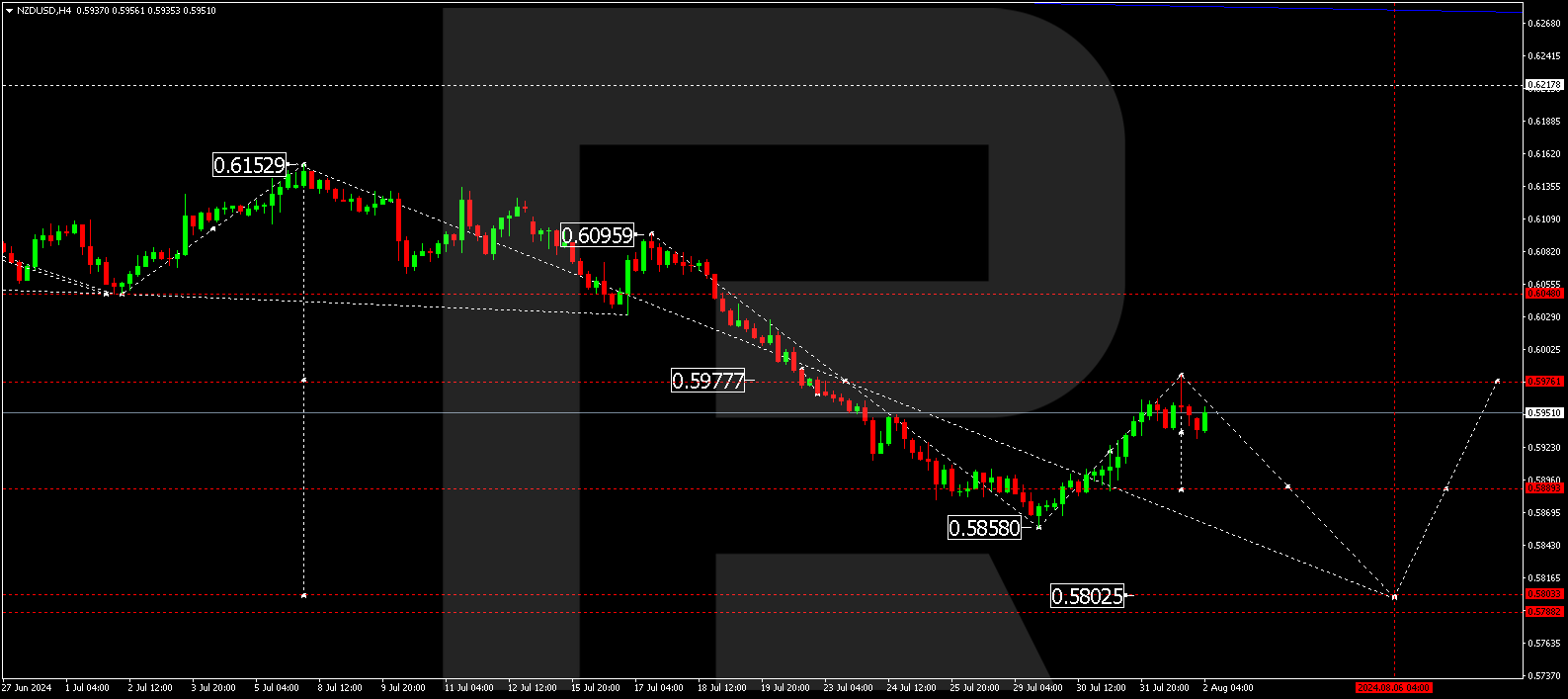

On the H4 chart, the NZDUSD pair has completed a decline wave, reaching 0.5858, and has corrected towards 0.5977 (testing from below). The NZDUSD forecast for today, 2 August 2024, indicates that a consolidation range is forming at the top of a corrective wave. A downward breakout will open the potential for a decline towards 0.5888. If the price breaks below this level, the trend could continue to 0.5802, the first target of the downward wave.

Summary

The NZDUSD pair has partially recouped its previous decline. Today’s NZDUSD technical analysis suggests the trend may continue to the 0.5888 and 0.5802 target levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.