CAD strengthens amid rising oil prices

The USDCAD rate is falling from a two-week high amid rising oil prices and the Federal Reserve chair’s recent statements.

USDCAD trading key points

- The Federal Reserve chair hinted at a potential interest rate cut in the coming months

- Oil prices surged sharply in recent days, gaining 5% and reaching a two-month high

- Canada’s S&P Global manufacturing PMI remained at 49.3 in June 2024

- USDCAD targets: 1.3606, 1.3740, 1.3820, 1.3870

USDCAD fundamental analysis

The US dollar declined after Federal Reserve Chair Jerome Powell hinted at monetary policy easing in his comments. Investors perceived this as a signal that the central bank will likely lower interest rates this year. The Canadian dollar’s strength was also bolstered by rising oil prices, which reached a two-month high. Canada’s S&P Global manufacturing PMI helped the US dollar avoid a significant decline. It remained at 49.3 in June 2024, decreasing for the fourteenth consecutive month. Sluggish domestic and external demand led to a further drop in manufacturing volumes and new orders.

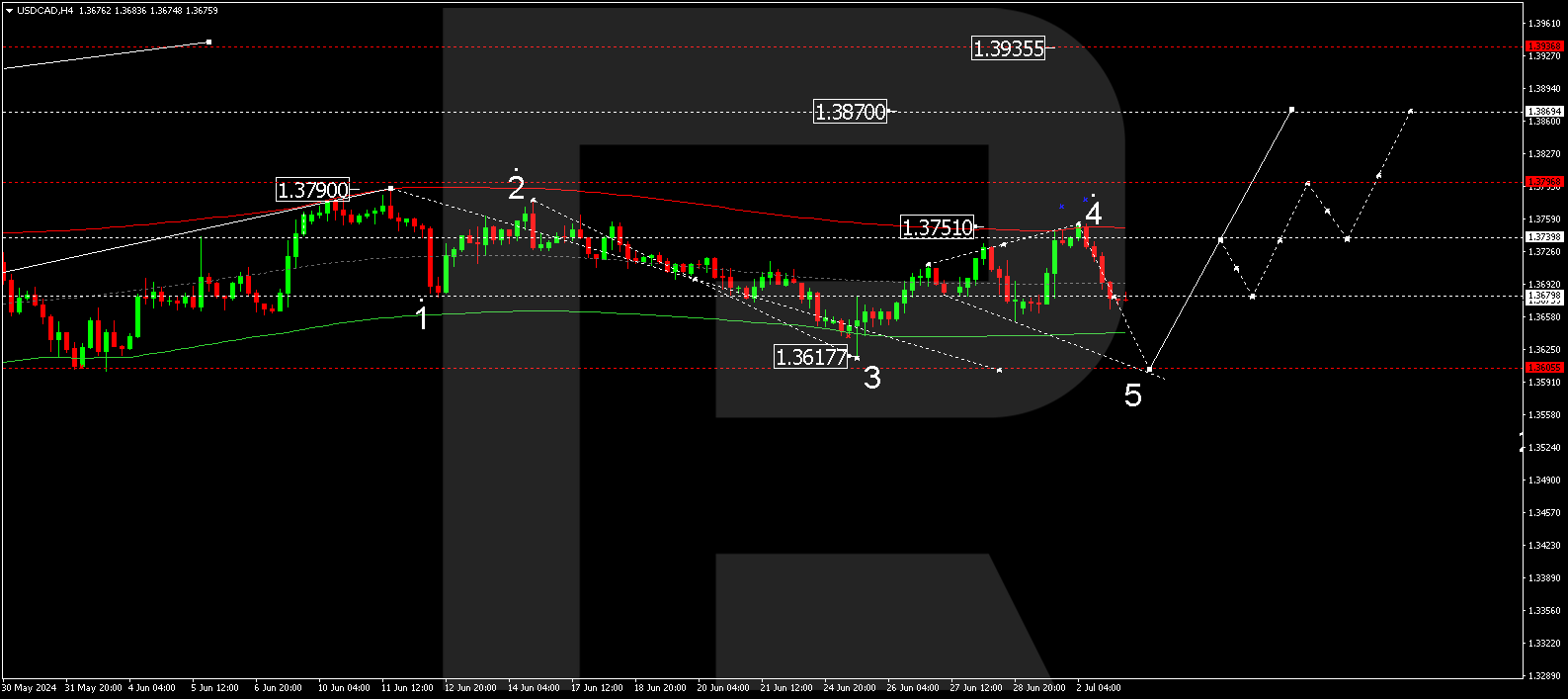

USDCAD technical analysis

According to the analysis for 3 July 2024, USDCAD has completed an upward impulse, reaching 1.3750. The market has declined to 1.3680 and is forming a consolidation range around this level. Today, the price might break below the range, aiming for 1.3606. Subsequently, the rate is expected to continue ascending to 1.3740, marking the first target. This level is crucial for another growth wave in the USDCAD pair, which is expected to start with a local target at 1.3870.

Summary

Rising oil prices and the Federal Reserve’s moderate stance will pressure the Canadian dollar. The USDCAD technical analysis points to a correction towards 1.3606, with the trend continuing to the 1.3740, 1.3820, and 1.3870 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.