USDCAD rises following Bank of Canada interest rate cut

The USDCAD pair continues to rise following a reduction in Canadian interest rates. Positive US data may cause the Canadian dollar to lose ground further. Find out more in our analysis dated 25 July 2024.

USDCAD trading key points

- Canada’s average weekly earnings (y/y) in May: previously at 3.69%

- Canada’s manufacturing sales (m/m): previously at 0.4%

- US initial jobless claims: previously at 243,000, forecasted at 237,000

- USDCAD forecast for 25 July 2024: 1.3825 and 1.3892

Fundamental analysis

The Canadian dollar is losing ground against the US dollar for the second consecutive week. The Bank of Canada lowered the interest rate by 0.25% to 4.5%. Consequently, the USDCAD rate has risen further, approaching April’s highs.

This week’s forecast of economic indicators is not favourable for the Canadian dollar. Average weekly earnings are expected to decline further, following decreases in the previous two reports. The decline in earnings could be attributed to rising unemployment, a negative economic factor.

Previous data show a decrease in manufacturing sales to 0.4%. Growth is unlikely in the current period, with a decline appearing more probable.

US initial jobless claims are projected to reach 237,000, lower than the previous figure. This suggests a decrease in unemployment, which could positively impact the US dollar and drive the USDCAD rate higher.

USDCAD technical analysis

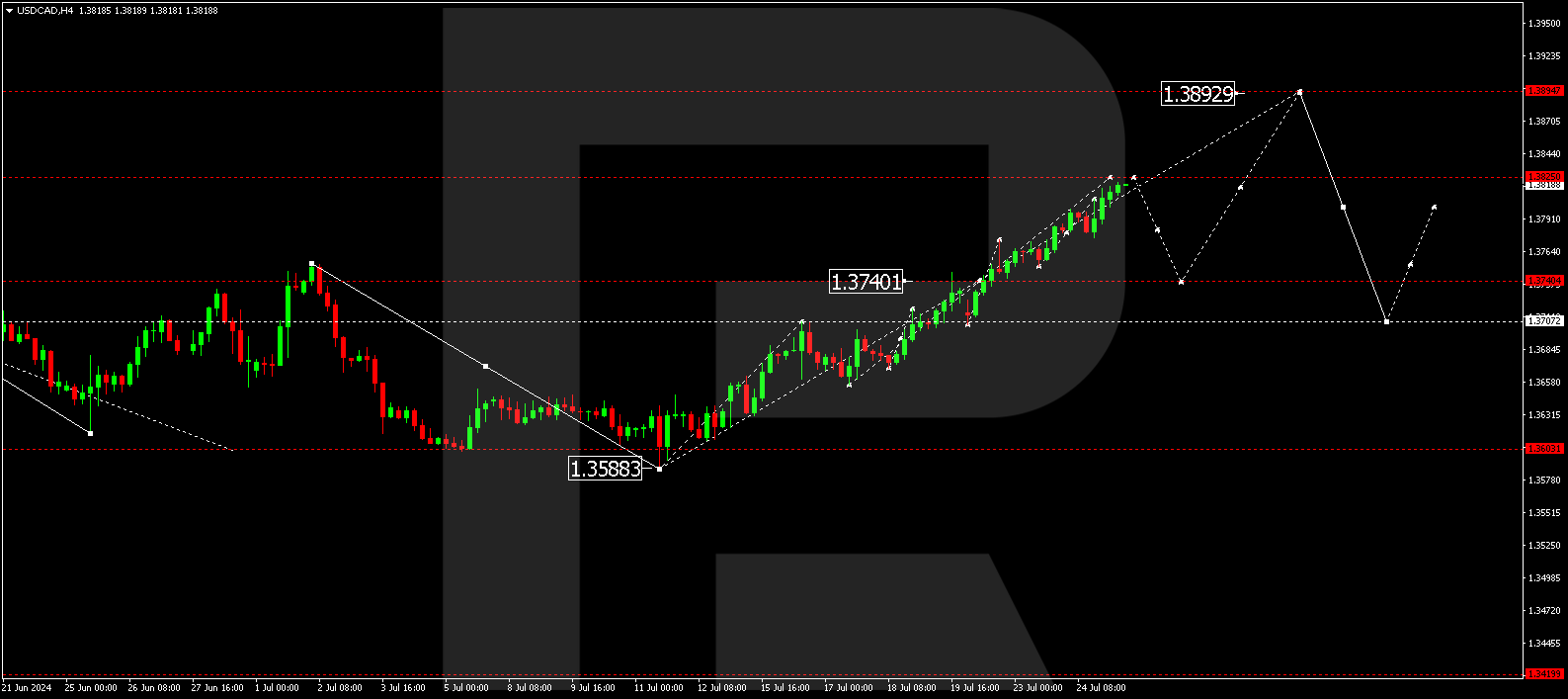

The forecast for 25 July 2024 shows that the USDCAD pair has completed a decline wave, reaching 1.3740. The market has formed a consolidation range around this level. With an upward breakout, the wave could extend to the local target of 1.3825. Once the price reaches this target, a correction is possible, aiming for 1.3740 (testing from above). Subsequently, a new growth wave could start, targeting 1.3892.

Summary

The interest rate cut in Canada and technical analysis for today’s USDCAD forecast suggest a potential uptrend towards 1.3825, which could extend to 1.3892.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.