USDCHF is correcting; the US dollar attempts to regain its position

The unchanged unemployment rate and declining sales have led to a correction in the USDCHF pair. The USD may lose ground further in the near term. Find out more in our analysis dated 6 August 2024.

USDCHF trading key points

- Switzerland’s non-seasonally adjusted unemployment rate (July): previously at 2.3%, currently at 2.3%

- Switzerland’s seasonally adjusted unemployment rate (July): previously at 2.4%, currently at 2.5%

- Switzerland’s retail sales in June (y/y): previously at -0.2%, currently at -2.2%

- USDCHF forecast for 6 August 2024: 0.8600 and 0.8666

Fundamental analysis

Switzerland’s non-seasonally adjusted unemployment rate remained at 2.3% the previous month. When seasonally adjusted, it increased by 0.1%. This indicator reflects the percentage of the unemployed working-age population actively seeking jobs. Analysis for 6 August 2024 indicates that these readings have slightly impacted the USDCHF rate, contributing to its correction.

Switzerland’s retail sales decreased significantly compared to the previous reading. The calculation is made quarterly based on samples from all retail stores in Switzerland. This indicator measures consumer spending and economic growth rates. Increased consumer spending typically points to economic growth and positively impacts the Swiss franc. Conversely, a reading below expectations and the previous value indicates negative economic trends.

The unemployment rate and declining retail sales in Switzerland have caused the USDCHF pair to form a corrective wave after the previous five-day decline.

USDCHF technical analysis

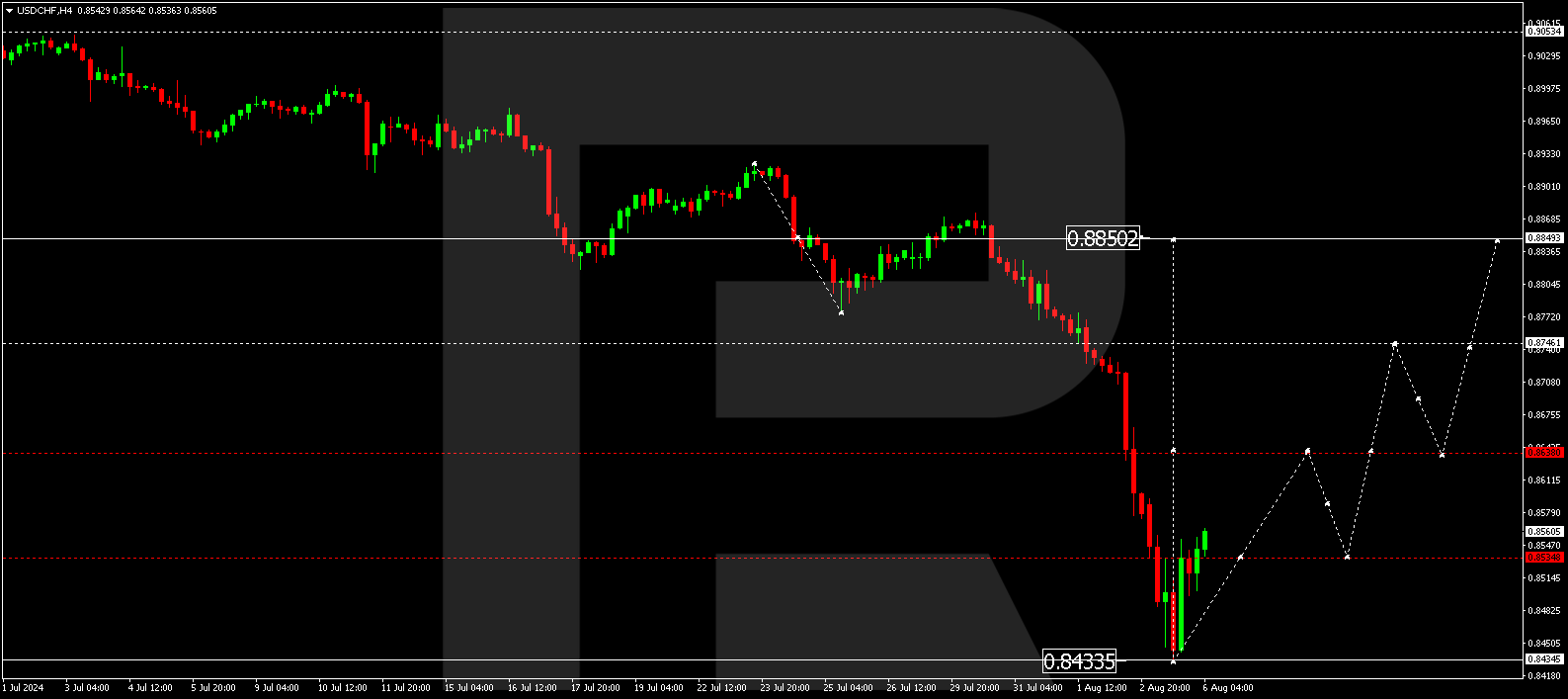

The H4 chart shows that the USDCHF pair has completed a downward wave, reaching 0.8433. Today, 6 August 2024, the USDCHF rate rose to 0.8555, forming a consolidation range around this level. The price is expected to break above this range, aiming for 0.8600 and potentially continuing the wave towards 0.8666, the initial target.

Summary

Today’s USDCHF forecast, based on the USDCHF technical analysis and fundamental data, suggests that the growth wave could extend towards the 0.8600 and 0.8666 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.