JPY remains strong: support from financial interventions is widely expected

The USDJPY pair has stabilised around monthly lows. Investors are wary of new currency interventions to support the yen.

USDJPY trading key points

- The Tankan index showed improved business sentiment

- Investors are held back by expectations of new financial interventions

- USDJPY price targets: 150.00 and 154.55

Fundamental analysis

The USDJPY pair is hovering around 158.35 today following three days of significant sales and two days of consolidation.

Investors refrain from active action due to expectations of further currency interventions by the Japanese authorities. The Bank of Japan’s data for the last week shows that the government could have spent nearly 6 trillion yen on them.

Morning’s Tankan data indicates that business sentiment among Japan’s major manufacturers improved in July, reaching a seven-month high, which is positive news for the Japanese economy.

The focus is on the Bank of Japan, which will hold a meeting at the end of the month. The regulator is expected to announce its plans to reduce bond purchases. An interest rate hike is less anticipated by investors.

USDJPY technical analysis

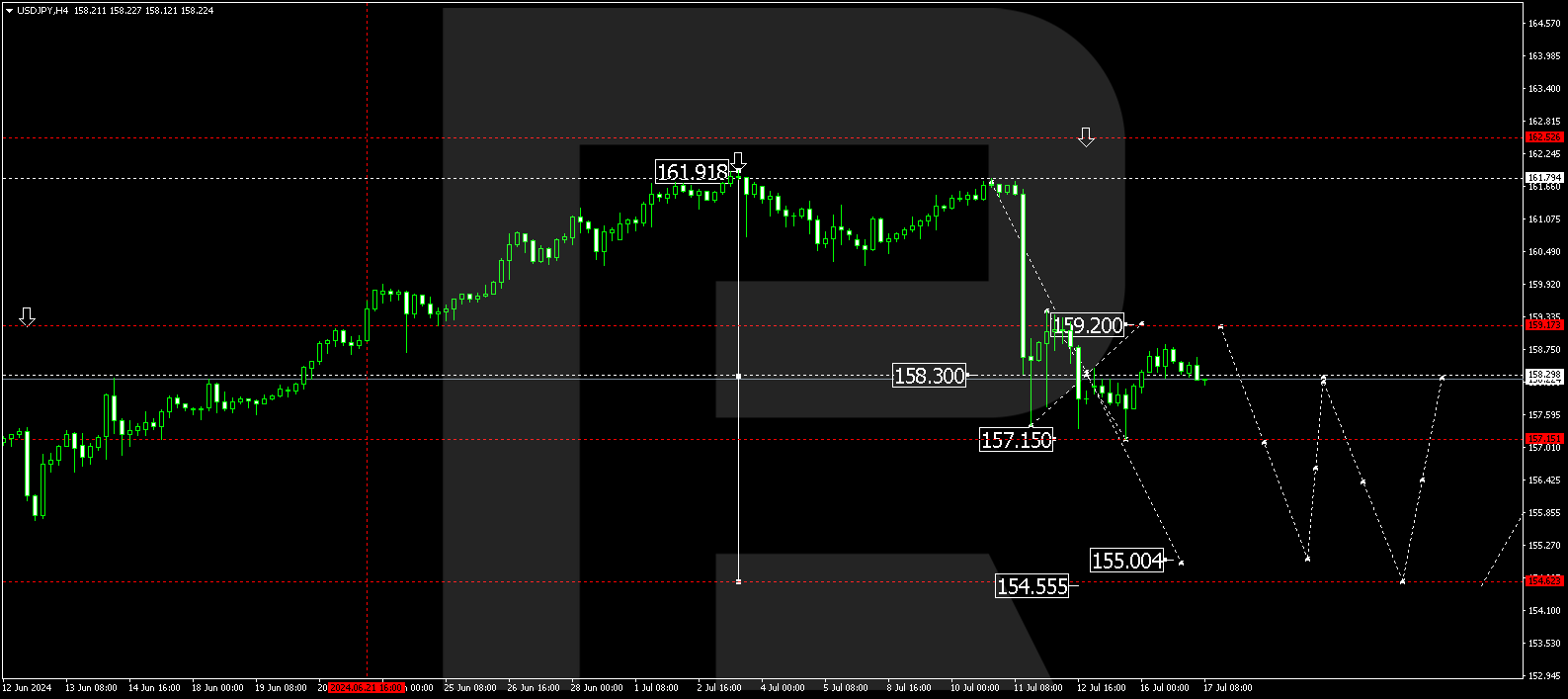

On the USDJPY H4 chart, a consolidation range is forming around 158.30 without any clear trend. The range extended down to 157.15. Today, 17 July 2024, the price could rise to 159.20 before declining to the local target of 155.00. A corrective wave is forming, with the main target at 154.55. At this level, the potential for a correction will be over.

Summary

The Japanese yen is supported by expectations of new BoJ currency interventions. Technical analysis for today’s USDJPY forecast suggests a further correction to the 155.00 and 154.55 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.