USDJPY is at a two-week low: the US dollar remains weak

The USDJPY pair continues to decline, with sentiment towards the US dollar decreasing. Find out more in our analysis dated 21 August 2024.

USDJPY forecast: key trading points

- The USDJPY pair weakens further

- Investors are focused on the upcoming decisions of the US Federal Reserve

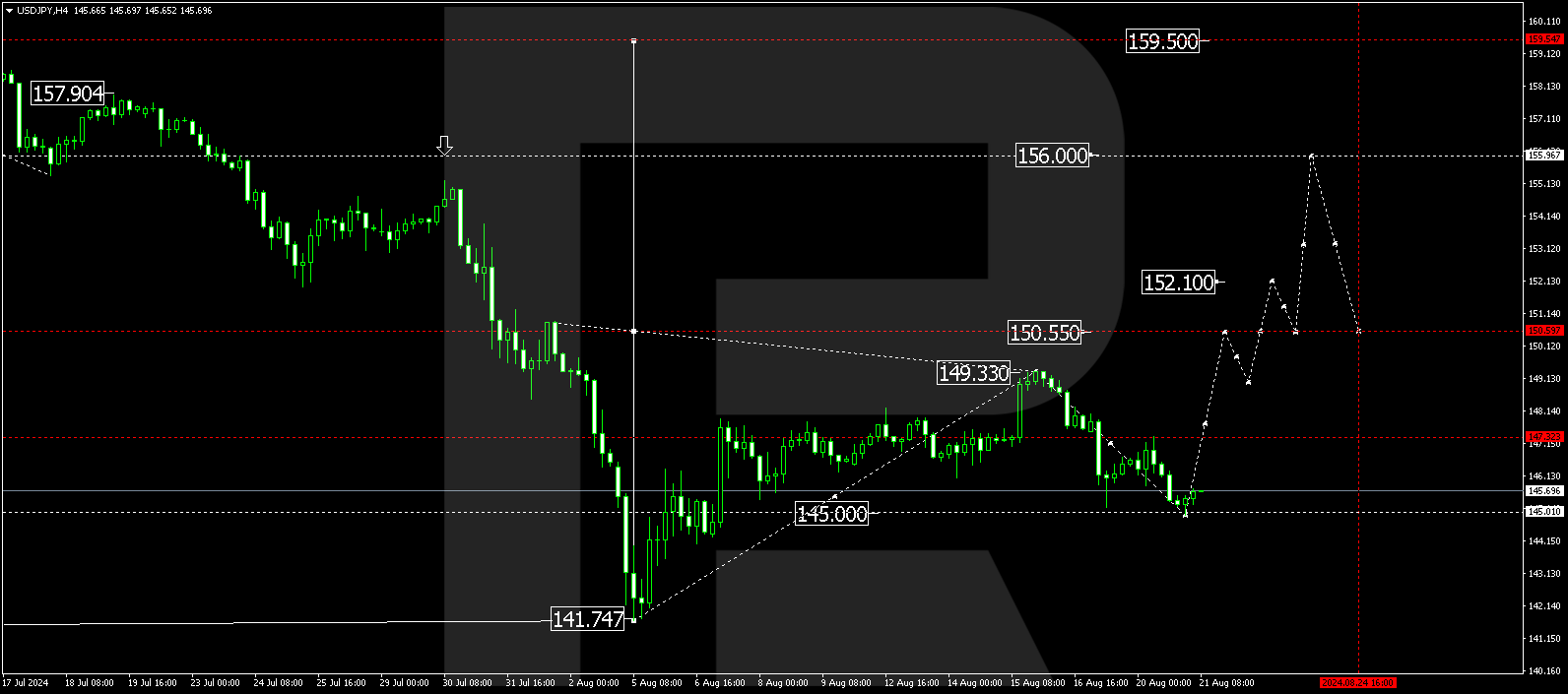

- USDJPY forecast for 21 August 2024: 147.77, 150.55, and 156.00

Fundamental analysis

The USDJPY rate dipped to 145.72 on Wednesday, marking a two-week low. The Japanese yen appears relatively strong, but this is largely because the US dollar is currently unattractive. Investors believe the US Federal Reserve will soon be compelled to reduce borrowing costs to avoid an economic downturn.

Today, attention is on the Federal Reserve’s latest meeting minutes. Subsequently, investors will watch the speech by Federal Reserve Chair Jerome Powell, which is due on Friday.

The possibility of the Bank of Japan hiking interest rates remains under review. At the end of the week, BoJ official Kazuo Ueda will clarify his actions in a speech to the Japanese parliament. The USDJPY forecast suggests that the yen will remain in a strong position.

USDJPY technical analysis

The USDJPY forecast for today, 21 August 2024, indicates that the market has completed a correction of the USDJPY rate to the 145.00 level on the H4 chart. According to the current USDJPY analysis, further growth towards the 147.77 level is highly likely. A breakout above this level would open the potential for a new wave of growth towards key levels of 150.55 and 156.00. This USDJPY forecast suggests that the uptrend could continue, targeting local highs.

Summary

The market currently favours the yen in the USDJPY pair, while the US dollar remains under pressure. However, technical indicators in today’s USDJPY forecast suggest a growth wave to the 147.77, 150.55, and 156.00 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.