USDJPY declines, and the yen continues to strengthen

The USDJPY analysis for 23 July 2024 indicates that the yen continues to strengthen in anticipation of the decision on interest rate changes in July.

USDJPY trading key points

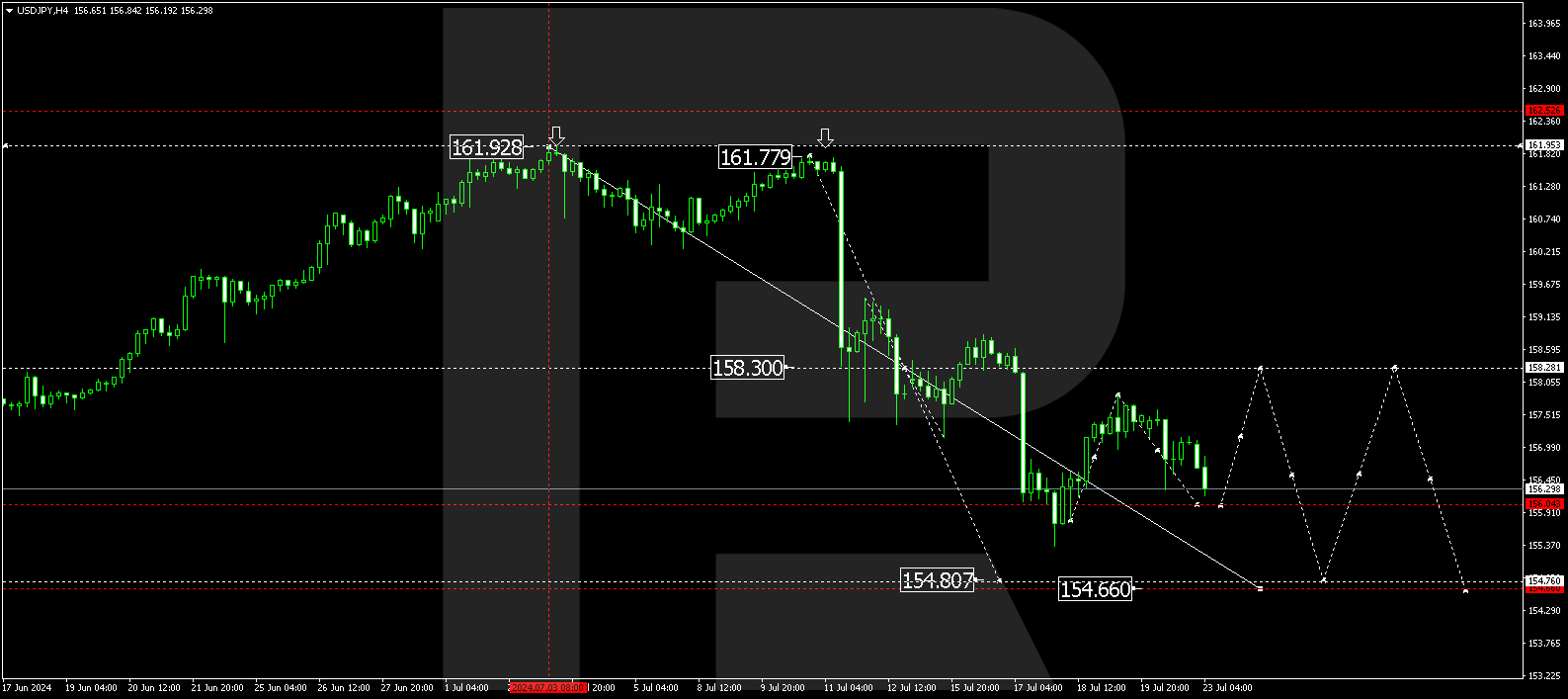

- US existing home sales (June): previously at 4.11M, forecasted at 3.99M

- USDJPY price targets: 158.28, 154.80, and 154.66

Fundamental analysis

The yen continues to strengthen against the US dollar as traders appear to be planning to reduce their positions ahead of the summer holiday season.

Bank of Japan’s officials have varied opinions on the interest rate change. Some believe a hike at a July meeting is possible, while others insist that weak consumer spending complicates the choice of further strategy. The outcome is expected to be clear only after the final decision.

US existing home sales in June are projected to be lower than in the previous period (forecasted at 3.99M), which could improve the chances of the yen’s further strengthening against the US dollar.

USDJPY technical analysis

The H4 chart shows that the USDJPY pair rose to 157.85. A correction towards 156.05 is forming today, 23 July 2024. Once the correction is complete, the price might rise to 158.28 (testing from below). Subsequently, another decline wave could develop, aiming for 154.80 and potentially extending the structure towards 154.66.

Summary

The buzz around Japan’s interest rate decision and technical analysis for today’s USDJPY forecast suggest a further decline towards the 154.80 and 154.66 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.