JPY: correction is not a sign of strengthening

The yen continues to strengthen against the US dollar on Tuesday, 25 June 2024. The USDJPY forecast appears optimistic amid the correction.

The yen is correcting after rising

Following the core consumer price index (CPI) release, the USDJPY rate continues to correct. Today, the Bank of Japan released a core consumer price index: the forecast was 1.9%, but the indicator showed an increase, reaching 2.1%.

The CPI shows the difference in prices for goods and services for the consumer and indicates changes in purchase trends and economic stagnation. A higher-than-expected indicator typically has a positive impact on the national currency. This practically helped strengthen the yen’s position, with the USDJPY pair currently being in a corrective phase. A speech by the US Federal Open Market Committee member Michelle Bowman may bring about additional changes to the yen’s temporary strengthening.

USDJPY technical analysis

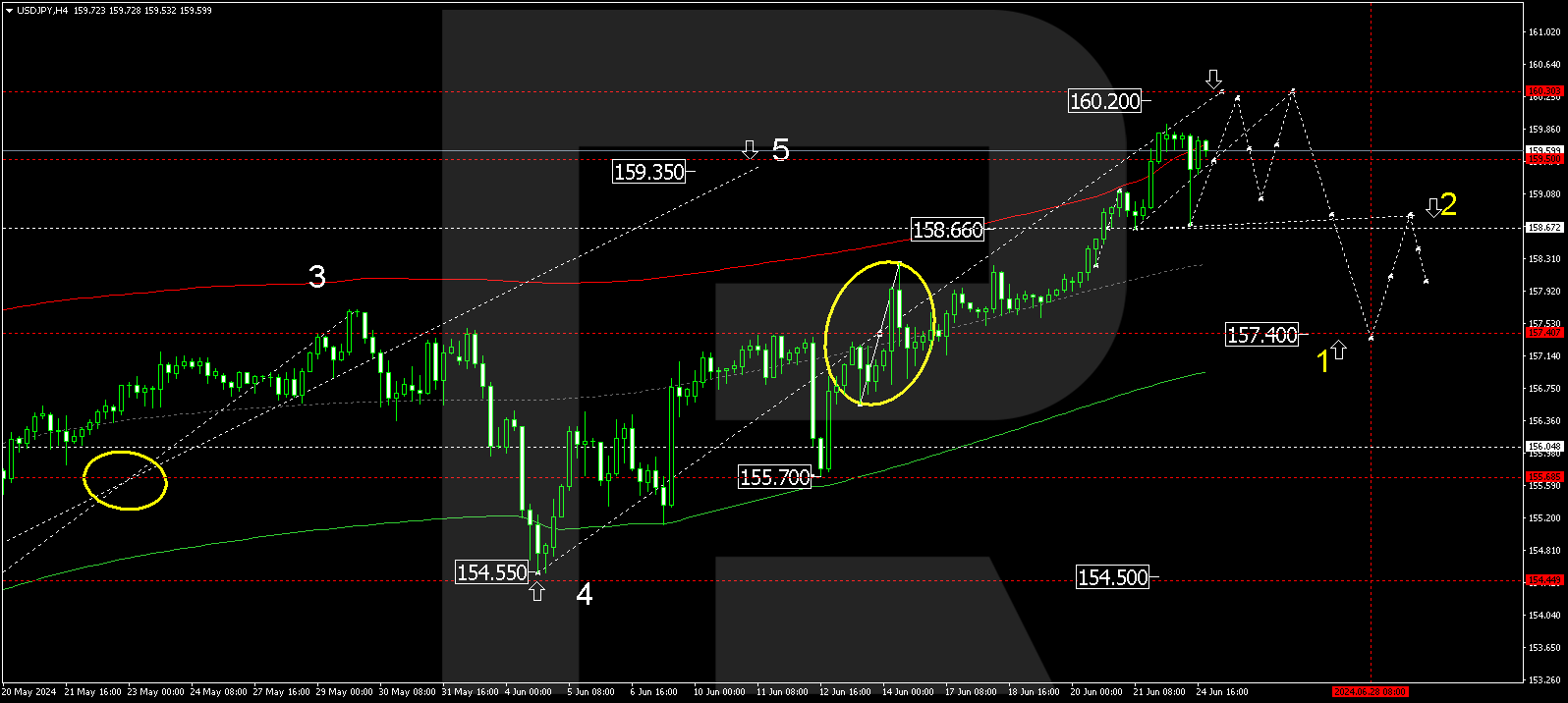

A consolidation range has formed around the 159.50 level on the USDJPY Н4 chart. The market has extended it upwards to 159.91 and downwards to 158.71. Today, 25 June 2024, the market broke above the 159.50 level, considering a rise to 160.20. Subsequently, a decline to 159.00 is possible, followed by a rise to 160.30. The market will practically reach a new high of a growth wave. Following this, a correction is expected to start, aiming for 157.40 as the first target for correction.

USDJPY technical analysis 25.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 155.70. The market has received support at the Envelope’s central line and continues growth to its upper boundary. A decline wave is expected to begin from the 160.30 level to the Envelope’s centre – 158.80. Subsequently, a consolidation range is anticipated to form around this level. With a downward breakout, the trend could continue to the Envelope’s lower boundary at 157.40.

Summary

The USDJPY technical analysis points to a potential growth wave towards 160.30 with an onward decline to the targets of 157.40 and 154.50.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.