JPY is falling without hope for financial interventions and is approaching a low

The USDJPY pair continues its ascent, with the Bank of Japan’s inaction working against the yen.

The Japanese yen is moving in line with devaluation and continues its decline

The Japanese yen continues to fall against the US dollar, with the USDJPY pair reaching 159.79 on Wednesday.

The JPY decline is primarily driven by the vast difference in interest rates between the Bank of Japan and the US Federal Reserve. The BoJ interest rate remains at zero. The central bank does not dare to revise it, postponing even less significant steps such as modifying the bond purchase program. The regulator’s indecisive stance substantially impacts the yen’s position.

The yen’s devaluation is only increasing. However, there is little chance that the government will resort to financial interventions. Meanwhile, the yen is approaching levels at which such interventions have previously occurred.

Yesterday’s statistics showed a 0.8% m/m decrease in the leading economic index in Japan compared to an earlier increase of 0.1%.

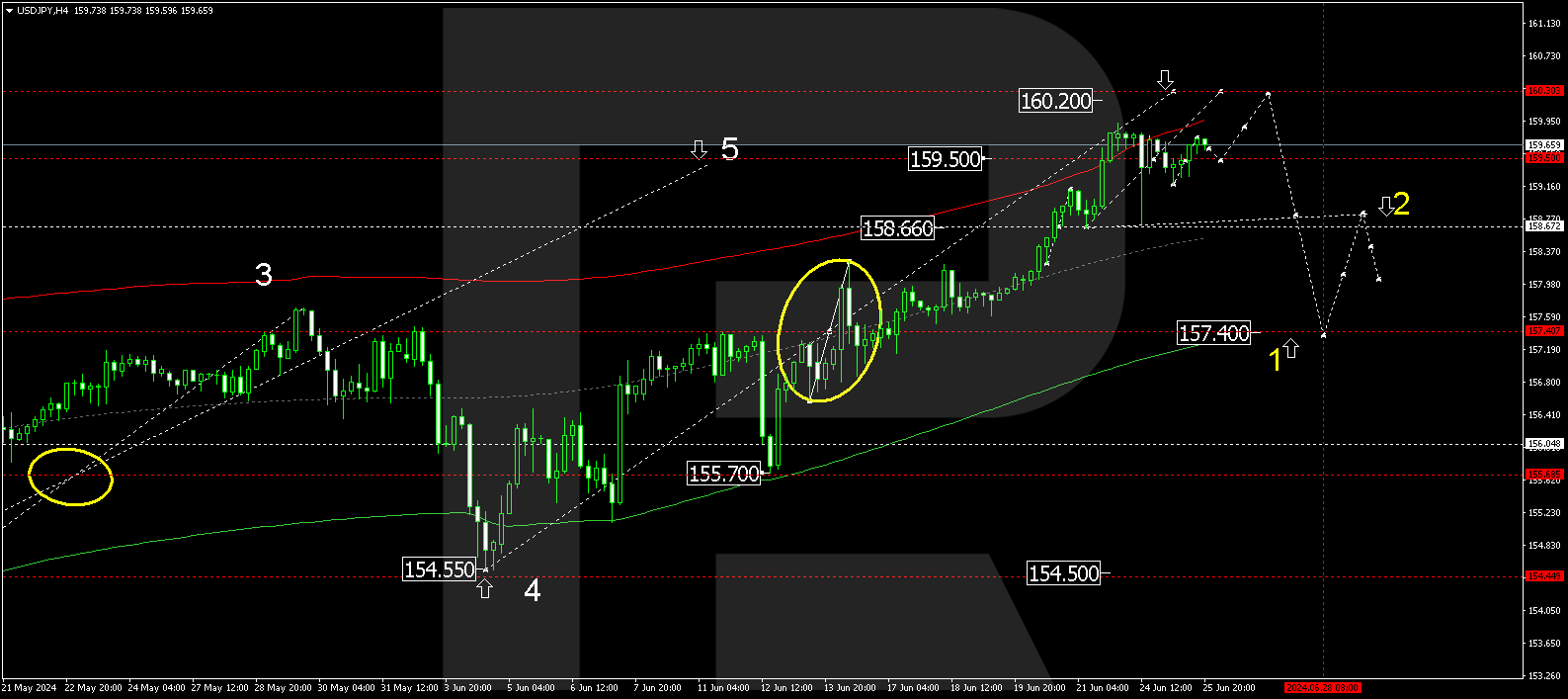

USDJPY technical analysis

On the H4 chart, USDJPY is currently in a consolidation phase around the 159.50 level. The consolidation range has extended towards 159.74. Today, 26 June 2024, a decline to 159.50 (testing from above) is possible, followed by a rise to 160.20, potentially continuing to 160.30. Subsequently, a correction might start, aiming for 157.40 as the first target for correction.

USDJPY technical analysis 26.06.2024

The Elliott Wave structure and a wave matrix with a pivot point at 157.40 technically confirm this USDJPY scenario. The market has received support at the Envelope’s central line and continues growth to its upper boundary. A decline wave is expected from the 160.30 level to the Envelope’s centre – 158.66. Subsequently, a consolidation range is anticipated to form around this level. With a downward breakout, the trend could continue to the Envelope’s lower boundary at 157.40.

Summary

The USDJPY technical analysis points to a potential growth wave towards 160.30, followed by an onward decline to the 158.66, 157.40, and 154.50 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.