USDJPY continues to rise; the yen is on the verge of an interest rate decision

Moderately positive unemployment news does not prevent the yen from losing ground against the US dollar. Analysis for 30 July 2024 shows that expectations of a decision to change interest rates in Japan are driving up the USDJPY rate. Find out more in our analysis dated 30 July 2024.

USDJPY trading key points

- The job openings-to-applicants ratio in Japan: previously at 1.24%, currently at 1.23%

- Japan’s unemployment rate: previously at 2.6%, currently at 2.5%

- US CB Consumer Confidence Index: forecasted at 99.7, previously at 100.4

- USDJPY forecast for 30 July 2024: 155.83 and 157.10

Fundamental analysis

Japan’s job openings-to-applicants ratio reflects the proportion of candidate applications relative to the number of actual vacancies. In June, there were 123 applicants per 100 job openings (compared to 124/100 in May’s report). The slight decrease could be due to reduced activities in companies processing applications.

Japan’s unemployment rate decreased by 0.1% from the previous period but remains close to 2.5%. Tensions in the employment market are exerting pressure, contributing to rising wages.

The US Consumer Confidence Index is projected to have declined to 99.7, indicating decreased consumer spending. Data below the forecast may negatively impact the USDJPY rate.

The Bank of Japan is considering options to increase wages as a strategy to combat inflation. The central bank will decide on interest rate changes on Wednesday, 31 July 2024.

The fundamental analysis forecast for 30 July 2024 indicates that the USDJPY pair is ready to resume growth to all-time highs.

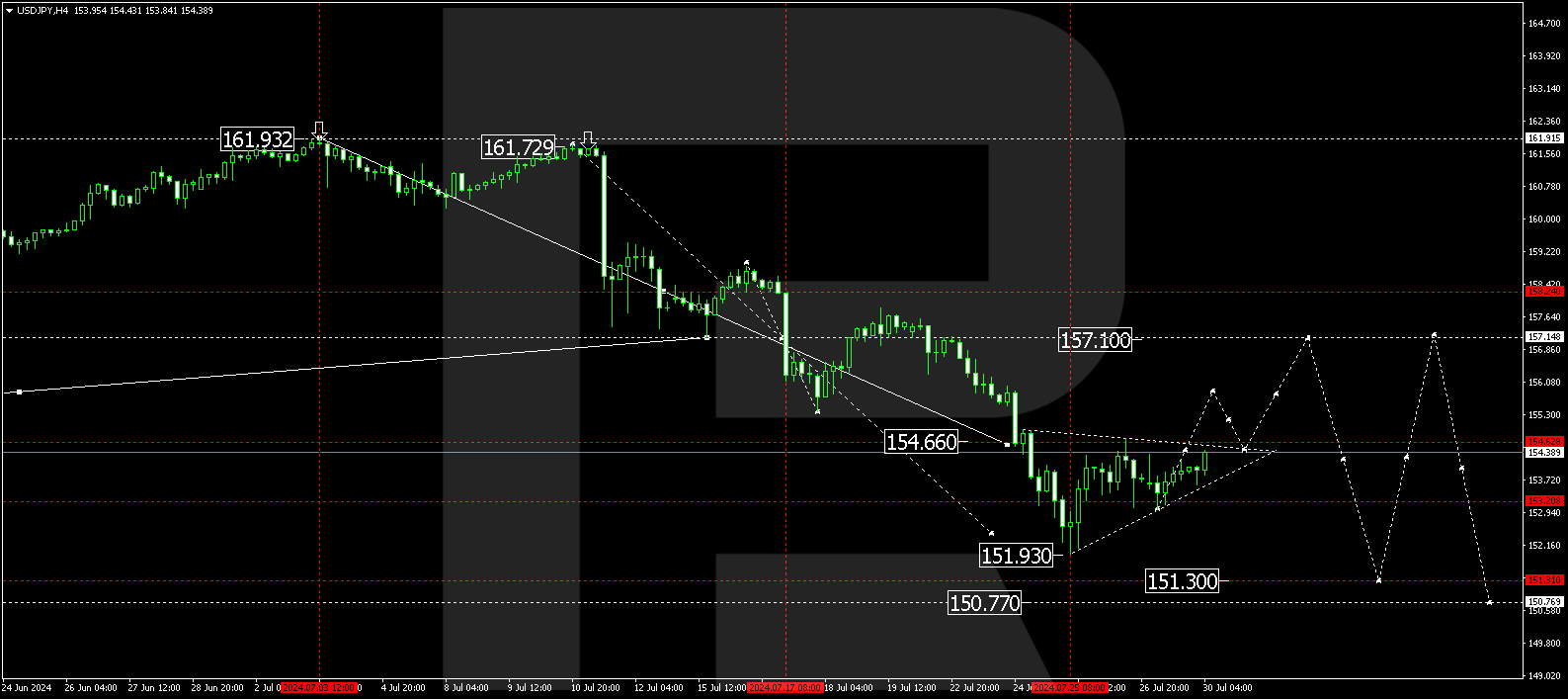

USDJPY technical analysis

On the H4 chart, the USDJPY pair has corrected towards 153.20. A consolidation range is forming above this level today, 30 July 2024. An upward breakout of the range will open the potential for growth in the USDJPY rate to 155.83, potentially continuing to 157.10. If the USDJPY quotes move further down, the corrective wave is expected to develop towards 151.30.

Summary

Expectations of a decision to change interest rates in Japan and technical indicators for today’s USDJPY forecast suggest that the corrective wave could continue to the 155.83 and 157.10 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.