EURUSD: the likelihood of Federal Reserve interest rate cuts increases

The EURUSD rate is slightly correcting on Friday as traders await the US employment report. Find out more in our analysis dated 2 August 2024.

EURUSD trading key points

- US manufacturing activity contracted more than expected, reaching 46.6

- Initial jobless claims increased to 249K

- Expectations of a Federal Reserve interest rate cut in September increased by 15.5%

- Today’s US employment report may significantly affect the EURUSD rate

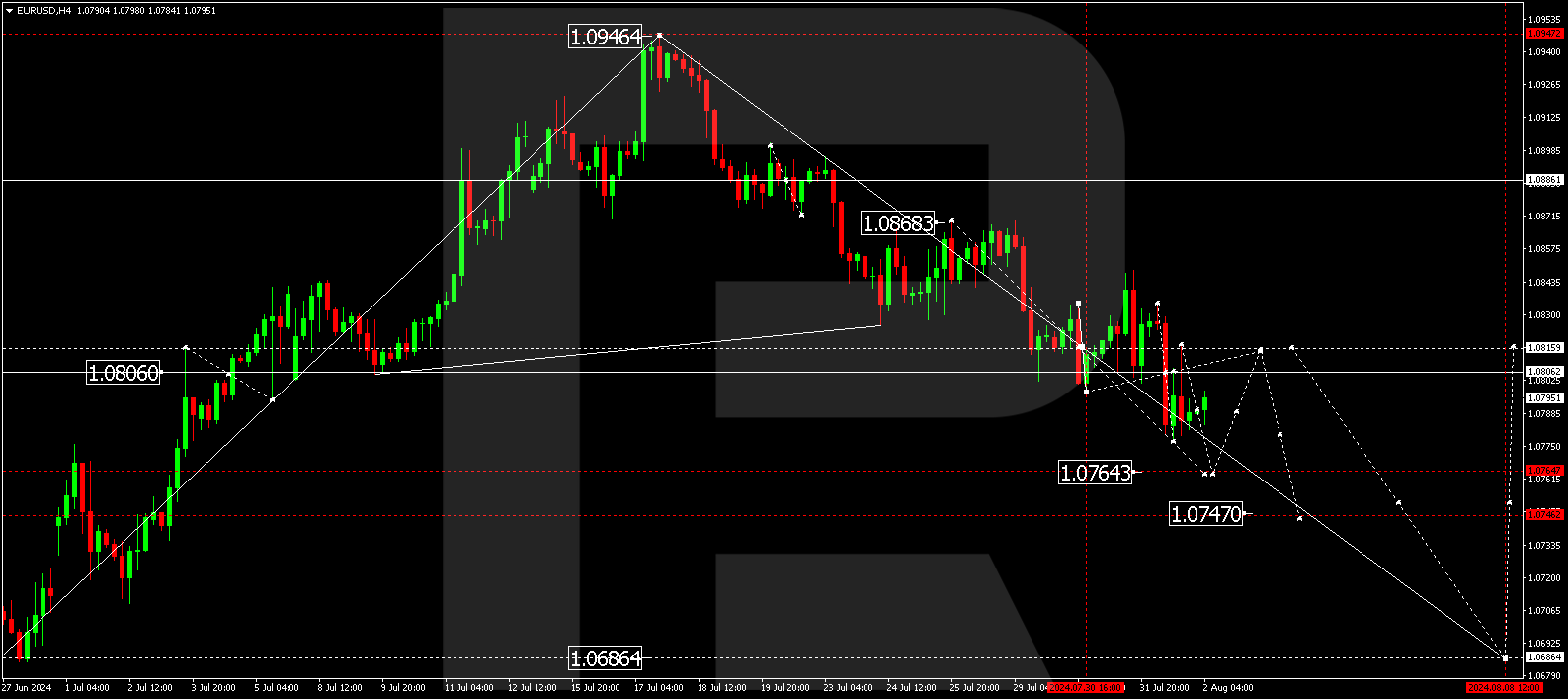

- EURUSD forecast for 2 August 2024: 1.0764, 1.0747, and 1.0686

Fundamental analysis

Yesterday’s data showed that US manufacturing activity contracted more than anticipated in July, and employment fell to 2020 levels.

The ISM manufacturing PMI decreased to 46.6 points in July 2024 from 48.5 the previous month, reaching an eight-month low amid declining new orders.

Initial jobless claims increased to 249K, marking the highest reading in nearly a year. This rise, along with other key indicators, suggests that the US employment market continues to weaken, which heightens expectations for the Federal Reserve to ease monetary policy.

Following the disappointing data release, traders now estimate the likelihood of a central bank 50-basis-point interest rate cut at 27.5%, up from 12.0% the day before.

Traders’ focus is now on the nonfarm payrolls report, which will provide additional data on the US employment market and economy in general. According to today’s EURUSD forecast, the indicators may stabilise, which could support strengthening the US dollar.

EURUSD technical analysis

On the H4 chart, the EURUSD pair has completed a decline wave, reaching 1.0777, and has corrected towards 1.0815 (testing from below). Another downward wave could start today, 2 August 2024, aiming for 1.0764 as the local estimated target. After reaching this level, the price could correct towards 1.0806. Subsequently, a new decline wave could begin, targeting 1.0747 and potentially continuing towards 1.0686.

Summary

Weak US economic data raise expectations of a Federal Reserve interest rate cut, exerting pressure on the EURUSD pair. However, a robust employment report due today may support the US dollar. Technical indicators included in today’s EURUSD forecast suggest that the trend could continue to the 1.0764, 1.0747, and 1.0686 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.