EURUSD: the euro declines after strong nonfarm payroll statistics

Amid the release of US employment data, the EURUSD pair continued to decline, falling to 1.0200. More details in our analysis for 13 January 2025.

EURUSD forecast: key trading points

- US nonfarm payrolls increased by 256 thousand in December, well above the forecast 154 thousand

- The US unemployment rate was 4.1% in December

- EURUSD forecast for 13 January 2025: 1.0200 and 1.0330

Fundamental analysis

US December nonfarm payrolls released on Friday pleased economists and investors, coming in at 256 thousand, above expectations. The unemployment rate decreased from 4.2% to 4.1%. As a result, the US dollar gained support, with the EURUSD rate plunging to near 1.0200.

Robust US employment data may bolster the Federal Reserve’s intention to pause the benchmark interest rate-cutting cycle.

US inflation statistics will be released this week, specifically the Consumer Price Index (CPI) and the Producer Price Index (PPI). Weaker-than-forecast readings will exert pressure on the USD and help strengthen the euro. Conversely, more substantial figures will support the US dollar, leading to a decline in EURUSD quotes.

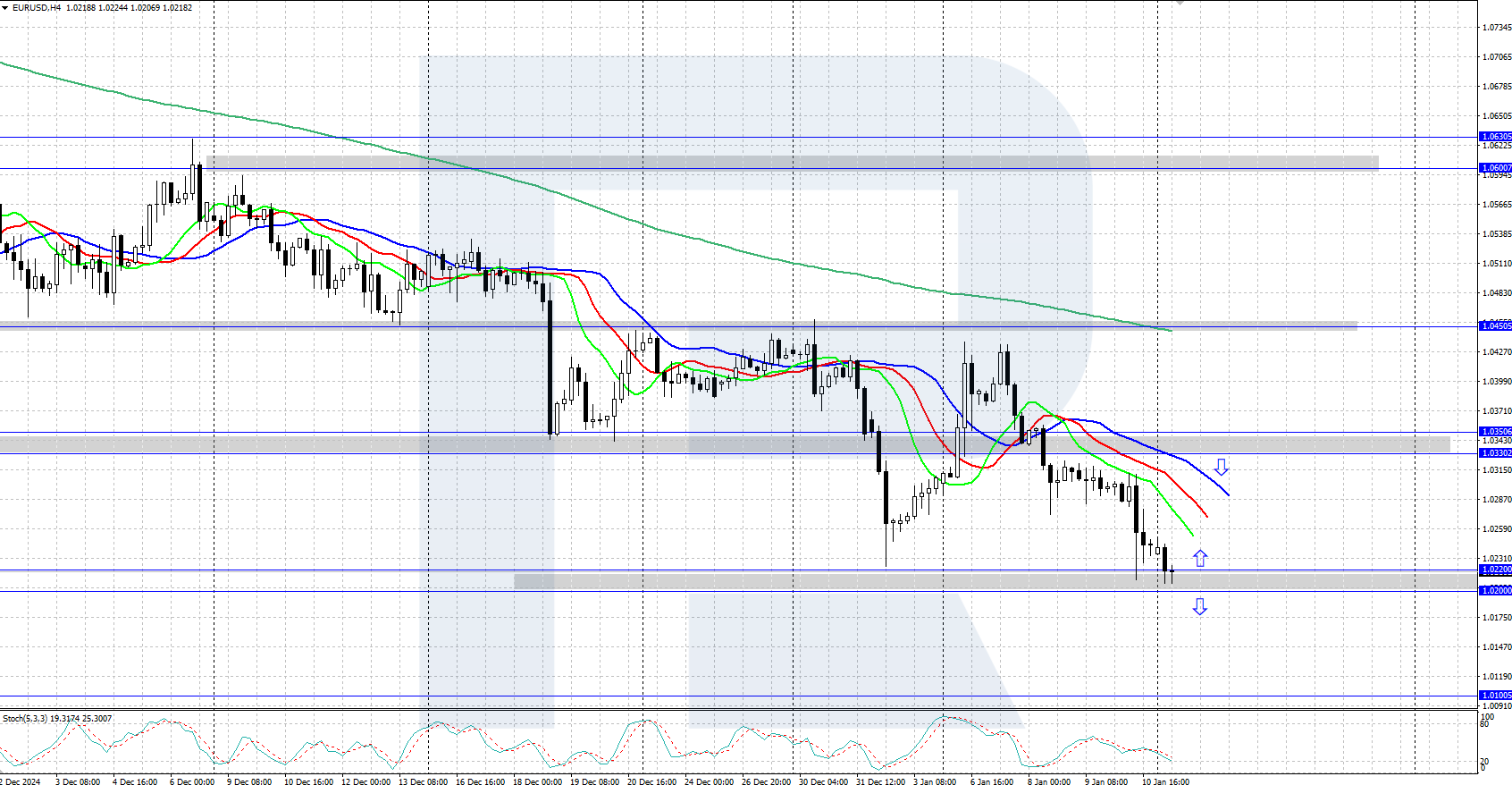

EURUSD technical analysis

On the H4 chart, the EURUSD pair is experiencing a strong downtrend. After the US employment data release, the pair dropped to the support area between 1.0200 and 1.0220, where it encountered local demand and attempted to rebound upwards. The daily trend is downward and is confirmed by the Alligator indicator, and the decline may continue after a minor correction.

Today’s EURUSD forecast suggests that if the bulls manage to hold the quotes above the 1.0200-1.0220 support area, the pair has the potential for a correction towards the 1.0330 resistance level. If the bears overcome the support range, the price could decline to 1.0100.

Summary

The EURUSD rate plunged to the area near 1.0200 following the release of strong US employment statistics. This week, the market will focus on US inflation data (the CPI and PPI), which could drive further price movements.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.