EURUSD: the ISM index signals a US economic slowdown

The EURUSD rate is undergoing a slight correction after its decline yesterday. Find out more in our analysis for 4 September 2024.

EURUSD forecast: key trading points

- The US manufacturing PMI remains below the critical 50-point level, confirming an economic slowdown

- The likelihood of a Federal Reserve 50-basis-point interest rate cut fell to 38% from 74% a month ago

- Market participants focus on job openings in the US employment market today

- EURUSD forecast for 4 September 2024: 1.1004 and 1.1096

Fundamental analysis

The EURUSD rate has rebounded from the 1.1030 support level, but selling pressure remains. Further declines in the pair may be driven by risks relating to the US economic slowdown, and corresponding expectations have recently gained traction in the markets. These factors led to more cautious forecasts regarding a Federal Reserve interest rate cut, supporting the US dollar.

The US manufacturing PMI rose to 47.2 points in August from 46.8 in July. However, the figure remains below the critical 50.0 points level, indicating a continued decline in activity in this sector.

This week’s critical development for financial markets will be the US Department of Labor’s unemployment report for August. The release of the July report, which demonstrated a sharp slowdown in job growth, caused a decline in global markets. Analysts expect the August report to show an increase of 165,000, up from 114,000 in July. Before this, investors will closely monitor today’s data release on job openings in the US employment market and the jobless claims report scheduled for Thursday.

Employment market statistics will likely determine the Federal Reserve’s decision at the September meeting, significantly impacting investor actions as part of the EURUSD forecast. Traders currently estimate the likelihood of a 50-basis-point base interest rate cut by the regulator at 38%, down from 74% a month ago.

EURUSD technical analysis

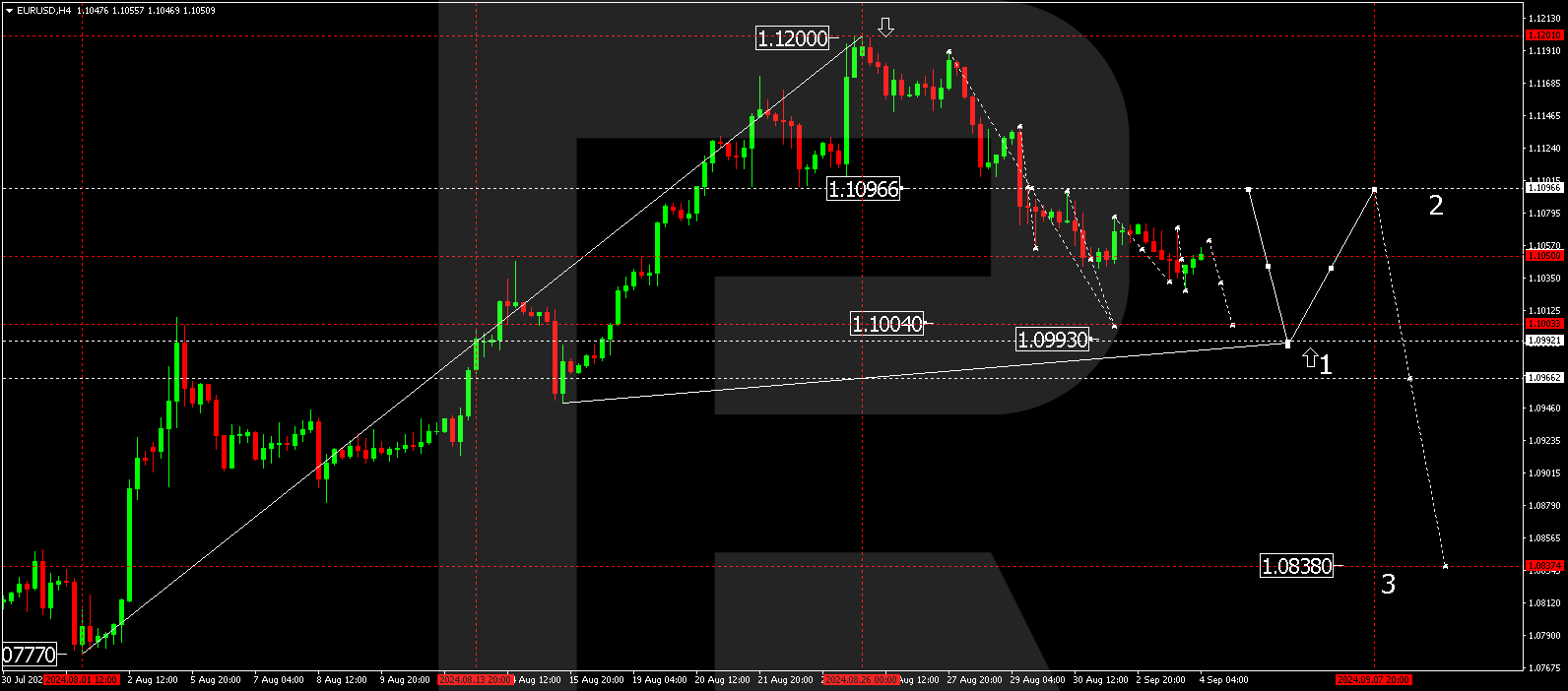

On the EURUSD H4 chart, the market has completed a downward wave, reaching 1.1026. A correction is expected today, 4 September 2024, aiming for 1.1055. A downward wave could develop once the correction is complete, targeting 1.1021. A breakout below this level may signal a continuation of the trend towards 1.1004, the local estimated target. After reaching this level, the price could correct towards 1.1096 (testing from below). Subsequently, another downward wave is expected to develop, aiming for 1.0990 as the first estimated target.

Summary

The EURUSD rate remains under selling pressure due to risks associated with the US economic slowdown. Markets will focus on the data on job openings in the US employment market due today and the US jobless claims report scheduled for tomorrow. Technical indicators in today’s EURUSD forecast suggest a potential decline to 1.1004, followed by a correction to 1.1096.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.