EURUSD under pressure: investors await US inflation data

The EURUSD rate is declining for the second consecutive session following the release of the US employment report. Find out more in our analysis for 9 September 2024.

EURUSD forecast: key trading points

- US employment growth slowed as job gains in August were lower than expected

- The unemployment rate decreased to 4.2%, indicating improving employment market conditions

- US employment data does not give a clear signal for the Federal Reserve, with the size of a potential interest rate cut remaining uncertain

- EURUSD forecast for 9 September 2024: 1.1060, 1.0985, and 1.0818

Fundamental analysis

The EURUSD rate is testing Friday’s low while investors continue to evaluate the potential size of a Federal Reserve interest rate cut amid mixed US employment data. The employment market report for August showed that the US economy created fewer jobs than expected. Nevertheless, the unemployment rate slightly decreased while wage growth remained stable.

The US created 142,000 jobs in August 2024, more than the downwardly revised reading of 89,000 for July but below market expectations of 160,000. The construction and healthcare sectors saw the most significant job gains. The unemployment rate fell to 4.2% from 4.3% in July, aligning with market expectations.

The employment data did not give traders a clear understanding of whether the Federal Reserve will lower interest rates by 25 or 50 basis points. The employment market is showing signs of cooling but not enough to raise serious concerns about an economic slowdown. Such expectations have supported the EURUSD forecast for today.

Investors now focus on the August inflation data scheduled for release on Wednesday. The annual inflation rate is expected to fall from 2.9% to 2.6%, which may emphasise the need for monetary policy easing. The final size of an interest rate cut remains unclear.

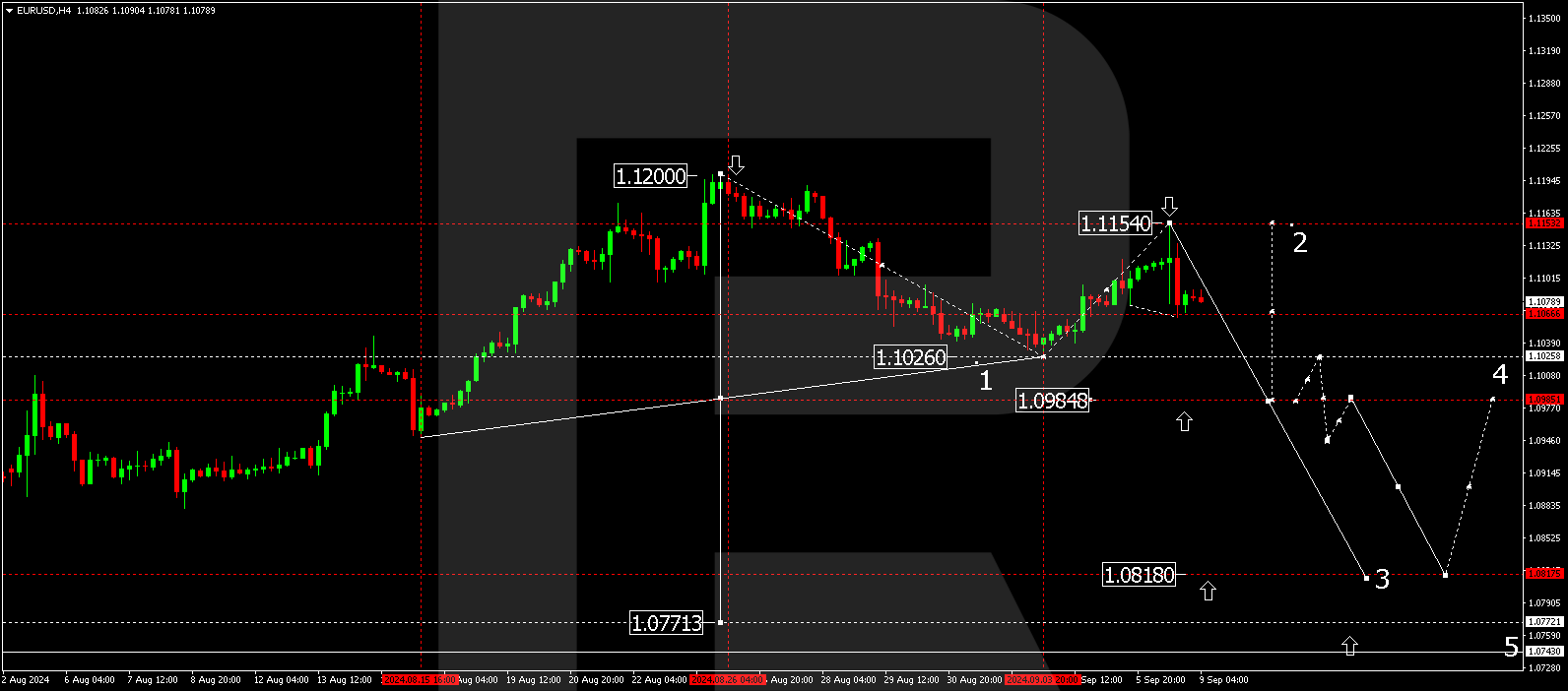

EURUSD technical analysis

On the EURUSD H4 chart, the market has completed a corrective wave, reaching 1.1154. Following the news, a downward impulse towards 1.1065 and a rise to 1.1133 were observed. The EURUSD rate is expected to decline to 1.1060 today, 9 September 2024. Subsequently, a consolidation range could develop around this level. A breakout below the range might signal a further movement towards 1.0985. This decline represents only half of the third wave, with its target at 1.0818.

Summary

The EURUSD rate declines amid expectations of US inflation data and uncertainty about the Federal Reserve’s future actions. An insignificant decrease in job growth and stable unemployment figures strengthen the US dollar. Technical indicators in today’s EURUSD forecast suggest that the wave could continue towards the 1.1060, 1.0985, and 1.0818 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.