EURUSD: the euro strengthens ahead of a Fed interest rate change

Declining industrial production in Europe and the Eurogroup meeting do not affect the strengthening of the euro against the US dollar. Discover more in our analysis for 13 September 2024.

EURUSD forecast: key trading points

- The eurozone’s industrial production in August (m/m): previously at -0.1%, projected at -0.6%

- The Eurogroup meeting

- The University of Michigan consumer sentiment index: previously at 67.9%, projected at 68.3%

- EURUSD forecast for 13 September 2024: 1.1103 and 1.1108

Fundamental analysis

Europe’s industrial production reflects the total output of the eurozone, including utilities, manufacturing plants, and mines. The previous reading was -0.1%; the forecast for 13 September 2024 suggests a decline to -0.6%.

Industrial production has been falling for the past few months. Negative readings may be due to high energy tariffs, which are forcing companies to reduce their output or shut down.

The Eurogroup will hold its next meeting today and will likely address economic development issues and options for action in case of a Federal Reserve interest rate cut. In anticipation of the Federal Reserve meeting, rumours have begun to circulate again about a potential 50-basis-point cut instead of a 25-basis-point reduction. This creates some confusion and allows the EURUSD rate to continue its ascent after a correction.

The University of Michigan consumer sentiment index estimates consumer confidence in the economy. It is a leading indicator of consumer spending, which accounts for a significant portion of economic activity. The index is expected to increase to 68.3%, up from the previous reading, but the actual figure may differ significantly.

Today’s EURUSD forecast does not appear encouraging for the US dollar as it may continue to lose ground against the euro until the Federal Reserve publishes a decision to change interest rates.

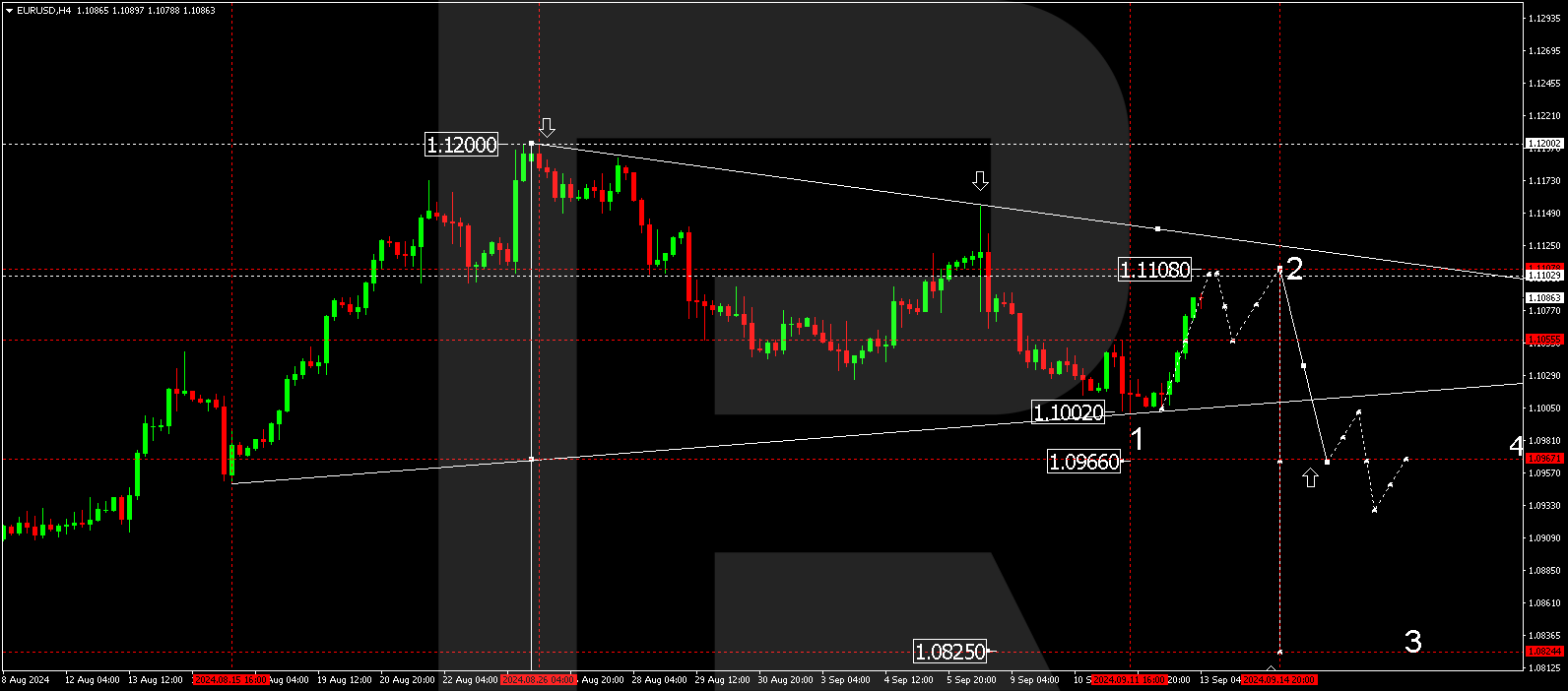

EURUSD technical analysis

The EURUSD H4 chart shows that the market has broken above the 1.1055 level. A growth wave could continue towards 1.1103 today, 13 September 2024. After reaching this level, the price could decline to 1.1055 (testing from above). Subsequently, another rise to 1.1108 is expected. The market suggests forming a triangle technical pattern at the top of the growth wave. It is relevant to view the current rise as a correction of the previous downward wave. Once the correction is complete, a new downward wave could start, aiming for the lower boundary of the triangle pattern at 1.1011.

Summary

The expectation of the Federal Reserve interest rate decision and the EURUSD technical analysis in today’s EURUSD forecast suggest that the growth wave could continue to the 1.1103 and 1.1108 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.