EURUSD forecast: the pair has all chances for growth continuation

A major data release on Eurozone and US indices may significantly impact EURUSD – read more in our analysis for 23 September 2024.

EURUSD forecast: key trading points

- French Manufacturing PMI: previous value - 43.9, forecasted - 44.3

- German Manufacturing PMI: previous value - 42.4, forecasted - 42.4.

- Eurozone Manufacturing PMI: previous reading 45.8, forecast 45.7.

- US Manufacturing PMI: previous value - 47.9, forecasted - 48.6

- EURUSD forecast for 23 September 2024: 1.1222 and 1.1290

Fundamental analysis

The Manufacturing Purchasing Managers' Index (PMI) measures the activity of purchasing managers in the industrial sector. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this indicator, as purchasing managers are the first to receive information about their company's performance. This makes the PMI an essential indicator for assessing the overall economic situation. A reading above 50 indicates an increase in production, while a reading below 50 indicates a decline.

The French PMI is forecast to increase slightly to 44.3, up from 43.9 in the previous month, while the German PMI is projected to remain at last month's level of 42.4 for the current period.

The overall Eurozone PMI is forecast to decline by 0.1 points to 45.7. The decline is insignificant. However, given that the index for almost all Eurozone countries is below 50.0, it can be assumed that the EU manufacturing sector, as a whole and individual countries, is not in a favourable situation. Nevertheless, the EURUSD forecast for 23 September 2024 looks quite optimistic.

The US PMI appears more favourable than the Eurozone forecast, with the actual index data expected to be higher than the previous value by 0.7 points. As practice shows, forecasts sometimes do not come true, and the actual values may differ significantly from the previous and forecasted ones.

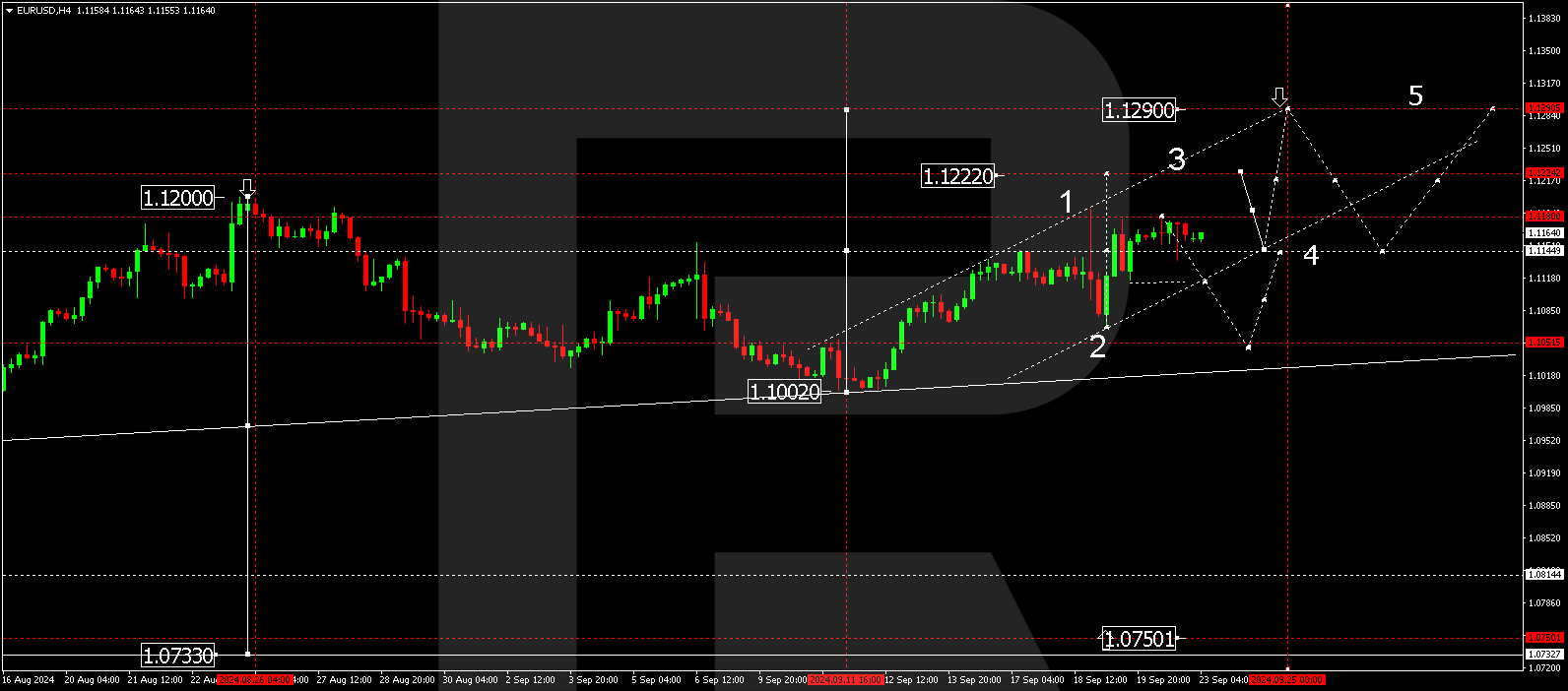

EURUSD technical analysis

On the H4 chart of EURUSD, the market continues to develop the consolidation range around the level of 1.1145 without a pronounced trend. Currently, the range has extended downwards to 1.1115 and upwards to 1.1180. Today, 23 September 2024, we expect an upward exit from the range. A breach of the 1.1180 level upwards can signal the continuation of the growth wave towards 1.1222. The target is local. After reaching this level, we will consider the probability of a correction to 1.1145 (test from above). Further continuation of the growth wave to the 1.1290 level is not excluded.

Summary

The Manufacturing PMI data from the European Union and the US slightly contradict the technical analysis of EURUSD. Nevertheless, the forecast for today on EURUSD suggests considering the probability of the growth wave developing to the levels of 1.1222 and 1.1290.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.