EURUSD analysis: the euro continues to strengthen against the US dollar

The monthly ECB report, alongside the latest US GDP and unemployment data, could be critical signals triggering further USD weakness. Read more in our EURUSD forecast and analysis for 26 September 2024.

EURUSD forecast: key trading points

- ECB monthly report

- US GDP (QoQ): previously 3.0%, forecasted 3.0%

- US Initial Jobless Claims: previously 219K, forecasted 224K

- EURUSD forecast for 26 September 2024: 1.1222 and 1.1290

Fundamental analysis

The ECB’s monthly report on the economic situation in the European Union will be released today, 26 September 2024. It includes data on the macroeconomic environment, the current state of monetary policy, and the economic outlook for the near future.

GDP is the total value of all goods and services produced in a country; it applies only to final products and does not include the cost of raw materials. The forecasted value of the US GDP is 3.0%, which aligns with the previous indicator. If the actual data matches expectations, it may provide some support to the USD.

The US Initial Jobless Claims figure reflects the number of people who applied for unemployment benefits for the first time during the previous week. The indicator assesses the state of the labour market, and an increase indicates an increase in unemployment. The last value was 219 thousand, and the forecast for 26 September 2024 appears somewhat pessimistic as the number of applications is expected to rise to 224 thousand.

According to the previous statistics, there is a tendency for a change in applications by more than 35k, which can significantly impact USD. Given the increased volatility of the data, a delta less than the specified level can be considered a margin of error, which does not always affect the EURUSD exchange rate. Nevertheless, the rise in unemployment is a negative factor for the US dollar, and, as the EURUSD forecast for 26 September 2024 shows, it continues to lose ground against the euro.

EURUSD technical analysis

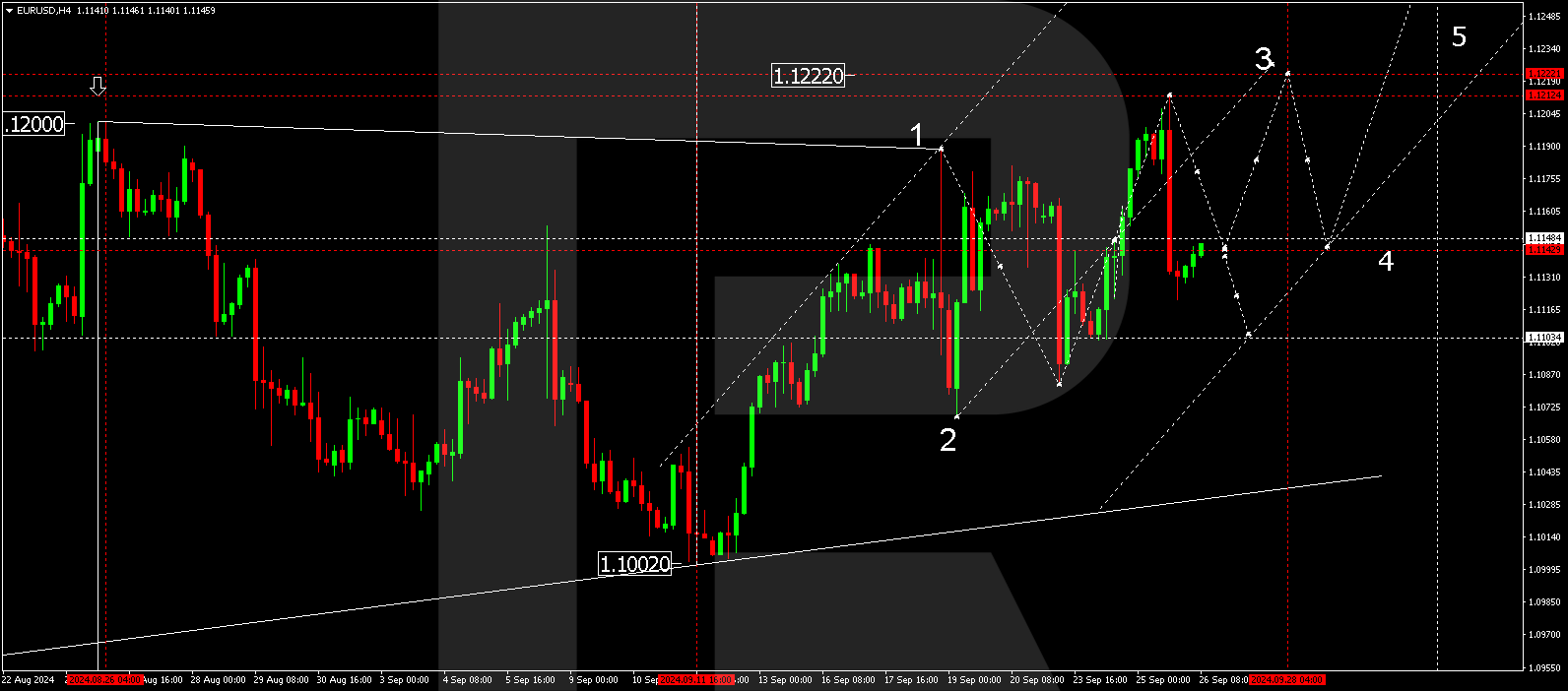

On the H4 chart, EURUSD technical analysis indicates a rising wave to the level of 1.1212 and a declining link to the level of 1.1121. Today, 26 September 2024, we do not exclude the continuation of the downward wave to the level of 1.1111. In the future, we expect the EURUSD rate to grow to the 1.1222 level. The target is local. After reaching this level, we will consider the probability of correction to the 1.1144 level (test from above). Then, it will be relevant to consider the likelihood of another wave of growth to the 1.1290 level. This is the primary target.

Summary

Based on the ECB report, the forecast for US unemployment, and the technical analysis, today’s EURUSD forecast suggests continued strength for the euro. The key levels to watch are 1.1222 and 1.1290, with the potential for further growth if the bearish factors affecting the USD persist.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.