EURUSD analysis: the pair is poised to rise as the US dollar declines for 4 weeks in a row

EURUSD is resuming its upward movement. The market is anticipating a significant easing of the Fed’s monetary policy in the future. Read more details in our analysis for 27 September 2024.

EURUSD forecast: key trading points

- EURUSD is set for growth

- The US dollar is declining as the market expects the Fed to reduce interest rates swiftly

- EURUSD forecast for 27 September 2024: 1.1222 and 1.1290

Fundamental analysis

EURUSD climbed to 1.1188 on Friday.

The EURUSD rate climbed to 1.1188 on Friday, supported by market fundamentals. Statistics published earlier showed a robust US labour market, with corporate profits growing rapidly in Q2, reinforcing positive signals seen earlier.

However, the US dollar remains under pressure as investors anticipate the Federal Reserve’s upcoming interest rate cut. According to CME FedWatch, there is a 51% probability of a 50-basis-point rate cut at the next meeting. This has contributed to the recent decline in the USD, further bolstering the EURUSD outlook.

The Fed has shifted its focus from inflation to maintaining stability in the employment sector. A range of crucial reports is expected today, including personal income, consumer spending, and Core PCE data. These will heavily influence the EURUSD forecast, which currently suggests a rise.

EURUSD technical analysis

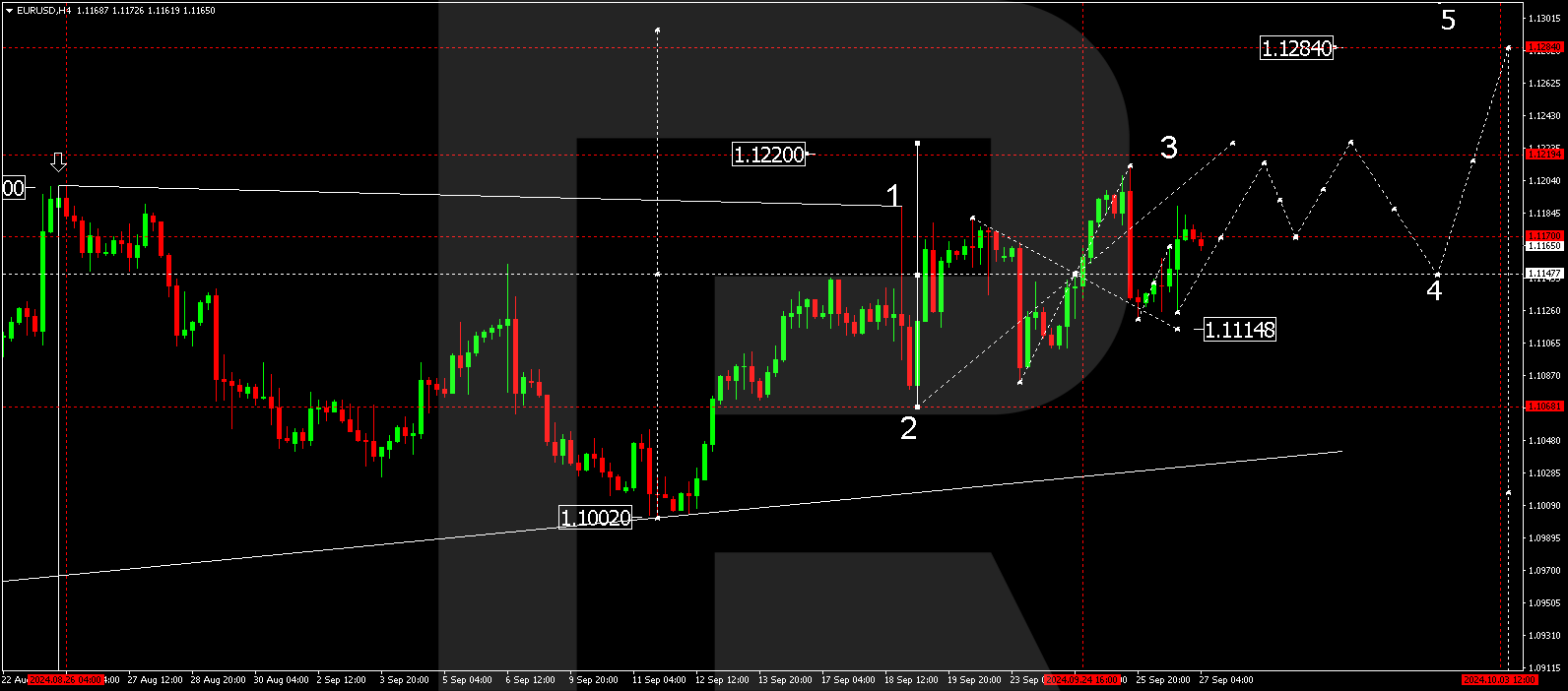

On the H4 chart of EURUSD, the market received support at 1.1121. A growth wave to 1.1164 and a correction to 1.1125 have occurred. Today, 27 September 2024, the growth impulse to 1.1188 was realised. We expect the EURUSD to correct to 1.1155. After completing this correction, we will consider the probability of the growth wave reaching the level of 1.1190. A breakout above this level will open the potential for further growth towards 1.1222. The target is local. The development of a broad consolidation range around 1.1145 without a pronounced trend continues.

Summary

EURUSD may continue to grow. For the US dollar, it would mark the fourth week of decline. Technical indicators for today’s EURUSD forecast suggest considering the likelihood of continuing the growth wave to the levels of 1.1222 and 1.1290.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.